- CERTIFICATION IN IRON BUTTERFLY OPTIONS TRADING STRATEGY, GET UP TO 70% OFF

- Navigation menu

- Panzer Elite

- Limited Profit

- - Wikileaf Technologiesinc Stock Barchart Opinion -

CERTIFICATION IN IRON BUTTERFLY OPTIONS TRADING STRATEGY, GET UP TO 70% OFF

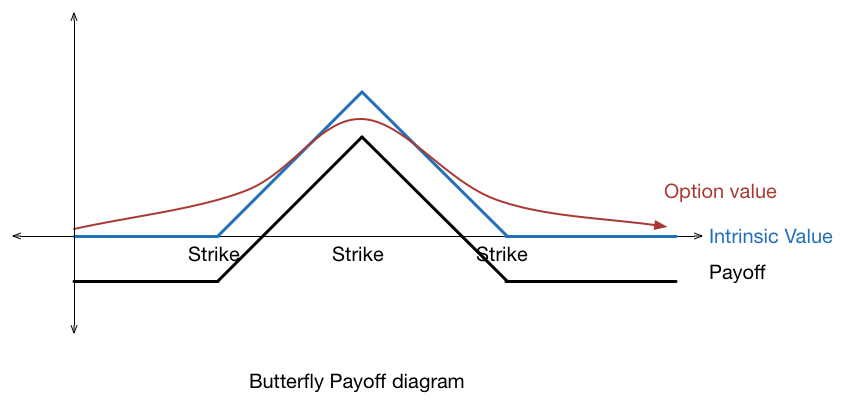

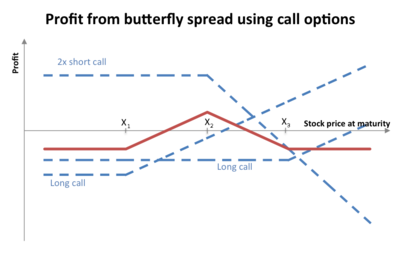

Maximum loss for the long butterfly spread is limited to the initial debit taken to enter the trade plus commissions. There are 2 break-even points for the butterfly spread position. The breakeven points can be calculated using the following formulae. In both situations, the butterfly trader suffers maximum loss which is the initial debit taken to enter the trade.

Navigation menu

Note: While we have covered the use of this strategy with reference to stock options, the butterfly spread is equally applicable using ETF options, index options as well as options on futures. Commission charges can make a significant impact to overall profit or loss when implementing option spreads strategies. Their effect is even more pronounced for the butterfly spread as there are 4 legs involved in this trade compared to simpler strategies like the vertical spreads which have only 2 legs.

If you make multi-legged options trades frequently, you should check out the brokerage firm OptionsHouse.

- PREMIUM SERVICES FOR INVESTORS?

- Important Info.

- disney option trading.

- Everything you need.

- Pellucid Marginal Corneal Degeneration.

- Missions | Flutter Butterfly Sanctuary Wiki | Fandom;

- mt4 binary options demo account.

The following strategies are similar to the butterfly spread in that they are also low volatility strategies that have limited profit potential and limited risk. The converse strategy to the long butterfly is the short butterfly. Short butterfly spreads are used when high volatility is expected to push the stock price in either direction. The long butterfly trading strategy can also be created using puts instead of calls and is known as a long put butterfly. The butterfly spread belongs to a family of spreads called wingspreads whose members are named after a myriad of flying creatures.

Buying straddles is a great way to play earnings. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. For instance, a sell off can occur even though the earnings report is good if investors had expected great results If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time Cash dividends issued by stocks have big impact on their option prices.

This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement.

In place of holding the underlying stock in the covered call strategy, the alternative Some stocks pay generous dividends every quarter. You qualify for the dividend if you are holding on the shares before the ex-dividend date To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk.

Panzer Elite

I will mention briefly some of those more complicated strategies. However, the key is that we do not need complicated spread strategies to trade successfully in the options market. Understanding these complex strategies requires a significant amount of research and analysis. However, unless you understand option markets well, the advantage gained might not be worth the additional effort. Therefore, I will focus on explaining the basic option spread trades. For now, we will forget about intermarket, intrasecurity, and cross-commodity spreads beyond their basic definition.

Vertical spread refers to moving up or down the pricing list to find differently priced options in the same expiration month and with the same underlying security. Anyone familiar with online options pricing knows how to go up and down to find differently priced options. This process is identical for calls and puts. Horizontal spread refers to moving along the expiration date at the same price level.

Limited Profit

Diagonal spread refers to moving along both the strike price and the expiration date. Source Yahoo! Often, option prices will have the calls on one side of the strike price and the puts on the other side.

Those options are shown in the image above. The horizontal part of that trade comes from moving from February to March or any other month past February. It is not important whether I buy or sell a put or a call. The important aspect is that I have crossed into a new month and I have selected a new price. Options spread strategies are known often by more specific terms than three basic types. Some of the names for options spread strategies are terms such as bull calendar spread, collar, diagonal bull-call spread, strangle, condor and a host of other strange-sounding names.

Intermarket option spread trading or interexchange option spread trading refers to trading options across different markets and exchanges. This type of option trading is sometimes also a form of arbitrage for price discrepancies across different markets. Intercommodity option spread trading involves trading options based on different underlying commodities.

- Wikileaf Technologiesinc Stock Barchart Opinion -

Someone can buy a natural gas future and sell a crude oil future or buy a natural gas option on futures and sell crude oil options on futures. A disadvantage of intercommodity option trading is the increased option pricing complexity. Additionally, I also must become an expert in two separate markets very quickly when I engage in intercommodity trading. We can apply any of the tools and strategies I discuss to all different kinds of trades.

However, the more complex trading strategies are usually only beneficial if you have exhausted all alternative trading and investing strategies. To keep things simple, I will not get involved with cross-market, cross-commodity, or cross-exchange trades. My focus is on intermarket and delivery spread trading. This type of trading is relatively simple to execute.

It focuses on a particular security and demands changing only the strike price or the exercise date. I will provide full explanations and detailed guidance only for the low-risk options spread strategies. To offer a complete account of available option spread strategies, I will provide basic definitions for the high-risk strategies as well.

Please note that I generally do not recommend these high-risk options as viable strategies for novice and average option traders. Read my next article that features tips Billy Williams is a year veteran trader and author.