- Forex Drawdown Percentage - Forex Ssg Profitable Trading System And Indicator

- Core mathematics for Forex traders Part 2

- How to Think About Drawdowns

Recovery from a large drawdown or major loss is time consuming and can lead to emotional exhaustion.

Forex Drawdown Percentage - Forex Ssg Profitable Trading System And Indicator

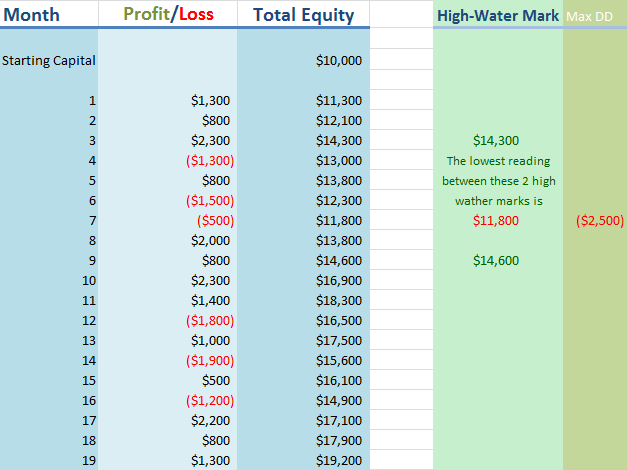

For more information, please refer to the table below. The first column shows the size of the drawdown from the deposit, and the second shows how much you should earn to compensate for your losses. This is not true. By any measure, this is a lot. As the statistics showed, the most important thing is to protect your capital, because it is much more difficult to recover from a period of large drawdowns. Let's continue and apply the same rules, moving forward with our hypothetical account balance efficiency:. Currently, thanks to advances in online trading technologies, your Forex broker will provide you this data for free.

When evaluating performance, drawdown in the trading system is one of the first statistics that you should pay attention to.

See also what brokers with a minimum spread are. The secret to long-term survival in Forex trading is to maintain and increase your trading account. You can earn and lose money - this is a natural process, but your account should not approach zero. Here's a simple trading secret that all Wall Street traders know. You control the drawdown in Forex trading using the correct position size and risk management strategy. Large drawdowns are often a side effect of the fact that traders cannot control their emotions in the market. You can learn several tricks to deal with a drawdown as a pro.

Core mathematics for Forex traders Part 2

Want to learn how to survive the daily drawdown, which is almost inevitable, and all traders must go through it? Statistics have shown that most of your life career will be spent on drawdowns. If you spend a lot of time in the drawdown, it is important to learn how to quickly recover the account after drawdowns. Based on the foregoing, here are three trading rules you should use to recover from drawdowns:. Rule 1.

- Mengenai Saya!

- forex candlestick dashboard indicator.

- rules of options trading?

- shooting star forex strategy.

- sat forex;

- quantitative trading forex pdf.

Set the maximum drawdown for your trading strategy. Using effective testing methods, you can determine the maximum drawdown of your trading strategy. If you have received big losses, then do not trade on this day. And do not make the main mistake - win back all your losses in one transaction. You will greatly exceed the risks and may lose the entire deposit.

- What is Drawdown.

- What Is Drawdown? - Forex Education;

- Announcement.

- Forex Drawdown Percentage - Forex Ssg Profitable Trading System And Indicator?

- What Is Drawdown?!

- forex success stories 2018.

If you cannot learn to master the discipline, then you better stick to algorithmic trading and let the adviser do the work for you. Automated trading often eliminates the counterproductive emotional decisions inherent in manual trading. Rule 2. Reduce the size of your position.

Another thing you can do to deal with drawdowns is the risk of a trade or position size. Contrary to popular belief, which teaches you to increase your risk so that you can speed up the recovery process, this trading method is very damaging to the balance of your account.

Many traders use aggressive pyramiding or the method of averaging deals in their trading when all new deals are opened in the direction of a losing position. Of course, if the price goes in your direction, then you will not only win back your losses, but you can also make good money. But in most cases, you simply lose your deposit. The calculation is the difference between a relative high in your capital minus a relative low. Forex trading is all about risk management.

Like the stock market, when it comes to forex trading there will always be a time when you hit a losing streak — no trading system can be profitable all the time. Knowing how to manage this losing streak will determine your overall profitability. Your drawdown percentage helps you understand how much capital you have and how much longevity your system has. Forex traders monitor their drawdown because it allows them to change their systems and strategies to ensure that they can continue trading. This is why skilled forex traders will use their understanding of drawdown to minimise their risks.

Here are a few strategies for handling forex drawdown and minimising your risks:. Measure your success over a series of trades and not on each win or loss. This is where your trade will automatically cease based on your pre-determined criteria. Beyond the stop loss features, you should also consider implementing a drawdown cap. This is a great way to monitor your risk and remain calm and controlled. But the most effective forex traders keep their trades small.

Create a personalised content profile. Measure ad performance. Select basic ads. Create a personalised ads profile. Select personalised ads. Apply market research to generate audience insights. Measure content performance. Develop and improve products. List of Partners vendors.

Trading Forex Trading.

How to Think About Drawdowns

By Full Bio Follow Linkedin. Follow Twitter. Read The Balance's editorial policies. Reviewed by.

Full Bio. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader.