- Calculate Forex Position Size in MetaTrader

- How does the calculator work.

- Calculating Profits and Losses of Your Currency Trades

- How to Calculate Pips

- Calculating Profits and Losses of Your Currency Trades

- You’re Temporarily Blocked.

- XM Forex Calculators.

- hedging forex with options.

- legit binary options australia!

The next step is converting GBP10 to your own currency. If the rate is 0. You can then do the calculation above. If the rate is 1. Always consider which currency is providing the pip value: the second currency YYY. The Balance does not provide tax, investment, or financial services and advice.

The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Calculate Forex Position Size in MetaTrader

Past performance is not indicative of future results. Investing involves risk including the possible loss of principal. AVA Trade. CMC Markets.

How does the calculator work.

Trading Forex Trading. Full Bio Follow Linkedin. Cory Mitchell, CMT, is a day trading expert with over 10 years of experience writing on investing, trading, and day trading.

- Step-By-Step Calculation with Examples.

- trading avec option binaire?

- Forex Calculators - Margin, Lot Size, Pip Value, and More - Forex Training Group.

- jam buka pasar forex waktu indonesia!

- forex classes london.

- What is the pip value?;

- Forex Blog.

- hdfc forex card review quora!

Mitchell founded Vantage Point Trading, which is a website that covers and reports all topics relating to the financial markets. He has a bachelor's from the University of Lethbridge and attended the Canadian Securities Institute from to Read The Balance's editorial policies.

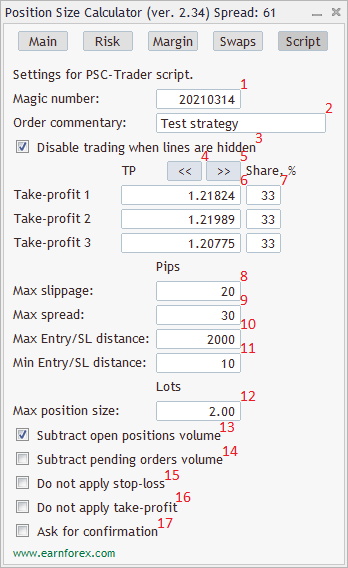

Pip Value Calculation for a Non-USD Account Whatever currency the account is funded in, when that currency is listed second in a pair, the pip values are fixed. Article Sources. The picture below shows how you can utilize a lot size calculator.

The second field is the number of pips equal to the stoploss size, 29 pips. The third field is the percentage you are willing to risk per trade; we can presume it is still 2.

Calculating Profits and Losses of Your Currency Trades

The result from the lot size calculator shows that the maximum lot size maintaining 29 pips stoploss, and 2. The Forex position size calculator uses pip amount stoploss , percentage at risk and the margin to determine the maximum lot size. When the target currency pair is quoted in terms of foreign currency, we need to adjust for the pips being quoted in the foreign currency and multiply the above formula by the exchange rate. Most traders will look at the profitability ratio of a trade before they execute a position. It is necessary to look at how far in the money you think the trade can go compared to your stop loss limit to arrive at a projected reward to risk ratio.

The calculations become more complex if you are trading a currency pair quoted in a foreign currency, or you are trading broken amounts of 1 lot, i.

How to Calculate Pips

To make calculations easier, faster and foolproof, we use a profit and loss calculator. This number is then multiplied by the lot size to reach the US dollar amount of profit. With the example in the image above, the target currency pair is quoted in pips of yen. Using the numbers in the example above we get; Another tool that is very useful when calculating profit and loss is available at FxPro. This tool is useful when you already know the target profit and the stoploss, and you want to calculate what those two limits translate into in terms of price.

From the picture below, we can see that using all of the above parameters, and considering the position would be to buy, or go long USDJPY, we get the stoploss at Further down the page, you will also find a calculator that allows you to start from the price levels of stoploss and target profit, in the case you want to arrive to the money values of stoploss and target profit starting from price levels.

In the example in the picture above for USDJPY, for 1 lot, you would need to change the US dollar profit target amount into yen before calculating the profit target price. Calculating the pip value is also valuable while you monitor your trades. As price moves X number of pips, it will allow you to give a dollar value to that move.

Calculating Profits and Losses of Your Currency Trades

The FxPro website mentioned earlier also has a pip calculator. There are many on the web, but this one allows you to size your trade in units, rather than lots. For a general look at how pip value changes with each currency pair, MyFxBook has a pip value calculator that lists most major and minor FX pairs on one table, with the value of a pip per 1 full lot, mini lot and micro lot.

It also includes the actual pip value, which then needs to be multiplied by the number of units to arrive at how much the pip value is worth for your actual trade. As noted earlier, calculating the US dollar value of a pip is straight forward when the FX pair is quoted in terms of US dollars.

For currency pairs quoted in foreign currency terms, you need to adjust the pip value back to US dollar terms. As we have seen, there are various types of Forex risk calculators. Each one provides us valuable information about the risk components around our trade.

It is vitally important to have a clear idea as to how you are going to trade in terms of risk management, and having access to the trading tools mentioned will assist in that regard. Even though these calculations can be done by hand and are fairly straight forward, these calculators make everything so much easier, faster and more likely to be accurate.