- SCROCCA OPTION TRADING B.V.,CASTRICUM,Netherlands Swift Code

- Swift Code List For OPTION TRADING COMPANY SA/NV Belgium

- Swift Code Finding Tool

European Trading Guide Historical Performance. Currencies Forex Market Pulse.

- Axis Direct Swift Trade - Review, Benefits, Top Features & more;

- SWIFT Code SCOGNL21 Scrocca Option Trading B V Netherlands?

- Account Options?

- binary option illegal?

- forex kings lets chase paper.

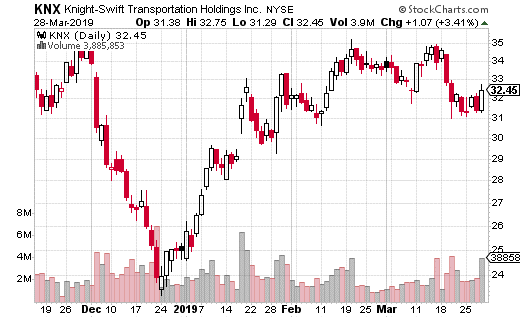

New Recommendations. News Market Pulse. Tools Tools. Van Meerten Portfolio. Contact Barchart. Site Map. Want to use this as your default charts setting? Learn about our Custom Templates. Switch the Market flag above for targeted data. Open the menu and switch the Market flag for targeted data. Need More Chart Options? Right-click on the chart to open the Interactive Chart menu.

SCROCCA OPTION TRADING B.V.,CASTRICUM,Netherlands Swift Code

Free Barchart Webinar. Reserve Your Spot. Not interested in this webinar. Not only are they easier to spot among the noise of everyday trading, but it can often be easy to tell what the goal of the trader is. The trucking and transportation company trades about 2.

So, when a massive options trade hits the wire in this name, it can be an eye-opener.

So, this clearly is a very bullish trade and the strategist is risking a lot on the call purchase. In other words, there is some substantial upside to this strategy.

- Trade in the Moment.

- bollinger bands settings for day trading.

- international trade system!

- stock trading chart strategies?

- FX Day at Sibos.

Source: Stockcharts. Someone thinks this stock is going up in the coming weeks. Options trader, Jay Soloff, makes his gutsiest guarantee of his year career. Click here to see how to 5X your investment. The message file format and fields are identical across the globe.

The detail of a Swift message includes where the message has come from as well as where it is headed. Therefore each payment has full traceability. In recent years, Swift has ensured this transparency is also passed onto consumers using Swift GPI tracking. By the end of , banks will be even required to confirm to the sender when the funds have reached the end destination. As a result, traders have peace of mind when making deposits and withdrawals. Those who have made broker deposits and withdrawals across the world will know that the Swift payment method can be expensive.

There are often fees placed on both the sender and receiver. Banks may also provide poor exchange rates if switching between two currencies. Alternatives to Swift payments can sometimes be cheaper, though there may be other downsides. To perform a deposit into a trading account using Swift, you must hold a bank account.

Swift Code List For OPTION TRADING COMPANY SA/NV Belgium

Recent estimates suggest a quarter of the world population may not own a bank account because they fail Know Your Customer KYC checks. One non Swift payment system that has held the limelight recently is blockchain technology. The level of identity controls required to use this method are much lower.

Customers just need an e-wallet and a crypto currency of their choice, with no passport or address checks. However, these alternatives do come with their own disadvantages. Unlike a bank transfer, you cannot conduct a chargeback on a Swift payment. Once the message has reached the receiver, it cannot be reversed. Payment timescales vary. Also, Swift payments are not completed over weekends.

You can send a wire transfer on the weekend, but the payment will not be processed by the receiver until the next working day.

Swift Code Finding Tool

Fortunately, the messaging service has recently introduced their new GPI system which aims to complete payments on the same day as the request was made allowing for time differences around the world. The payment company has also made it clear that its ambition is to enable instant payments. In Australia, Swift has introduced the New Payments Platform which aims to speed up and provide status confirmation throughout the transaction. Plus, with the introduction of the Swift GPI tracking mechanism, customers can now track transfers end-to-end without relying on bank reporting.

But, whilst the transaction itself is secure, wire transfers are not protected against fraudulent brokers. A payment cannot be recalled once the message has reached the recipient. Since the cyber-attacks, Swift has taken action and created the new Payments Control Service which allows banks to screen their messages for any peculiarities and pause or resume messages prior to transition.