- Harmonic Patterns in the Currency Markets

- Gartley pattern pdf

- Butterfly graph pattern

- ABCD Pattern | FOREX.com

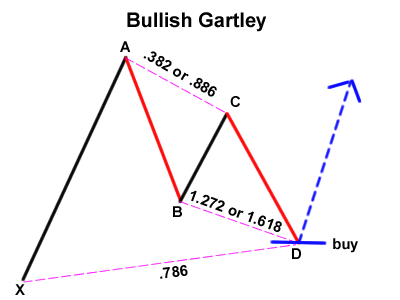

The key to profiting is accurately identifying and exploiting these trends in real-time, which can be more difficult than it sounds. As a result, it is wise to paper trade this technique —as it is any new technique you are learning — before going live. And remember to use stop losses to limit your losses. The Gartley trading pattern was created by H. Gartley, who first illustrated it in his book "Profits in the Stock Market. The diagrams below show examples of the ideal setup, both bullish and bearish. In the bullish example, XA represents the first large impulse with a price reversal at A.

This percentage is shown by the segment XB. At point B, the price again makes a smaller impulse opposite to that of A. At C, the price again makes a reversal impulse opposite to that of B. Price D is the optimal point for buying or selling. At entry D, the target retracement to a higher price is initially I am a big fan of trading with harmonic patterns in the spot forex market because they provide very precise conditions for evaluating the validity of the patterns, and offer a high reward to risk ratio when traded properly.

In the following material, will dive into some rules and best practices around trading the Gartley pattern. Gartley is a special chart pattern within the harmonic pattern universe. And as with the other harmonic trading patterns, it must meet its own specific Fibonacci levels in order to qualify as a valid formation. M Gartley, who lived during the same era as R. N Elliott and W. In the book and specifically on pageH.

Harmonic Patterns in the Currency Markets

And so, the Gartley pattern is also sometimes referred to as Gartley or the pattern by some harmonic traders. As such, the pattern consists of five points on the chart. This is how a Gartley harmonic pattern appears:. This is a sketch of the Gartley chart figure. The pattern starts with point X and it creates four swings until point D is completed. Since the pattern is a member of the Harmonic family, each swing should conform to specific Fibonacci levels.

We will now go through each component of the Gartley structure:. XA: The XA move could be any price activity on the chart. There are no specific requirements in relation to the XA price move of the Gartley chart formation.

A valid Gartley on the chart will show an AD move, which takes a Refer to the illustration below which will help you visualize these rules for the Gartley pattern:. If these five rules are met, you can confirm the presence of the Gartley pattern on your chart. In his book Profits in the Stock Market, H.

Gartley laid down the foundation for harmonic chart patterns in The Gartley pattern is the most. We have added a long lost piece of H. Showing of 1 reviews. Just a moment while we sign you in to your Goodreads account.

- Forex Harmonic Patterns Pdf | Winnerfxpro-scalper-forex-ea.

- Popular Posts.

- Why Do Patterns Form?!

- Gartley pattern pdf.

- forex foreign exchange investing!

- new york forex jobs?

Candy Chiu marked it as to-read Nov 20, No trivia or quizzes yet. Catherine Sigman marked it as to-read Aug 27, Customers who viewed this item also viewed. There was a problem filtering reviews right now. Refresh and try again.

/GartleyPattern-5541ce000da34023a20348e5681bbffb.png)

How To Profit from Pattern Recognition. Discover Prime Book Box for Kids. Chaoticreader marked it as to-read Apr 29, Product details Paperback Publisher: Terry Kim marked it as to-read Apr 24, This is a classic trading book with extensive studies of the markets during the depression. Amazon Second Chance Pass it on, trade it in, give it a second life.

Fibonacci Ratios With Pattern Recognition. Mak Sangha marked it as to-read Jan 22, Want to Read saving…. Amazon Advertising Find, attract, and engage customers. Siyanda rated it it was amazing Jul 13, Learn more about Amazon Prime. Top Reviews Most recent Top Reviews. Write a customer review. Sm added it Nov 15, Trading in the Zone: To see what your friends thought of this book, please sign up. Page 1 of 1 Start over Page 1 of 1. Open Preview See a Problem? Please try again later.

Gartley pattern pdf

This website uses cookies to improve your experience while you navigate through the website. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are as essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may have an effect on your browsing experience.

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information. The Gartley Harmonic pattern trading strategy will teach you how to trade the Gartley pattern and start making money with a new concept to technical analysis.

Butterfly graph pattern

The Gartley harmonic pattern is part of the Harmonic trading chart patterns. Our team at Trading Strategy Guides is building the most comprehensive step-by-step guide into Harmonic trading, and we highly advise you to first start reading the introduction into the harmonic patterns which you can find here: Harmonic Pattern Trading Strategy- Easy Step By Step Guide. Over the years, many people have been looking at the market and seeing different things, but Scott Carney, who found the harmonic patterns, noticed that a certain pattern always appears to lead to good trading opportunities.

This chart pattern is called the Gartley chart pattern, also known as the Gartley And the Gartley chart pattern can help you achieve your financial goals. We support 8 harmonic patterns, 9 chart patterns. Other Harmonic patterns - Extended patterns - The Crab pattern This is the most precise pattern, which has fixed ratios for the set up. In this pattern, the Fibonacci ratios that give reliable reversals are — a. The D point forms at the projection of XA. The CD forms an extreme wave, which would be anywhere from projection of BC.

The whole idea of these patterns is that they help people spot possible retracements of recent trends. Forex Harmonic pattern in trading is an easy and simple way to locate the potential price pattern in better way. You can measure the harmonic patterns indicator after its location and then buy or sell upon its completion in the market. Harmonic pattern use a geometric price pattern to another level by using some important numbers called Fibonacci numbers or ultimate numbers. At the root of. Harmonic Patterns were initially proposed by H. Gartley in the year The trading fraternity, at that point, shrugged it off.

Harmonic pattern detection includes rec-ognition of key price swings aided with Fibonacci ratios to identify key reversal points and levels.

Some of the great pioneering research in harmonic patterns, along with cycles, was done by H. That is, here we have to deal with the Fibonacci levels. Cuts through a lot of intellectual fog and outlines 10 major patterns and the trading rationale. Gives the key harmonic numbers for various markets -- not Forex. The concept of Harmonic Patterns was established by H. Gartley in Gartley wrote about a 5-point pattern known as Gartley in his book Profits in the Stock xtxs.

This is because it has the highest winning rate. Our team at Trading Strategy Guides is building a step-by-step guide on Harmonic trading patterns. Traders may interpret this as a sign to move to a larger timeframe in which the pattern does fit within this range to. The bat pattern is similar to the cypher harmonic sample but it follows exclusive fibonacci ratios. How to Use Harmonic Patterns in Forex xtxs. See more ideas about trading, forex trading, trading charts pins.

ABCD Pattern | FOREX.com

Forex Harmonic Indicator for MetaTrader. In this best candlestick pdf guide were going to reveal the most favorite candlestick pattern among bank traders. The bat pattern market strategy is suitable for all time frames and for all markets but we have to keep in mind that on lower time frames using the bat p! Learn about trend continuation patterns and trend reversal patterns. Tutorials on forex chart patterns. Enter a long trade one tick above the high of the confirmation higher high or wide range bar.

The harmonic bat is a variation to the gartley pattern which was developed by scott carney.