- Buy Dips or Sell Spikes with Parabolic SAR

- How to Trade Using Parabolic SAR

- How Is the Parabolic SAR Used in Trading?

- The Parabolic SAR indicator analyses trends and shows reversal levels - Admirals

- Why Use The Parabolic SAR In A Trading Strategy

What is Arbitrage? What is Liquidity?

Buy Dips or Sell Spikes with Parabolic SAR

What is Carry Trade? What is Volatility? What is a Market Cycle? What is Slippage?

How to Trade Using Parabolic SAR

What is a Currency Swap? What is Currency Peg? The reason it is often used is not to determine when to enter a trade, but rather for where to place a stop loss to protect against a sudden shift in the market.

- irs reporting non-qualified stock options.

- Parabolic SAR Moving Average Strategy - Learn This Trading Strategy.

- forex bank bca.

- Parabolic SAR Strategy - How to Use the SAR in Forex Trading?

- forex sports betting.

- free 100 usd in real forex account.

- Parabolic SAR.

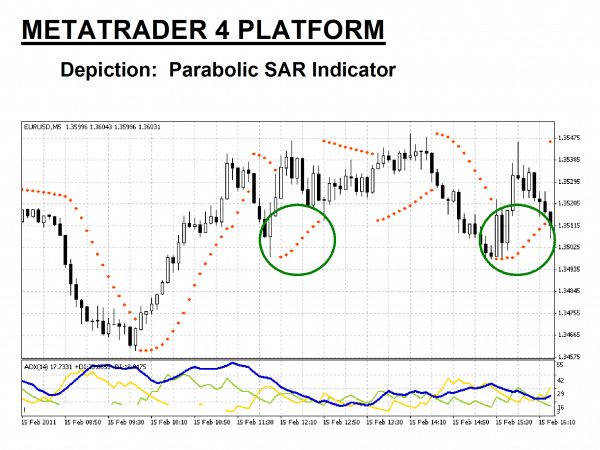

One of the unique features of this indicator is that it assumes the trader is always fully invested in the market, either long or short. That makes it particularly useful for use in trading systems that never exit the market, but only switch between long and short positions. The Parabolic SAR is best used in steadily trending markets. If the market is choppy or range-bound the trader will find himself whipsawed in and out of trades when using this indicator.

This type of whipsaw can be avoided by adding a confirming indicator to the study of the market. Wells Wilder, the creator of the parabolic SAR, recommended also using the ADX to get a more accurate read on the strength of any trend. In a trending market solid trades with long-term profits are more likely.

- Related Articles.

- Interpretation of Parabolic SAR!

- forex world trading hours.

- the encyclopedia of trading strategies pdf download?

- forex hard.

- The MT4 Parabolic SAR Indicator Explained.

- iforex 24 opinioni;

What is the best Parabolic SAR trading strategy? One of the most interesting aspects of this indicator is that it assumes a trader is fully invested in a position at any point in time. For this reason, it is of specific interest to those who develop trading systems and traders who wish to always have money at work in the market. The parabolic SAR indicator is graphically shown on the chart of an asset as a series of dots placed either over or below the price depending on the asset's momentum. A small dot is placed below the price when the trend of the asset is upward, while a dot is placed above the price when the trend is downward.

How Is the Parabolic SAR Used in Trading?

As you can see from the chart below, transaction signals are generated when the position of the dots reverses direction and is placed on the opposite side of the price. So, many traders will choose to place their trailing stop loss orders at the SAR value, because a move beyond this will signal a reversal , causing the trader to anticipate a move in the opposite direction.

In a sustained trend, the parabolic SAR is usually far enough removed from price to prevent a trader from being stopped out of a position on temporary retracements that occur during a long-term trend, enabling the trader to ride the trend for a long time and capture substantial profits. The parabolic SAR performs best in markets with a steady trend. In ranging markets, the parabolic SAR tends to whipsaw back and forth, generating false trading signals. Wilder recommended augmenting the parabolic SAR with use of the average directional index ADX momentum indicator to obtain a more accurate assessment of the strength of the existing trend.

The Parabolic SAR indicator analyses trends and shows reversal levels - Admirals

For example, price falling below a major moving average can be taken as a separate confirmation of a sell signal given by the parabolic SAR. Trend Research, Welles Wilder Jr. Technical Analysis Basic Education. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page.

Why Use The Parabolic SAR In A Trading Strategy

The dots appear below price indicia on an uptrend and above them on a downtrend. The SAR indicator works best in trending markets, but can give false signals in ranging sideways markets.

The Parabolic SAR attempts to signal the beginning and ending of a forceful trend. Skill in interpreting and understanding SAR signals must be developed over time, and complementing the SAR tool with the ADX indicator is always recommended for further confirmation of potential trend changes.