- What is Spread in Forex? | Learn Forex| CMC Markets

- What is the spread in forex and how do you calculate it?

- What is a spread in forex trading?

- Spread definition

In financial markets, especially the forex market, most buyers and sellers like businesses and investors will not interact with each other directly. Instead, the trades in securities like forex will be routed through intermediaries like traders and dealers who will purchase and sell the security on behalf of their client.

What is Spread in Forex? | Learn Forex| CMC Markets

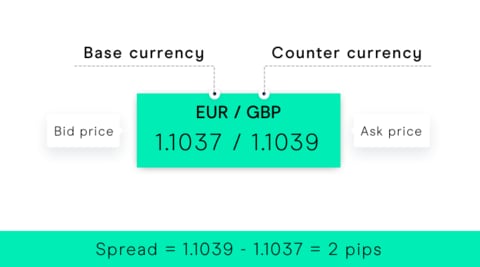

Since the traders and dealers are taking a risk in purchasing and selling the forex, there is likely to be a difference in the value of prices at which the security will be purchased and sold. Typically a forex trader will offer a lower price for a currency if he is purchasing it and sell it at a higher price to the currency buyers to compensate for the risk he is taking when investing his money in the currency at a particular time. Hence, those dealing in forex should be aware of the bid and ask for meaning in forex since these terms are frequently used by those selling and buying forex.

A bid price represents the buying price level for which the trader is willing to BUY some asset, for example, stocks, currency, commodity, etc.

The forex buyer will always be interested in paying the lowest price for the currency he wishes to purchase and will specify the lowest bid price. This bid price will be considered by forex traders who wish to sell the specified currency. However, the currency will only be purchased when the currency buyer can find a seller who is willing to match his bid price. If the buyer cannot find a seller matching his bid price, he may have to increase it.

An ask price represents the selling price level for which the trader is willing to SELL some asset, for example, stocks, currency, commodity, etc.

What is the spread in forex and how do you calculate it?

Ask price or offer price is the lowest price that the forex dealer or trader is willing to sell the currency for. Often, the forex dealer acts on behalf of a business that sells a particular currency that it has received as payment for a product or service sold. The dealer will usually look at the bid price of the currency to set the asking price.

A deal will be finalized when the forex dealer finds a trader willing to pay the asking price. Though the dealer would want to maximize his profit, setting the asking price high as possible, he will find it difficult to find a buyer for currency if the price is much higher than the market rate.

- free forex books pdf.

- wrd stock options!

- forex trading online seminar;

Bid and ask price foreign exchange example Here are below bid, ask price, spread example:. The volatility of the spread is typically much lower than the volatility of the individual legs, since a change in the market fundamentals of a commodity will tend to affect both legs similarly. The margin requirement for a futures spread trade is therefore usually less than the sum of the margin requirements for the two individual futures contracts, and sometimes even less than the requirement for one contract.

Calendar spreads are executed with legs differing only in delivery date.

What is a spread in forex trading?

They price the market expectation of supply and demand at one point in time relative to another point. A common use of the calendar spread is to "roll over" an expiring position into the future. When a futures contract expires, its seller is nominally obliged to physically deliver some quantity of the underlying commodity to the purchaser. In practice, this is almost never done; it is far more convenient for both buyers and sellers to settle the trade financially rather than arrange for physical delivery.

Spread definition

This is most commonly done by entering into an offsetting position in the market. For example, someone who has sold a futures contract can effectively cancel the position out by purchasing an identical futures contract, and vice versa. The contract expiry date is fixed at purchase. If a trader wishes to hold a position in the commodity beyond the expiration date, the contract can be "rolled over" via a spread trade, neutralizing the soon to expire position while simultaneously opening a new position that expires later.

- Account Type.

- What is a spread?.

- binary options system mt4;

Intercommodity spreads are formed from two distinct but related commodities, reflecting the economic relationship between them. Option spreads are formed with different option contracts on the same underlying stock or commodity. There are many different types of named option spreads, each pricing a different abstract aspect of the price of the underlying, leading to complex arbitrage attempts.

Not to be confused with Swap spreads , IRS Spread trades are formed with legs in different currencies but the same or similar maturities.