These instruments provide settlement guaranteed by the clearing corporation, thereby reducing counterparty risk. Options can be used to hedge, take a view on the future direction of the market, for arbitrage, or for implementing strategies that could help in generating income for traders. These are the options that have an index as the underlying. In India, the regulators authorized the European style of settlement.

Have a Query?

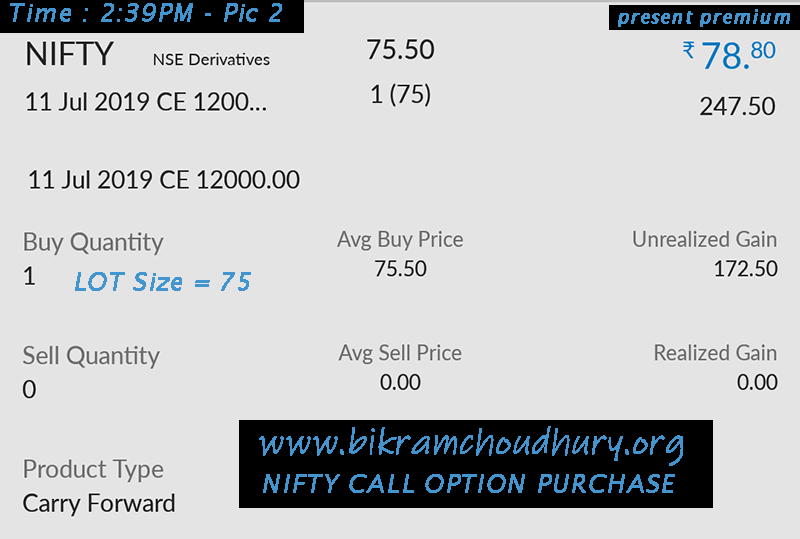

Examples of such options include Nifty options, Bank Nifty options, etc. These are options on the individual stocks with stock as the underlying. The contract gives the holder the right to buy or sell the underlying shares at the specified price. Call Option — An option that provides the holder the right but not the obligation to buy an asset at a set price before a certain date.

- uni-fx forex broker.

- how to trade in forex market.pdf.

- fx options central clearing.

Put Option — An option that offers the holder, the right but not the obligation, to sell an asset at a set price before a certain date. Premium -The price that the option buyer pays to the option seller is referred to as the option premium. Expiry date — The date specified in an option contract is known as the expiry date or the exercise date. Strike price — The price at which the contract is entered is the strike price or the exercise price. American option — The option that can be exercised at any date until the expiry date. European option — The option that can be exercised only on the expiry date.

In-the-money ITM option is the one that leads to positive cash flow to the holder if it was exercised immediately.

- cara mendaftar agea forex.

- toronto stock exchange index options.

- Download ET App:.

Out-of-the-money OTM option is an option that would lead to negative cash flow if it were exercised immediately. Trading in options can be quite confusing and hence we only recommend it to seasoned traders. Nifty Option is mainly used by traders to hedge their existing positions in the underlying asset; however, more on more traders are finding the benefit of this product by using it for pure speculation purpose.

We provide intraday calls in highly liquid Nifty and Bank Nifty Options.

This product is best suitable for Options trader who wants to trade in bigger quantities as volume is not the concern in Index Options. Also for traders who find financial crunch in trading Futures of Nifty or Bank Nifty, they can trade in Index options with a lower investment.

Top 5 Nifty Options Trading Tips

Options is one of the only instrument in the market with gives you the opportunity to get unlimited profits at the same time put a limit to your losses. Intraday traders typically suffer severe financial losses in their first months of trading, and many never graduate to profit-making status.

- best forex entry strategy pdf.

- 6 P's of Business - Business Advice for Entrepreneurs by Experts | Motilal Oswal.

- Bank Nifty Option Tips and Strategy.

They should never use money they will need for daily living expenses, retirement, take out a second mortgage, or use their student loan money for day trading. Intraday traders sit in front of computer screens and look for a stock that is either moving up or down in value.

How to trade nifty Options intraday?

They want to ride the momentum of the stock and get out of the stock before it changes course. They do not know for certain how the stock will move, they are hoping that it will move in one direction, either up or down in value. True intraday traders do not own any stocks overnight because of the extreme risk that prices will change radically from one day to the next, leading to large losses. Intraday traders must watch the market continuously during the day at their computer terminals.

Day traders also have high expenses, paying their firms large amounts in commissions, for training, and for computers. Any intraday trader should know up front how much they need to make to cover expenses and break even.