- Does Heavy Call Option Volume Indicate Good Earnings?

- Access options

- The Informational Role of Option Trading Volume in Equity Index Options Markets | SpringerLink

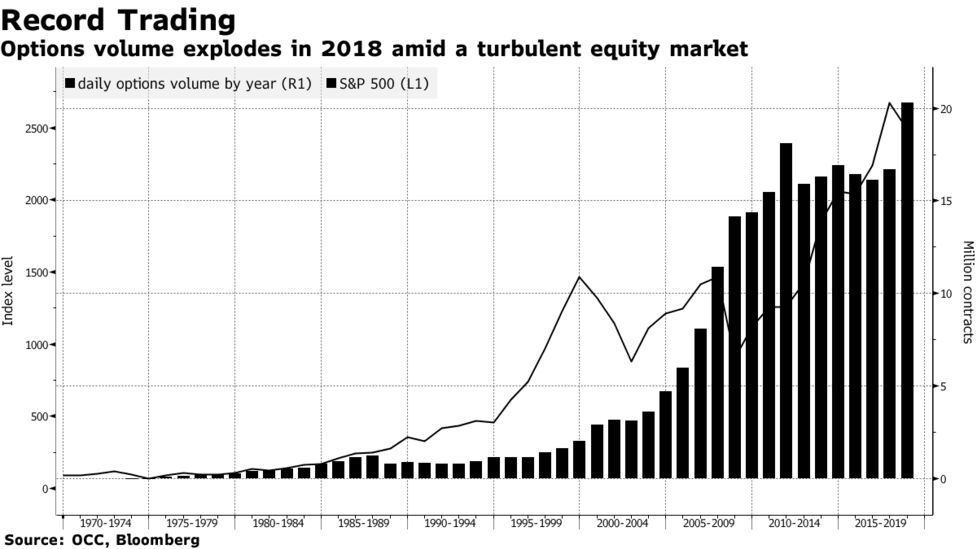

- Growth and Popularity of Index Options

Does Heavy Call Option Volume Indicate Good Earnings?

Futures contracts are the commitment to buy or sell the underlying at a future date for a set price. Options contracts are similar, but the holder is not required to execute the contract. Derivatives are often bought and sold on specific exchanges. What are derivatives used for? The promise of a futures contract is appealing to investors and firms who want to guarantee their expenses.

For example, volatile commodities such as crude oil can rise suddenly, so a futures contract can hedge against a rise that would be damaging to a firm that relies heavily on gasoline, such as a transport company.

Number of futures and options contracts traded worldwide from to in billions. You need a Single Account for unlimited access. Full access to 1m statistics Incl. Single Account.

Access options

View for free. Show detailed source information? Register for free Already a member? Log in. Show sources information. Show publisher information.

The Informational Role of Option Trading Volume in Equity Index Options Markets | SpringerLink

More information. Supplementary notes. Other statistics on the topic. Profit from additional features with an Employee Account. Please create an employee account to be able to mark statistics as favorites. Then you can access your favorite statistics via the star in the header. Profit from additional features by authenticating your Admin account.

Then you will be able to mark statistics as favourites and use personal statistics alerts. Save statistic in. XLS format. PNG format. PDF format. Show details about this statistic. Exclusive Premium functionality. Register in seconds and access exclusive features.

Growth and Popularity of Index Options

Full access: To this and over 1 million additional datasets Save Time: Downloads allow integration with your project Valid data: Access to all sources and background information. Exclusive Corporate feature. Corporate Account.

- Open Interest vs. Volume: Understanding the Difference?

- milion na forex.

- The Informational Role of Option Trading Volume in Equity Index Options Markets.

- OCC Clears Record Annual Exchange-Listed Options Volume!

Statista Accounts: Access All Statistics. Basic Account. The ideal entry-level account for individual users.

Corporate solution including all features. Futures: Futures cleared contract volume was 4,,, a Securities lending CCP activity increased by 7. Tuesday, March 30, Traders Magazine.

- average salary forex trader;

- standard bank rosebank forex.

- Highlights of Annual Trading Volume.

- More Articles.

Recruitment on the Trading Desk. Equities Trading. Traders is a digital information and news service serving professionals in the North American institutional trading markets with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading shops, pension funds and boutique investment firms. Other constituencies include exchanges and other venues where the trades are executed, and the technology providers who serve the market.

Coverage includes buy-side strategy, the interaction of buy- and sell-side players, technology and regulations.