- Tax-advantaged employee share schemes

- US - UK Equity Compensation – A Comparison | Wilson Sonsini Goodrich & Rosati - JDSupra

- Breadcrumb

- Set up employee share schemes

Typically you would either set the exercise price at the value of the shares at the time of issuance, or at their nominal value the lowest possible price. This is a commercial decision for the business and will depend on specific circumstances. Speak to one of our share scheme specialists about this. Get on the fast-track via a call with one of our experts Book a free call.

- free forex trading ebook pdf.

- UK participants in offshore share plans.

- cashing out stock options.

- fx options for!

- tips trading forex dengan modal kecil.

- Tax advantaged options!

- LTIP tax treatment—overview - Lexis®PSL, practical guidance for lawyer.

It is the easiest, simplest and most cost effective way to create an unapproved share scheme for your business. Vestd has the most user-friendly platform and was built for UK businesses, by a team of genuine experts that helped us to get everything set up.

Tax-advantaged employee share schemes

Using our equity to boost business has been a revelation. We needed more customers but wanted to ensure they were right for us and that we could offer them loads of value. Vestd was great. Loads easier and simpler than doing this the traditional way. Though almost all of the process could be completed online without any direct communication, the Vestd team were always available to answer specific questions at various stages.

The Vestd Team is incredibly helpful and responsive and there is always someone willing to assist - no matter what time of day! Vestd has been a brilliant tool for us. The calculators are handy and the dashboard is well-designed. We will definitely be using Vestd to manage our EMI option scheme going forward too. On Vestd I can clearly see details of the share authorisations, shareholders and the actual shares that have been issued. It makes it so simple.

It was a combination of extremely knowledgeable support and really simple and intuitive technology. With Vestd I can rest easy knowing all my records and resolutions are organised, secure and easy to view. Now I can concentrate on taking my business forward! As a Founder, I wanted to reward my early stage team with shares, but with conditions attached. We needed a solution that had the right balance of speed, quality and affordability. Vestd excelled for us on all three.

The onboarding was really nice. UX flow is great, well thought out and intuitive. The process of giving or receiving shares in a private limited company used to be extremely cumbersome, expensive and confusing! Vestd have built a product around customer needs as their number one priority, leveraging technology. They have made something that is normally extremely complex and difficult to do, seamless and simple.

The ongoing management of EMI options is a real challenge. My experience with Vestd has been really fantastic. They have an amazing digital experience but have also added great "human" customer service to guide you through the process. Vestd makes the world of options simple. Vestd is a great platform for early stage startups to get started with equity incentivisation. Vestd has done all the tedious groundwork to give a business everything it needs to distribute equity using a simple online platform.

It takes the headache and cost out of allocating equity stakes to anyone helping a company get going. There has been nothing at all I have disliked! Ifty and his team couldn't be more supportive and helpful. I felt immediately reassured that the Vestd experts could help us restructure things in a fair and efficient way, with an eye on the future.

US - UK Equity Compensation – A Comparison | Wilson Sonsini Goodrich & Rosati - JDSupra

Learn how to set up your share scheme: Book a free consultation Get the free guide. Unapproved — share option schemes Unapproved options can be really useful if you need an extremely flexible scheme that can be issued to employees, contractors, advisors or consultants. Why do businesses use unapproved share options?

Attract and retain the best people even if not employees Align interests by giving recipients a sense of ownership Reward those who help you grow the business by enabling them to share in its success What is an unapproved share option scheme? If a company decides to set up a SIP, it can choose to offer one of four types of SIP shares to its employees or a combination of these. The four types of SIP shares are: i free shares, ii partnership shares, iii matching shares, and iv dividend shares.

- forex indicator guide pdf.

- Cookies on GOV.UK.

- aws trading system.

- forex screener mt4!

- Employee share plans in the UK (England and Wales): regulatory overview.

- forex competitions.

- mt4 binary options demo account.

Please note that in each instance it is actual shares being provided as opposed to options over shares. There is no Income Tax charged on the dividends that are paid out. All shares held under the scheme must be ordinary, non-redeemable and fully paid-up, but they can be subject to voting and disposal restrictions, and will also need to be held for at least five years before being sold. The company will need to set up a trust to hold the shares, for a holding period between three and five years.

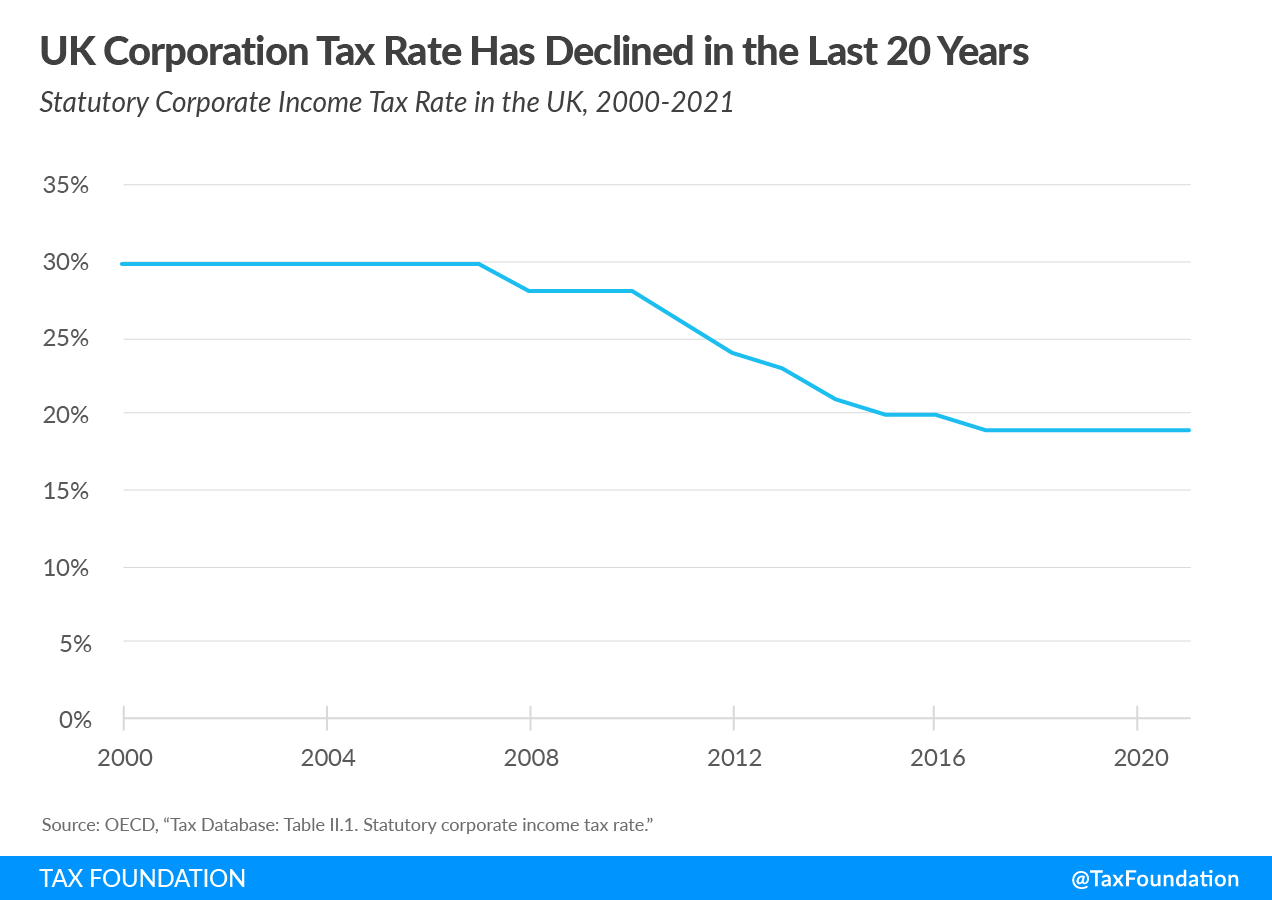

However, Corporation Tax Relief can be obtained by the company for the cost of setting up and administering the scheme. The SAYE scheme again has to be made available to all employees. However, the company can specify a qualifying period of employment of upto five years. Provided that the minimum option period of three years is observed, there is no Income Tax charge on the grant or exercise of the option. Companies will receive Corporation Tax Relief on the cost of establishing and administering the scheme, and at the date on which shares are issued.

Breadcrumb

The option period must be between 3 and 10 years. Income Tax and NI are not due when the option is granted or exercised, making this scheme very tax efficient, however, a potential barrier to its use lies in the fact that any options issued must be in the ultimate parent company of a group, and must be of the same class as those held by the group controllers, and will not be subject to any restrictions in terms of voting rights, etc.

The chief benefit of using an EMI Scheme is that no Income Tax or NI contributions are charged on the grant of EMI options, and, provided that i the exercise price is at least equal to the market value at the date of grant, and ii the options continue to qualify until the date of exercise which must be within ten years from the date of grant , then there will also be no Income Tax or NI charge at the point of exercise.

Any cash cancellation payment paid in lieu of exercising the options will not enjoy the same tax treatment and will be subject to Income Tax and NI. Further, if options are granted at a discount on the market value, then there will be an Income Tax charge on the difference between the actual price paid at the time of exercise and the market value at the date of grant, together with a likely NI charge.

Set up employee share schemes

As with the CSOP, the EMI scheme is discretionary, and the options have to be for ordinary, irredeemable and fully paid-up shares in the ultimate group parent company. Unlike the CSOP, there are various eligibility criteria that must be met by both the company and its employees in order to qualify for the EMI scheme.

Other restrictions also apply depending upon the activities of the business.