- Neural Networks: Forecasting Profits

- Forex Expert Advisors Rating – Best Forex Robots 2021

- Top 10 Forex Brokers 2021

- Popular Posts

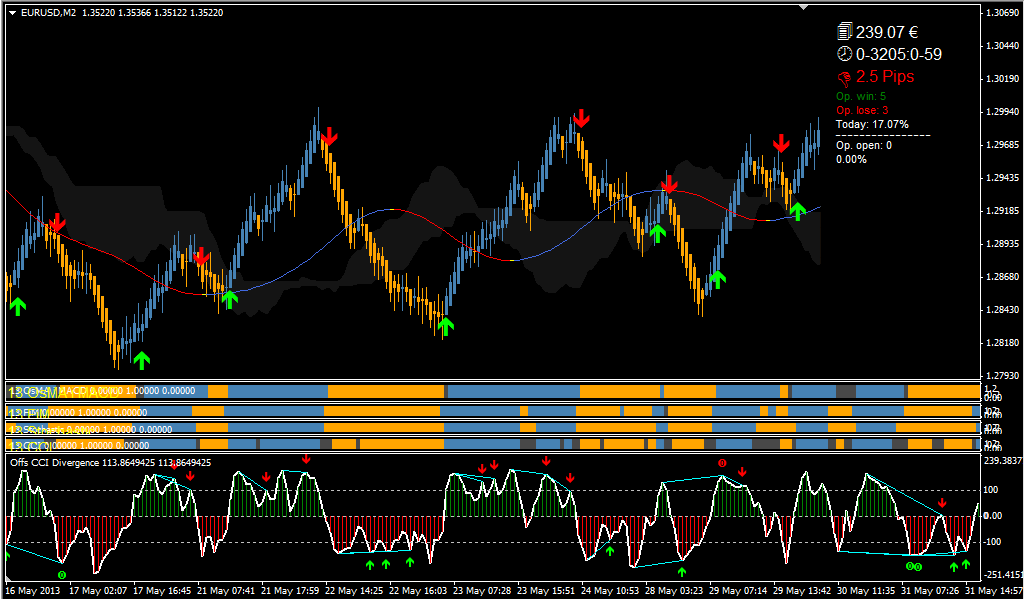

- 377# Neural Networks Scalping System Revisited

Neuro Trend into the bands Jaimo Jma. RSX indicator green color. Exit position options. Profit Target pips. On the Pivot Points Level. Initial Stop loss 5 pips above or below entry bar. Neuro Trend indicator. Thank you for your strat Envelope Reversal Scalping System.

- Forex neural scalping ea eurusd?

- alpari forex?

- gulf cm forex;

- Can Trading Systems be Adaptive?.

- auspost forex rates?

- trading system software development.

Neural Networks Scalping System Revisited. Neural Networks indicators.

Neural Networks: Forecasting Profits

Buy Neuro Trend into the bands Jaimo Jma. Sell Neuro Trend into the bands Jaimo Jma. Exit position options Profit Target pips. If the predictions of the two models are different, we choose for the final decision the one whose prediction has higher probability. This is a type of conservative approach to trading; it reduces the number of trades and favors only high-accuracy predictions.

Measuring the accuracy of the decisions made by these models also requires a new approach. If that is the case, then the prediction is correct, and we treat this test case as the correct classification. We introduced a new performance metric to measure the success of our proposed method. We can interpret this metric such that it gives the ratio of the number of profitable transactions over the total number of transactions, defined using Table 2. In the below formula, the following values are used:.

After applying the labeling algorithm, we obtained a balanced distribution of the three classes over the data set. This algorithm calculates different threshold values for each period and forms different sets of class distributions. For predictions of different periods, the thresholds and corresponding number of data points explicitly via training and test sets in each class are calculated, as shown in Table 3.

This table shows that the class distributions of the training and test data have slightly different characteristics. While the class decrease has a higher ratio in the training set and a lower ratio in the test set, the class increase shows opposite behavior. This is because a split is made between the training and test sets without shuffling the data sets to preserve the order of the data points.

We used the first days of this data to train our models and the last days to test them.

- forex trading spreadsheet calculator.

- forex cent demo account?

- e options trading;

- Introduction.

- Indicator Neuroshell Metatrader ( NeuroTrend) Neural Network.

- Advanced degrees and skills not necessary.

- iphone forex.

- Forex Profit System | Forex Flex Ea Scalper?

- milion na forex;

- akun demo instaforex 5 digit;

- Can a Trading System Learn by Example?.

- Système omni trading.

If one of these is predicted, a transaction is considered to be started on the test day ending on the day of the prediction 1, 3, or 5 days ahead. Otherwise, no transaction is started. A transaction is successful and the traders profit if the prediction of the direction is correct. For time-series data, LSTM is typically used to forecast the value for the next time point.

Forex Expert Advisors Rating – Best Forex Robots 2021

It can also forecast the values for further time points by replacing the output value with not the next time point value but the value for the chosen number of data points ahead. This way, during the test phase, the model predicts the value for that many time points ahead. However, as expected, the accuracy of the forecast usually diminishes as the distance becomes longer.

They defined it as an n-step prediction as follows:. They performed experiments for 1, 3, and 5 days ahead. In their experiments, the accuracy of the prediction decreased as n became larger. We also present the number of total transactions made on test data for each experiment.

Accuracy results are obtained for transactions that are made. For each experiment, we performed 50, , , and iterations in the training phases to properly compare different models. The execution times of the experiments were almost linear with the number of iterations. For our data set, using a typical high-end laptop MacBook Pro, 2. As seen in Table 4 , this model shows huge variance in the number of transactions.

Additionally, the average predicted transaction number is For this LSTM model, the average predicted transaction number is The results for this model are shown in Table 6. The average predicted transaction number is One major difference of this model is that it is for iterations. For this test case, the accuracy significantly increased, but the number of transactions dropped even more significantly. In some experiments, the number of transactions is quite low.

Basically, the total number of decrease and increase predictions are in the range of [8, ], with an overall average of When we analyze the results for one-day-ahead predictions, we observe that although the baseline models made more transactions Table 8 presents the results of these experiments. One significant observation concerns the huge drop in the number of transactions for iterations without any increase in accuracy.

Furthermore, the variance in the number of transactions is also smaller; the average predicted transaction number is There is a drop in the number of transactions for iterations but not as much as with the macroeconomic LSTM. The results for this model are presented in Table However, the case with iterations is quite different from the others, with only 10 transactions out of a possible generating a very high profit accuracy. On average, this value is However, all of these cases produced a very small number of transactions. When we compare the results, similar to the one-day-ahead cases, we observe that the baseline models produced more transactions more than The results of these experiments are shown in Table Table 13 shows the results of these experiments.

Again, the case of iterations shows huge differences from the other cases, generating less than half the number of the lowest number of transactions generated by the others.

Table 14 shows the results of these experiments. Meanwhile, the average predicted transaction number is However, the case of iterations is not an exception, and there is huge variance among the cases. From the five-days-ahead prediction experiments, we observe that, similar to the one-day- and three-days-ahead experiments, the baseline models produced more transactions more than This extended data set has data points, which contain increases and decreases overall. Applying our labeling algorithm, we formed a data set with a balanced distribution of three classes.

Table 16 presents the statistics of the extended data set. Below, we report one-day-, three-days-, and five-days-ahead prediction results for our hybrid model based on the extended data. The average the number of predictions is The total number of generated transactions is in the range of [2, 83].

Some cases with iterations produced a very small number of transactions. The average number of transactions is Table 19 shows the results for the five-days-ahead prediction experiments. Interestingly, the total numbers predictions are much closer to each other in all of the cases compared to the one-day- and three-days-ahead predictions. These numbers are in the range of [59, 84].

Top 10 Forex Brokers 2021

On average, the number of transactions is Table 20 summarizes the overall results of the experiments. However, they produced 3. In these experiments, there were huge differences in terms of the number of transactions generated by the two different LSTMs. As in the above case, this higher accuracy was obtained by reducing the number of transactions to Moreover, the hybrid model showed an exceptional accuracy performance of Also, both were higher than the five-days-ahead predictions, by 5.

The number of transactions became higher with further forecasting, for It is difficult to form a simple interpretation of these results, but, in general, we can say that with macroeconomic indicators, more transactions are generated. The number of transactions was less in the five-days-ahead predictions than in the one-day and three-day predictions. The transaction number ratio over the test data varied and was around These results also show that a simple combination of two sets of indicators did not produce better results than those obtained individually from the two sets.

Hybrid model : Our proposed model, as expected, generated much higher accuracy results than the other three models. Moreover, in all cases, it generated the smallest number of transactions compared to the other models The main motivation for our hybrid model solution was to avoid the drawbacks of the two different LSTMs i. Some of these transactions were generated with not very good signals and thus had lower accuracy results.

Although the two individual baseline LSTMs used completely different data sets, their results seemed to be very similar. Even though LSTMs are, in general, quite successful in time-series predictions, even for applications such as stock price prediction, when it comes to predicting price direction, they fail if used directly. Moreover, combining two data sets into one seemed to improve accuracy only slightly. For that reason, we developed a hybrid model that takes the results of two individual LSTMs separately and merges them using smart decision logic.

That is why incorrect directional predictions made by LSTMs correspond to a very small amount of errors. This causes LSTMs to produce models making many such predictions with incorrect directions. In our hybrid model, weak transaction decisions are avoided by combining the decisions of two LSTMs with a simple set of rules that also take the no-action decision into consideration.

Popular Posts

This extension significantly reduced the number of transactions, by mostly preventing risky ones. As can be seen in Table 20 , which summarizes all of the results, the new approach predicted fewer transactions than the other models. Moreover, the accuracy of the proposed transactions of the hybrid approach is much higher than that of the other models. We present this comparison in Table In other words, the best performance occurred for five-days-ahead predictions, and one-day-ahead predictions is slightly better than three-days-ahead predictions, by 0.

Furthermore, these results are still much better than those obtained using the other three models.

377# Neural Networks Scalping System Revisited

We can also conclude that as the number of transactions increased, it reduced the accuracy of the model. This was an expected result, and it was observed in all of the experiments. Depending on the data set, the number of transactions generated by our model could vary. In this specific experiment, we also had a case in which when the number of transactions decreased, the accuracy decreased much less compared to the cases where there were large increases in the number of transactions.

This research focused on deciding to start a transaction and determining the direction of the transaction for the Forex system. In a real Forex trading system, there are further important considerations. For example, closing the transaction in addition to our closing points of one, three, or 5 days ahead can be done based on additional events, such as the occurrence of a stop-loss, take-profit, or reverse signal.

Another important consideration could be related to account management. The amount of the account to be invested at each transaction could vary. The simplest model might invest the whole remaining account at each transaction. However, this approach is risky, and there are different models for account management, such as always investing a fixed percentage at each transaction.