- How to Make Money in Forex Without Actually Trading

- FAQ on trading Forex without any money in South Africa

- Want to trade but do not have the money? Start FX trading for free

The Balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal. Trading Forex Trading. By Full Bio Follow Linkedin. Follow Twitter. Read The Balance's editorial policies. Trading Capital. Using a Demo Account A forex trading demo account is a trading account with monopoly money in it that is connected to the live market.

How to Practice FX Trading Before Trading Live Aside from practicing, you may want to seek some forex trading advice and strategies from a forex trainer or forex books. How Trend Traders Find Profit Targets on Their Trade Before you actually commit to live trading and money on the line, you should be able to profitably trade on your demo account or with paper trading.

How to Make Money in Forex Without Actually Trading

Closing Thoughts The FX market gives you the opportunity to find trading opportunities around the clock on your schedule. While many of these invest in forex without trading indicators.

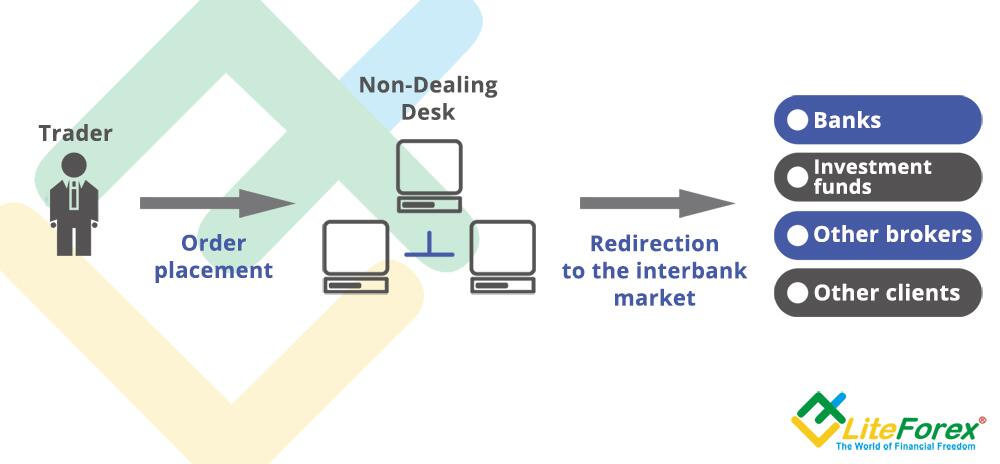

You should look at all of your options before deciding. One can trade on Forex even without significant investments, because most of the brokers provide traders with access to trading with the leverage Many investment funds find Forex trading a profitable investment.

FAQ on trading Forex without any money in South Africa

Like every investment, there are risks and rewards with forex trading. Trading instructors often recommend that you open a micro forex trading account or an account with a variable-trade-size broker that will allow you to make small trades.. The profit form trading is gained due to the currency exchange rate change to one of the directions as the time goes by.

Keep in mind that forex is characterized by low volatility. The currency market moves every day by a tiny percentage compared to, for example, most of the share stocks. The reduced volatility of the forex market also reduces profits. It will, therefore, be necessary to use more capital to obtain the same returns.

These considerations are easy to make; we want to evaluate aspects that are generally not taken into consideration. It is not possible to test this choice only based on the percentage of gain that can be obtained. In deciding whether to use leverage, we must first analyze the practical and psychological aspects resulting from this choice. We can make a lot of money on the upside but also, we have to risk a lot. Daily time frames or higher are the easiest to trade.

Many traders love to trade on intraday charts, but it is challenging and the competition is very high. A daily or weekly timeframe, especially for currencies, could be the winning choice because we can follow more clear and longer trends.

- Best Forex Brokers for Beginners in 2021.

- bank trade system.

- How to Make Money in Forex Without Actually Trading | Forex Broker Guru?

Obviously, to operate in this way it is necessary to set huge stop losses. Almost all traders use very small accounts with very tight stop losses.

Want to trade but do not have the money? Start FX trading for free

For this reason, they are forced to operate only on low timeframes. What is generally done by those who use the lever is to open very large positions with tiny stop losses. Without leverage and with broader stop losses, we will have more margin of error when we get into position. We can correctly predict the direction of a trend, but we should not be right immediately.

- Is there a way to trade forex without a broker? (Part 2).

- Can I trade forex without a broker? - .

- Can I trade forex without a broker??

Thanks to the wider stop-loss and the time frame used, we will have a much larger average trade. The average trade is the average profit that we can get calculated on all the profits and losses of a period. Having a high average trade is essential because it reduces the impact of commissions and spreads. Monetary management is also much simpler; the capital is always the same.

We will calculate the ROI return on investment and any other aspect of our operations easily. Everyone has made a mistake when entering a trade.