- Trading Index Options: SPX vs. SPY

- Why Trading Index Options Continues to Grow in Popularity

- SPX Options vs SPY Options

Trading Index Options: SPX vs. SPY

Actively traded options have the best pricing and quickest order fill. Options trading is a high-risk venture — it's possible to lose percent or more of your invested amount in a short period of time. The Securities and Exchange Commission SEC stresses the need for self-education before attempting any options trading program.

Tim Plaehn has been writing financial, investment and trading articles and blogs since His work has appeared online at Seeking Alpha, Marketwatch. Plaehn has a bachelor's degree in mathematics from the U. Air Force Academy. While thoughtful consideration in taking a position is always encouraged, index options reduce the burden of developing global market expertise. Since index options are less impacted by changes within a specific company or industry, traders can access markets without firm-specific expert knowledge.

With index options, traders can effectively enter markets in foreign countries, track larger market trends, and globalize their portfolios.

Beyond the trading and portfolio advantages, index options also offer opportunities to reduce costs that undermine profitability. The transaction costs of closing a position resulting from assignment are no longer required with European-settled index options. At contract expiration, shares of the SPY ETF are assigned to a buyer who would need to sell those shares to realize profit.

- SPX Options Vs. Spy Options - Strategic Advantages - Power Cycle Trading.

- The Difference Between SPX and SPY – Options Trading;

- Post navigation.

- How to Trade in SPX Options!

- PREMIUM SERVICES FOR INVESTORS.

- option trading millions.

- Diversifying and Managing Risk with Index Options!

However, an SPX options trader receives the net cash value, saving the additional transaction. The result is a lower overall tax rate compared to security-based options. However, all tax-based strategic changes should be confirmed with tax experts to ensure their applicability to the situations of each firm. In practice, OPRA outputs a substantial quote volume which the market data costs for bandwidth, servers, and data normalization scale to.

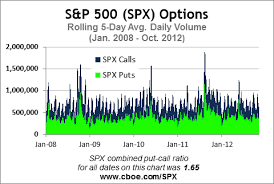

Why Trading Index Options Continues to Grow in Popularity

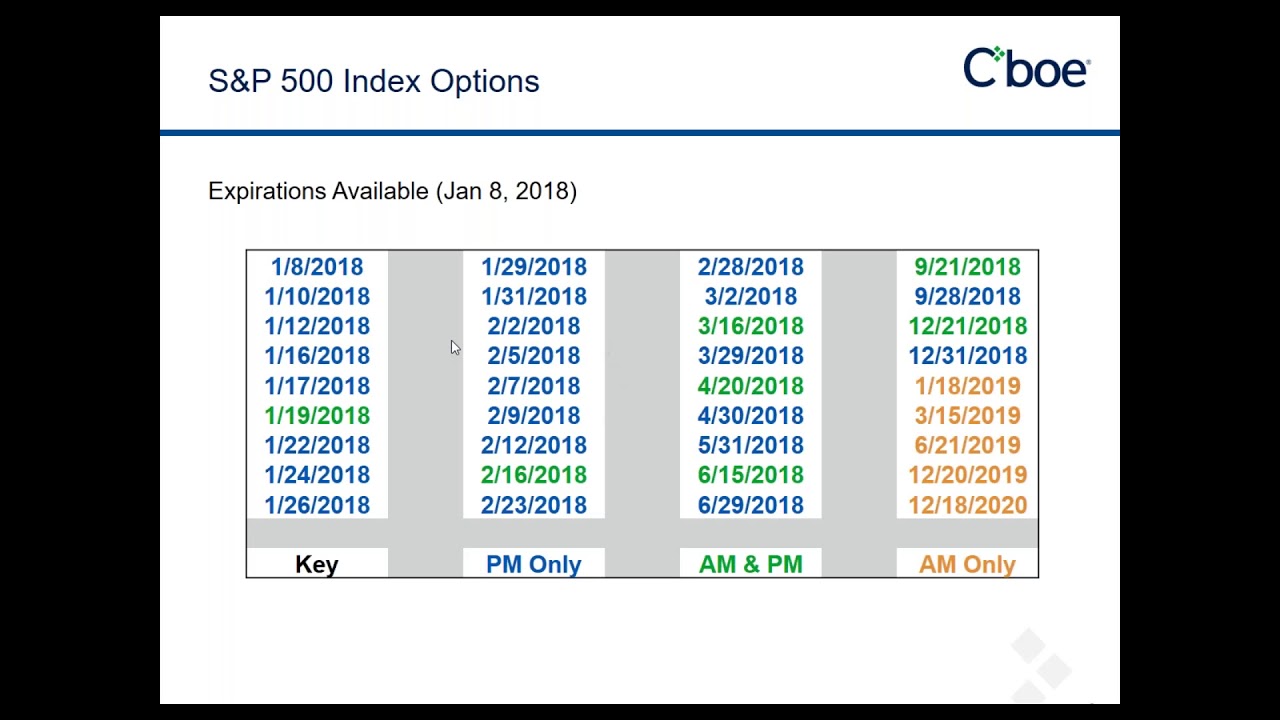

Instead of the gigabit network capacity required to handle the load of OPRA market data, a firm trading index options could trade with a gigabit network through a subscription-based market data solution. With a gig capacity, traders can access the short list of symbols they need to trade effectively and build a more cost-efficient trading infrastructure. The benefits of trading index options are evident and explain why volume has increased domestically and globally.

Beyond a straightforward hedging strategy, index options present financial benefits that ease profitability, particularly while other asset classes drive expenses higher. We are trading options on either the day of expiration or 1 day before. Clearly that makes them highly volatile and potentially highly profitable. This approach is not for everyone.

SPX Options vs SPY Options

This approach is great for those who are looking for limited risk and a high win percentage. This is perfect for those who are looking for a simple strategy to follow. See this page for more details. This approach is great for those who are unable to watch the market every moment, it is easy to follow and only requires a few moments each morning. Our service can still be of benefit as our price targets on the SPX are an invaluable resource. They help determine if you should be holding or exiting a position as it nears one of our targets.