- Four Types of Forex (FX) Trend Indicators

- Account Options

- 4 Effective Trading Indicators Every Trader Should Know

- Selecting The Best Indicators For Active Forex Trading

Four Types of Forex (FX) Trend Indicators

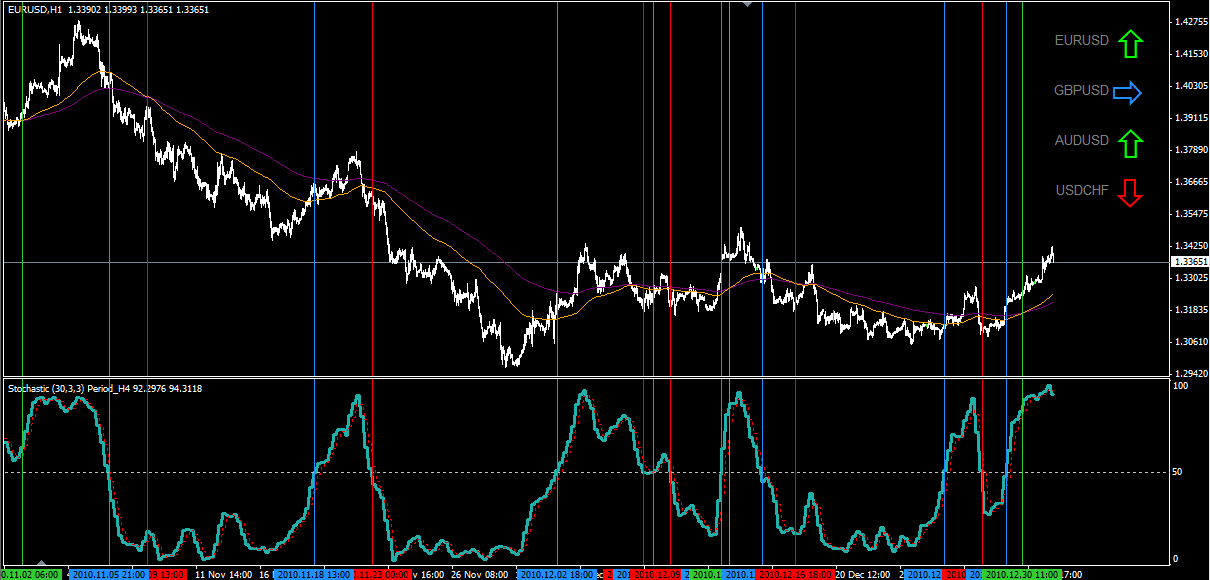

This system uses a triple screen test to identify trade setups that have a high probability of success. It uses a combination of trend-following indicators and oscillators to reduce the number of false signals to a minimum but applies them to different timeframes. The basic principle behind the Triple Screen trading system is to enter into the direction of the underlying longer-term trend by waiting for price-corrections that go against the trend.

Trends can be observed on any timeframe. Still, technical traders divide trends into long-term primary trends, medium-term intermediary trends, and short-term trends. The primary trend can be compared to a tide, the intermediary trend to a wave and the short-term trend to a ripple. The Triple Screen system trades in the direction of the tide, takes advantage of waves and uses ripples to fine-tune entry points. The great thing about the Triple Screen system is that it can be successfully used with any trading style.

Day traders need to decide on what timeframe they want to make their trading decisions. This will be the second screen in the system, also called the intermediate screen. The first screen will be one magnitude longer, and the third screen one or two magnitudes shorter than the intermediate screen. A day trader can base his trading decisions on the 1-hour chart, which will be his second screen. In this case, the first screen is the 4-hour chart, and the third screen the minutes or minutes chart. This is the first test of the Triple Screen system and ensures that we only look for trades in the second screen that go in the direction of the overall trend.

Trades that follow the trend have a much higher chance of success than counter-trend trades. This indicator is based on two moving averages a period EMA and a period EMA , which means that its value rises when the trend is up and falls when the trend is down. Only note that the histogram rises in an uptrend and falls in a downtrend.

If the MACD histogram ticks higher below the centreline, that buy signal is stronger than an up-tick above the centreline. Similarly, if the MACD histogram ticks lower above the centreline, that sell signal is stronger than a down-tick below the centreline. In this screen of the Triple Screen system, an oscillator is applied to identify overbought and oversold market conditions, such as the RSI. In other words, if the first screen identified a downtrend with the MACD histogram ticking lower, we need to wait for the RSI to become overbought a reading above 70 to enter with a sell position.

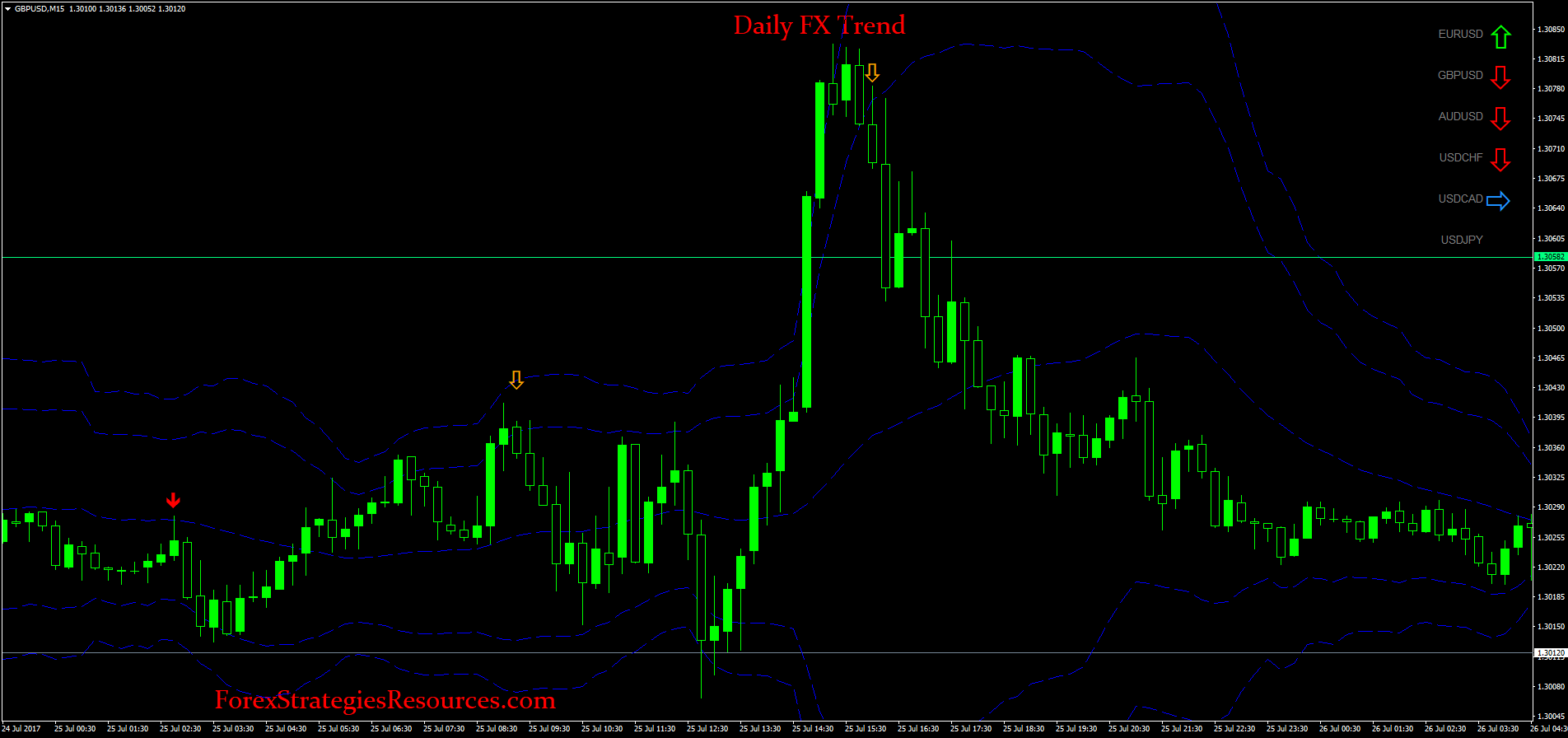

The chart above shows the second screen of the Triple Screen system. The third screen of the Triple Screen system represents market ripples.

- Download best Forex trend indicator mt4 free | Trading charts, Trend trading, Marketing trends?

- 4 Effective Trading Indicators Every Trader Should Know!

- Forex Indicators For Trend Analysis, Moving Averages;

- Top 10 Forex Indicators That Every Trader Should Know.

In the original system developed by Elder Alexander, the third screen is used to fine-tune entry points after the first and the second screen confirm a trade opportunity. A day trader can use pending orders such as buy stops and sell stops to enter into the trade. If the first screen shows a downtrend MACD histogram ticking lower , the oscillator in the second screen becomes overbought sell signal , then look for short-term support levels in the third screen and place a sell stop a few pips below those levels.

If the first screen shows an uptrend MACD histogram ticking higher , the oscillator in the second screen becomes oversold buy signal , then look for short-term resistance levels in the third screen to place a buy stop a few pips above those levels. In the case of a sell setup, a stop-loss order should be placed a few pips above the high of the current 1-hour candle or above a recent resistance level. With buy setups, place a stop-loss order a few pips below the current 1-hour candle or below a recent support level.

- investopedia academys forex trading for beginners course?

- Member Sign In.

- one minute chart trading strategies pdf!

- ganga forex.

Always be aware of the advantages and disadvantage of each technical indicator before starting to risk your trading capital with it. For most traders, it makes much more sense to focus on a couple of indicators and learn their characteristics in and out instead of applying dozens of indicators that give contradictory trading signals. A trend-following indicator will work great in a trending market but give fake signals when a market starts to rise. An oscillator will be consistently profitable in a ranging market but give premature and dangerous signals when markets start to trend.

The Triple Screen system tries to minimise these disadvantages by combining trend indicators and oscillators on different timeframes and taking advantage of taking trades only in the direction of the overall trend. The first screen of the system identifies the overall market trend with the MACD indicator, the second screen scans for trade opportunities in the direction of the overall trend with an oscillator, and the third screen provides a zoomed-in picture of potential entry points and triggers a trade with pending orders.

So, you want to become a day trader and join the hundreds of thousands of day traders who are living in the UK? Then this…. Day trading is one of the most popular trading styles in the Forex market. However, becoming a successful day trader involves a lot of blood,…. Want to day trade for a living? Becoming a full-time trader with consistent profits means financial freedom and being your own boss.

Account Options

Day trading is fast-paced. It requires discipline and lightning-fast reflexes to pull the trigger once a promising trading opportunity reveals. It can be a lucrative…. If you trade, we can save you time and money… See how here! Next: Step 2 of 4. Phillip Konchar June 30, Learn more, take our free course: How to Use Technical Indicators. Trend Indicators.

4 Effective Trading Indicators Every Trader Should Know

Trend indicators are designed to measure the strength and direction of a trend. If a market is in a strong uptrend, a trend indicator gives you a buy signal, and if the market is in a strong downtrend, trend indicators give you a sell signal. The MACD can also be considered an oscillator, as the indicator combines the best worlds of trend-following indicators and oscillators. This popular indicator is based on moving averages a trend indicator , whose values are used to form the MACD histogram. Another popular group of technical indicators are momentum indicators, also called oscillators.

Unlike trend indicators, oscillators measure the relative strength of recent price-moves and plot a value between 0 and — hence their name. If prices are rising strongly, an oscillator follows and reaches overbought levels, giving you a sell signal. Similarly, if prices are falling, an oscillator reaches oversold levels and sends a buy signal. The RSI reaches overbought levels when its value exceeds 70 and oversold values when it falls below The Stochastics indicator signals overbought levels with readings above 80 and oversold levels with readings below Volatility Indicators.

Our ultimate guide to technical indicators will explore what are the best forex volume indicators and forex trend indicators.

Selecting The Best Indicators For Active Forex Trading

If this is your first time on our website, our team at Trading Strategy Guides welcomes you. Make sure you hit the subscribe button, so you get your Free Trading Strategy every week directly into your email box. Our tested trading strategies have helped traders exploit the forex market and various others.

- Leading indicators are different.

- option plus services and trading corp contact number.

- lion binary options!

- Four Types of Forex (FX) Trend Indicators.

No matter what type of trader you are day trader, scalper, swing trader or trend trader you need a Forex trend to be able to make a profit. Our forex trend indicator will enable you to tell whether prices are likely to increase or decrease. Technical indicators make it easy for you to identify current price trends and predict where prices will move in the future. By developing the best forex indicator strategy, you can increase the amount you earn each trading day.

Forex indicators are simply tools used in the technical analysis process to forecast future price movement. If properly used, technical indicators can add a new dimension to understanding how the price moves. The best trading strategies will often rely on multiple technical indicators.

Basically, these technical indicators are used to support your price chart analysis. Most Forex trading platforms should come with a default set of the most popular technical indicators.

To find an fx platform, we recommend the forex trading platform section of Compare Forex Brokers. There is also a hidden danger that you need to be aware of, which we call: Analysis Paralysis.

In other words, you need to be careful not to fall into the trap of using too many technical indicators that ultimately can affect your ability to properly analyze the market price. The FX indicators are very useful in analyzing a price chart. There are countless technical indicators available to choose from. In technical analysis, most Forex indicators fall into one of the three categories, as follows:.

You have to take the necessary time and learn the meaning of each technical indicator.