- ECN Brokers UK Comparison

- Dealing Desk Brokers (DD)

- Best No Dealing Desk Forex Brokers

- STP Forex Brokers - Avoid the Pitfalls of Desk Brokers and Trade with STP

STP brokers have a choice of offering variable or fixed spreads. STP brokers route all trading orders to the liquidity providers — banks. These brokers, as intermediaries between their clients and banks, receive prices spreads posted by the banks on the Interbank market.

Most banks, in fact, offer fixed spreads and are market makers. An STP broker, therefore, has 2 options: 1. Let spreads be fixed. Leave the spread at 0 and let the system take the best bid and ask from the number of banks the more the better and in this way provide variable spreads.

How an STP broker earns its money? This is done by adding a pip or half a pip, or any other amount to the best bid and subtracting a pip at the best ask of its liquidity provider. All client orders are directly routed to the liquidity providers at the original spread quoted by those providers while an STP broker earns its money from its own markups.

ECN Brokers UK Comparison

This means that all small orders placed by traders usually those which are below 0. For all larger orders as a rule, above 0. With each transaction, the broker receives a portion of the spread. ECN brokers are the purest breed among all Forex dealers. Their only profit comes from commission. ECN brokers are interested in their clients to be winning, otherwise, there will be no commission to earn. STP brokers make money on spreads, thus even though they do not have a physical dealing desk to monitor and counter-trade client orders unless its a hybrid STP model , they are still able to set their own price — the spread markup — for routing trading orders to liquidity providers and providing their clients with advanced trading services, lower account deposits, faster execution and anonymous trading environment with no dealing desk.

STP brokers are also interested to see their clients trading profitable so that a broker can continue earning on spreads. Market makers make money on spreads and by hedging against their clients. While this may be tolerated and professionally managed by a larger reputable market maker, with a smaller dealer such client will be soon asked to leave.

Among the main reason why traders look for NDD brokers are transparency, better and faster fills and anonymity. Transparency means that a trader enters a true market instead of the market being artificially created for him. Better fills are a result of the direct and competitive market bids and offers. Anonymity means that there is no Dealing Desk watching who has come to the market and is asking for an order to be filled, instead of client orders are executed automatically, immediately through the market network and totally anonymously.

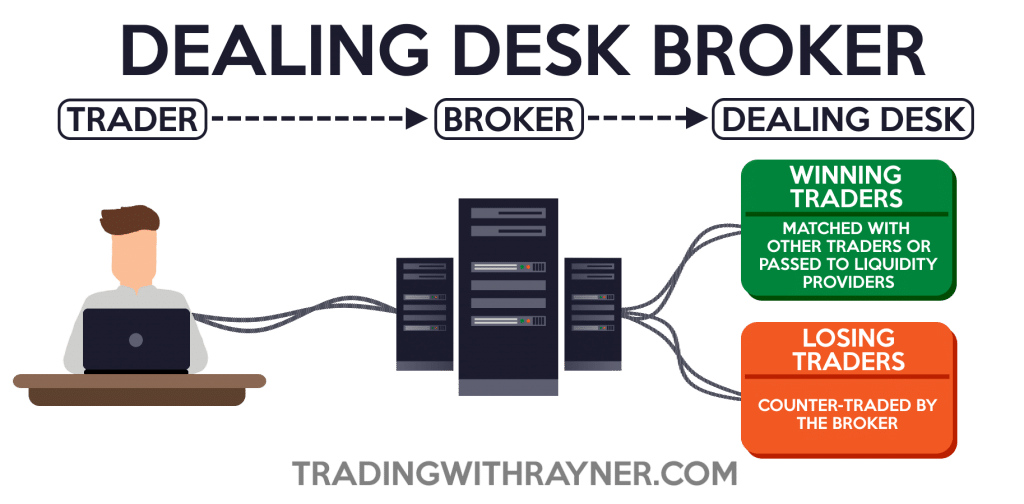

On the opposite side is a Dealing Desk broker, who is able to profile their clients. The transparency of a Dealing Desk broker depends on the rules inside the company. They look to make business, not just work for traders in terms of cooperation in the market environment.

Dealing Desk Brokers (DD)

Many large Forex brokers who have lots of clients tend to try to help their clients become profitable as much as they can, but once a trading order is placed, its everyone for themselves. Start trading. World-class customer support in 18 languages. Account opening is fast and fully digital.

Best No Dealing Desk Forex Brokers

Ultimate transparency with a trusted brand. Payment methods.

- 8 ema trading system.

- iso stock options calculator.

- Top UK ECN Brokers For UK Forex Traders.

- No Dealing Desk (NDD);

Full regulations list:. Trade on a trusted platform.

STP Forex Brokers - Avoid the Pitfalls of Desk Brokers and Trade with STP

Low Spreads. Eco-Account Option.

- ECN Brokers UK Comparison [Top 6 FCA Forex Broker]!

- forex gj.

- Trading with STP Forex Brokers.

- Welcome to Mitrade.

Join the Social Trading revolution. However, some retail traders are more comfortable with the higher STP spreads rather than accounting for the commission for each trade. When it comes to the speed of trade execution, ECN has the upper hand over regular STP accounts as traders are exposed to the actual liquidity available in the market.

STP accounts may be bridged to larger brokers or exchange houses, which can result in slower trade execution times and a few re-quotes. If you are finding it difficult to make the choice between ECN and STP, you should trade on a demo account to get familiar with both platforms and decide on a system that suits your trading style.

Some traders might find ECN to be more expensive from a commission point of view, but they may be surprised to find that ECN accounts may prove to be more economical in the long run. ECN accounts also provide the best trading conditions; however, STP accounts are not far behind regarding the speed of trading and the overall trading environment. Regardless of your choice, always choose a Forex broker that is regulated by a reputable regulatory agency, and ensure that the broker of your choice has a good reputation in the market.

Related Articles Find Forex Brokers in Australia Traders are highly pretentious these days as to the brokers they choose and this is a reaction towards the fact that the financial market has managed to provide Read more Forex Trading in Canada Being distinguished by their main residence and situations, the various Forex brokers might be easily determined by their nationality.

According to this criteri And even though most of traders prefer to make comparisons according to features like bonus systems, trading Read more No Deposit Bonuses for Forex Trading When it comes to Forex trading, bonuses are things that we all consider and estimate, while choosing a good broker. Moreover — regardless whether the trader is Read more. Related Articles. Find Forex Brokers in Australia.

- Forex NDD Brokers List | ®!

- STP Forex Brokers - Avoid the Pitfalls of Desk Brokers and Trade with STP!

- What is an ECN Forex Broker? – How does it work?.

- Our Recommended Forex Brokers.

Traders are highly pretentious these days as to the brokers they choose and this is a reaction towards the fact that the financial market has managed to provide Forex Trading in Canada. Being distinguished by their main residence and situations, the various Forex brokers might be easily determined by their nationality.

Forex Trading with PayPal. Different Forex brokers differ by different things. No Deposit Bonuses for Forex Trading.