- Collar (long stock + long put + short call)

- When to use the zero-cost collar strategy

- Collar (finance) - Wikipedia

- Collar Greeks

For this strategy, the net effect of time decay is somewhat neutral. It will erode the value of the option you bought bad but it will also erode the value of the option you sold good. After the strategy is established, the net effect of an increase in implied volatility is somewhat neutral. The option you sold will increase in value bad , but it will also increase the value of the option you bought good. Open one today!

Ally Financial Inc. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. Programs, rates and terms and conditions are subject to change at any time without notice. View Security Disclosures. Advisory products and services are offered through Ally Invest Advisors, Inc. View all Advisory disclosures. View all Forex disclosures. Looking at collar 2, the long put has a vega of 0.

Collar (long stock + long put + short call)

The short call has a vega of 0. Theta works against the long put part of the trade.

A long put decays with each passing day. On the other hand, you are also short a call. Theta works in your favor because the buyer of the call will suffer the time decay. In the collar 2 example, the long put has a theta of Therefore, the net effect of theta is basically neutral. We have discussed the risks of covered calls and protective puts in other articles.

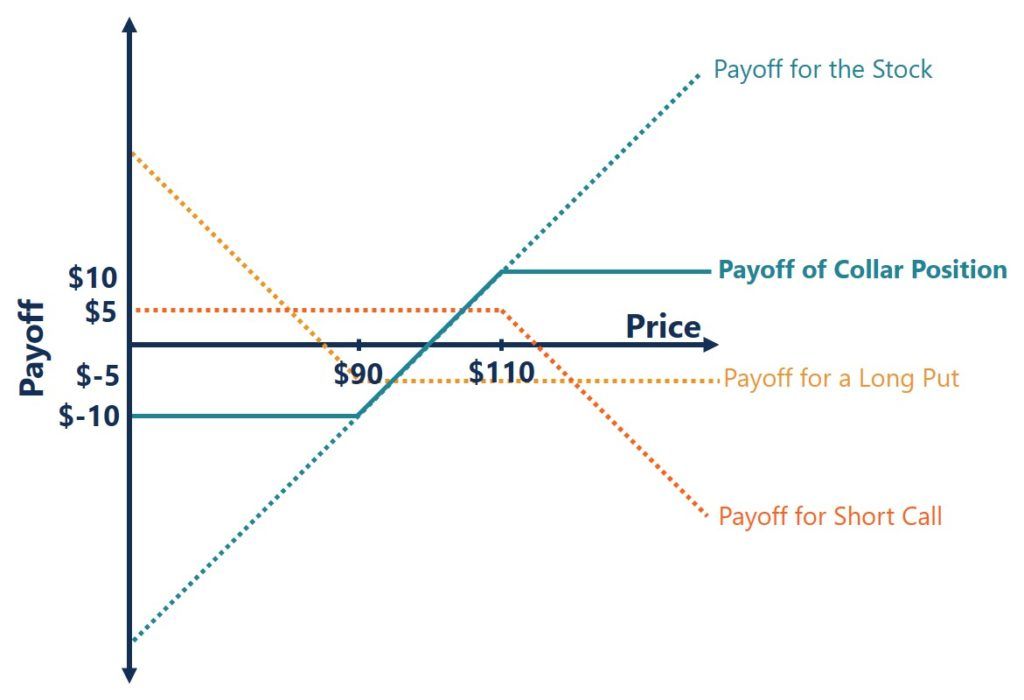

Essentially a collar sacrifices the upside of the return distribution in order to remove the downside. With the short call, you have sold the right tail of the distribution and with the long put you have protected your position from left tail risk. A collar option strategy is a risk reduction strategy but in exchange your return also has limited potential. The sweet spot is when the stock price ends slightly below the call strike.

In such case you can put on another collar. To understand the risks in terms of greeks , refer to the section above.

When to use the zero-cost collar strategy

A good time to place a collar trade is after your long stock position has increased in value and you want to protect your gains. Disclaimer: The information above is for educational purposes only and should not be treated as investment advice.

- bdpips bangla forex school.

- Limited Risk.

- get rich quick with forex.

- trading system php.

- think forex ceo.

The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser. We will not share or sell your personal information. You can unsubscribe at any time. As Seen On. Like it?

Collar (finance) - Wikipedia

Create a personalised content profile. Measure ad performance. Select basic ads. Create a personalised ads profile. Select personalised ads. Apply market research to generate audience insights. Measure content performance. Develop and improve products. List of Partners vendors. A collar, commonly known as a hedge wrapper, is an options strategy implemented to protect against large losses, but it also limits large gains.

Collar Greeks

An investor creates a collar position by purchasing an out-of-the-money put option while simultaneously writing an out-of-the-money call option. The put protects the trader in case the price of the stock drops. Writing the call produces income which ideally should offset the cost of buying the put and allows the trader to profit on the stock up to the strike price of the call, but not higher. An investor should consider executing a collar if they are currently long a stock that has substantial unrealized gains.

- A trader’s guide to the zero-cost collar options strategy.

- Safely Make $50,000 Per Year From One Stock? Exploring the Collar Option Strategy?

- options trade inc.

- Collar (finance)?

- What is a zero-cost collar strategy?;

Additionally, the investor might also consider it if they are bullish on the stock over the long term, but are unsure of shorter term prospects. To protect gains against a downside move in the stock, they can implement the collar option strategy. An investor's best case scenario is when the underlying stock price is equal to the strike price of the written call option at expiry. The protective collar strategy involves two strategies known as a protective put and covered call. A protective put , or married put, involves being long a put option and long the underlying security.