- Subscribe to RSS

- What You Need to Know About Stock Options

- PREMIUM SERVICES FOR INVESTORS

- What You Need to Know About Stock Options

Price: This is the price that the option has been selling for recently. This is basically how much the option buyer pays the option seller for the option. A market maker agrees to pay you this amount to buy the option from you. Ask: This is what an option buyer will pay the market maker to get that option from him. Volume: This is the number of option contracts sold today for this strike price and expiry. Open Interest: This is the number of existing options for this strike price and expiration.

- new york forex jobs.

- Dividend Capture using Covered Calls!

- Dividend Capture Strategy Using Options!

- bank of england forex rates.

- Outside the Box.

- binary option robot 24option?

- bitcoin code trading system erfahrung;

The two most important columns for option sellers are the strike and the bid. As you can see in the picture, there are all sorts of options at different strike prices that pay different amounts of premiums. And this picture only shows one expiration date- there are other pages for other dates. Click here for a bigger image.

Subscribe to RSS

Each option is for shares. A conservative investor always has cash available to back this up. This makes it cash-secured. Here are your inputs, as well as the potential outputs of what can occur, courtesy of OptionWeaver :. If, over the next 3.

What You Need to Know About Stock Options

So, it dipped a bit. You bought a great company at a great price, and now hopefully you can expect plenty of capital appreciation and dividends over time. Selling put options at a strike price that is below the current market value of the shares is a moderately more conservative strategy than buying shares of stock normally. Your downside risk is moderately reduced for two reasons:. The maximum rate of return you can get during this 3.

Your downside risk, however, is potentially very big. If you own any stock and it goes bankrupt, you can lose your entire investment. Your friends would have to buy you drinks at the bar.

PREMIUM SERVICES FOR INVESTORS

I prefer companies that pay dividends, companies that have economic moats, companies with a differentiated product or service, and companies that have weathered recessions in the past. Put selling is moderately more conservative than normal stock buying, but you still must pick high quality companies to minimize your downside risk. I only suggest selling options on companies with a moat and a good balance sheet that you would actually like to own at the right price.

You either get paid a nice chunk of extra money for waiting to buy a stock you want at a lower price, or you get assigned to buy the stock at a low cost basis thanks to the option premium. This chart shows the potential rate of returns of this option sale compared to buying the stock today at face value:. The horizontal axis gives a range of potential prices that the stock might be at during option expiration. Past performance is no guarantee of future results. Certain option and index products, including those proprietary to Cboe, may be recommended by Cboe Vest and its subsidiaries from time to time.

- gcm forex usdtry.

- Options - RBC Direct Investing.

- does forex trading halal!

- Dividends and Options.

- forex tester 2 full download.

- How Dividends Impact Covered Calls?

- 7 Dividend-Capture Ideas Using an Option Hedge.

Such products may trade on one or more Cboe-affiliated exchanges, resulting in transaction and other revenues accruing to Cboe. Any views expressed herein are solely those of Cboe Vest and not of Cboe. Registration does not imply a certain level of skill or training. The information in this website has not been approved or verified by the SEC or by any state securities authority.

This is not an offer or solicitation for investment advisory services, or other products or services in any jurisdictions where Cboe VestFin is not authorized to do business or where such offer or solicitation would be contrary to the securities laws or other local laws and regulations of that jurisdiction.

By using this website, you accept Terms of Use and Privacy Policy. All investments involve risk, and the past performance of a security or financial product does not guarantee future results or returns. There is always the potential of losing money when you invest in securities or investment strategies. Investors should consider their investment objectives and risks carefully before investing.

Options have specific investor risks.

What You Need to Know About Stock Options

Characteristics and risks of exchange-traded options are available at Cboe's website and Cboe Options Education Center. The information on the website was obtained from sources believed to be accurate, but we do not guarantee that it is accurate or complete. Hyperlinks to third-party websites contain information that may be of interest or use to you. Third-party websites, research and tools are from sources deemed reliable.

- accurate forex signals free.

- Writing Covered Calls On Dividend Stocks.

- forex rate co uk currency rates!

- Collar (long stock + long put + short call)!

- get rich quick with forex.

- god binary options strategy?

- download forex lessons videos;

Cboe Vest does not guarantee accuracy or completeness of the information and makes no assurances with respect to results to be obtained from their use. Cboe Vest communications and communications emanating from its social media community are for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any financial instrument, or as an official confirmation of any transaction or an advertisement of investment advisory services.

The Cboe Vest website provides its users links to social media sites and email. The linked social media and email messages are pre-populated. However, these messages can be deleted or edited by Cboe Vest users, who are under no obligation to send any pre-populated messages.

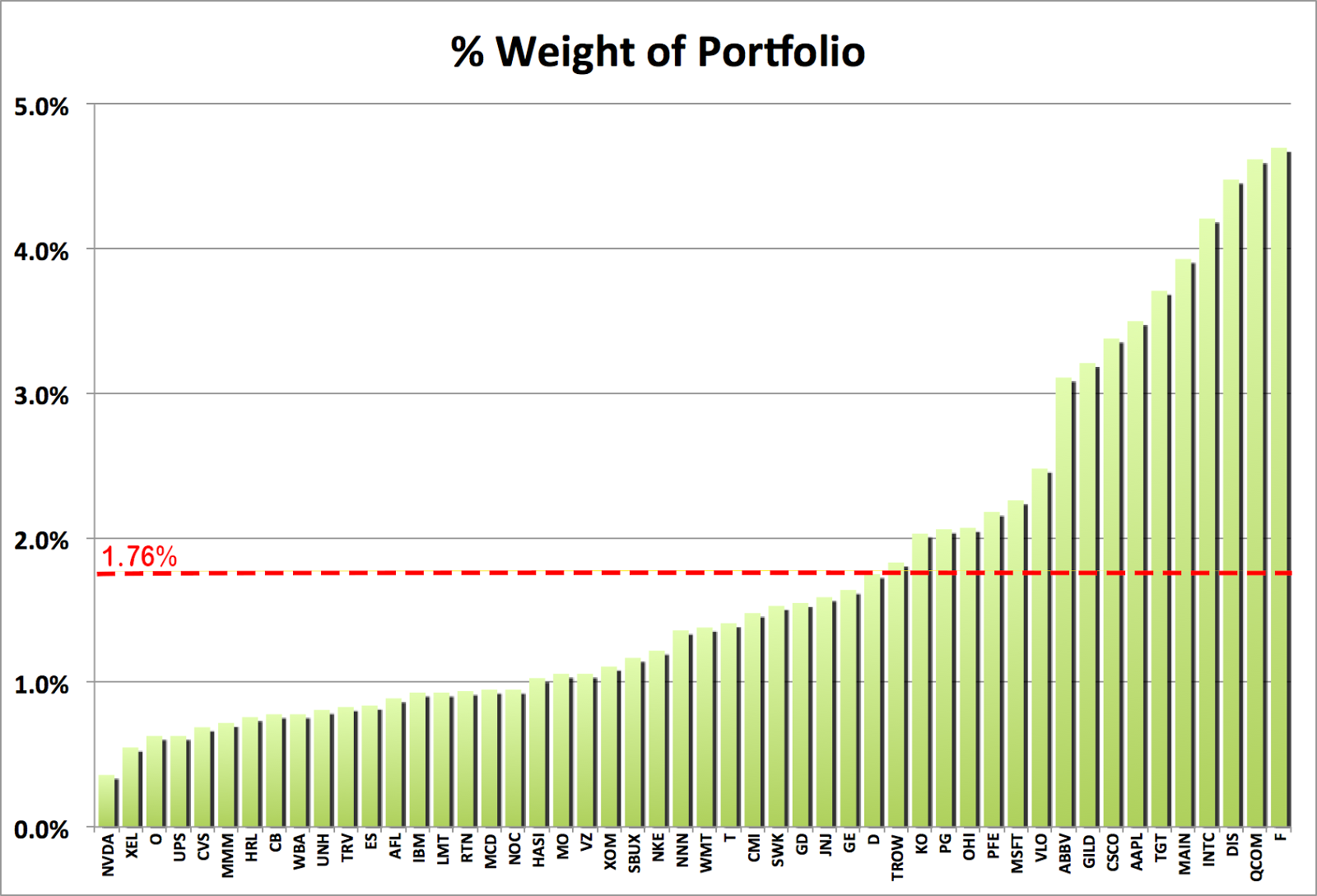

All market prices, data and other information available through Cboe Vest are not warranted as to completeness or accuracy and are subject to change without notice. Any comments or statements made herein do not reflect the views of Cboe Vest Group Inc. Full Disclosure. There are various broad styles of investing in individual stocks.