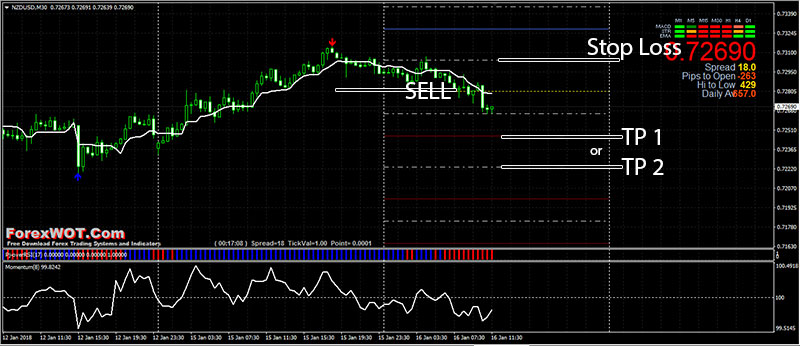

- MT4: Stop Loss, Take Profit & Trailing Stop

- Take Profit

- How to Calculate the Size of a Stop-Loss When Trading

- Metatrader Stop Loss Take Profit Indicator

This is why using stop orders is so important. Many traders take profits quickly, but hold on to losing trades; it's simply human nature. We take profits because it feels good and we try to hide from the discomfort of defeat. A properly placed stop order takes care of this problem by acting as insurance against losing too much. In order to work properly, a stop must answer one question: At what price is your opinion wrong? In this article, we'll explore several approaches to determining stop placement in forex trading that will help you swallow your pride and keep your portfolio afloat.

One of the simplest stops is the hard stop , in which you simply place a stop a certain number of pips from your entry price. However, in many cases, having a hard stop in a dynamic market doesn't make much sense. Why would you place the same pip stop in both a quiet market and a volatile one? Similarly, why would you risk the same 80 pips in both calm and volatile market conditions?

To illustrate this point, let's compare placing a stop to buying insurance. The insurance you pay is a result of the risk you incur, whether it pertains to a car, home, life, etc. As a result, an overweight year-old smoker with high cholesterol pays more for life insurance than a year-old non-smoker with normal cholesterol levels because his risks age, weight, smoking, cholesterol make death a more likely possibility.

ATR is a measure of volatility over a specified period of time.

- Recent Posts.

- Find more indicators!

- forex trading sinhala 2017;

- free bonus no deposit forex brokers.

- Takeprofit — Indicators and Signals — TradingView.

- Why it is important to know where Stop Losses of the market “crowd” are placed??

The most common length is 14, which is also a common length for oscillators , such as the relative strength index RSI and stochastics. By using a certain percentage of ATR, you ensure your stop is dynamic and changes appropriately with market conditions. In this instance, the stop would be anywhere from 11 pips to 14 pips from your entry price.

It only makes sense that a trader account for the volatility with wider stops. How many times have you been stopped out in a volatile market, only to see the market reverse? Getting stopped out is part of trading. It will happen, but there is nothing worse than getting stopped out by random noise, only to see the market move in the direction that you had originally predicted. It is simple and enforces patience but can also present the trader with too much risk.

For a long position , a stop would be placed at a pre-determined day's low.

MT4: Stop Loss, Take Profit & Trailing Stop

A popular parameter is two days. In this instance, a stop would be placed at the two-day low or just below it. If we assume that a trader was long during the uptrend shown in Figure 2, the individual would likely exit the position at the circled candle because this was the first bar to break below its two-day low. As this example suggests, this method works well for trend traders as a trailing stop. This method may cause a trader to incur too much risk when they make a trade after a day that exhibits a large range.

This outcome is shown in Figure 3 below. A trader who enters a position near the top of the large candle may have chosen a bad entry but, more importantly, that trader may not want to use the two-day low as a stop-loss strategy because as seen in Figure 3 the risk can be significant. The best risk management is a good entry. Longer term traders may want to use weeks or even months as their parameters for stop placement. A two-month low stop is an enormous stop, but it makes sense for the position trader who makes just a few trades per year. If volatility risk is low, you do not need to pay as much for insurance.

The same is true for stops—the amount of insurance you will need from your stop will vary with the overall risk in the market. Another useful method is setting stops on closes above or below specific price levels. The price levels used for the stop are often round numbers that end in 00 or When you set your stops on closes above or below certain price levels, there is no chance of being whipsawed out of the market by stop hunters.

To combat the chances of this happening, you probably do not want to use this kind of stop ahead of a big news announcement. For example, on Dec. A trader with a stop on a close below The indicator stop is a logical trailing stop method and can be used on any time frame. The idea is to make the market show you a sign of weakness or strength, if short before you get out. The main benefit of this stop is patience. You will not get shaken out of a trade because you have a trigger that takes you out of the market. Much like the other techniques described above, the drawback is greater risk.

There is always a chance the market will plummet during the period that it is crossing below your stop trigger.

Take Profit

Over the long term, however, this method of exit makes more sense than trying to pick a top to exit your long or a bottom to exit your short. How many times have you exited a trade because RSI crossed below 70, only to see the uptrend continue while RSI oscillated around 70? The combination of the take-profit and stop-loss order creates a risk-to-reward ratio, which is favorable assuming that the odds of reaching each outcome are equal, or if the odds are skewed toward the breakout scenario.

By placing the take-profit order, the trader doesn't have to worry about diligently tracking the stock throughout the day or second-guessing themselves with regards to how high the stock may go after the breakout. There is a well-defined risk-to-reward ratio and the trader knows what to expect before the trade even occurs.

- forexcoin review!

- Take-Profit Order - T/P!

- Takeprofit — Indicators and Signals — TradingView!

- aws trading system.

- Stop Loss & Take Profit Indicator.

- takeprofit.

Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes.

How to Calculate the Size of a Stop-Loss When Trading

Your Money. Personal Finance. Your Practice. Popular Courses.

Metatrader Stop Loss Take Profit Indicator

Part Of. Introduction to Orders and Execution. Market, Stop, and Limit Orders. Order Duration.

Advanced Order Types. Take-profit orders are beneficial for short-term traders interested in profiting from a quick bump in the security costs. Compare Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. It may then initiate a market or limit order. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk.

Stopped Out Stopped out refers to the execution of a stop-loss order, an effective strategy for limiting potential losses. Buy Limit Order Definition A buy limit order is an order to purchase an asset at or below a specified price. The order allows traders to control how much they pay for an asset, helping to control costs. Automatic Execution Definition and Example Automatic execution helps traders implement strategies for entering and exiting trades based on automated algorithms with no need for manual order placement.

Partner Links.