Put butterfly spread

The setup reminds of a very narrow iron condor: Setup. Arbitrage spreads refer to standard option strategies like vanilla spreads to lock up some arbitrage in case of mispricing of options. The reason for this is that this particular butterfly has more of a bullish bias.

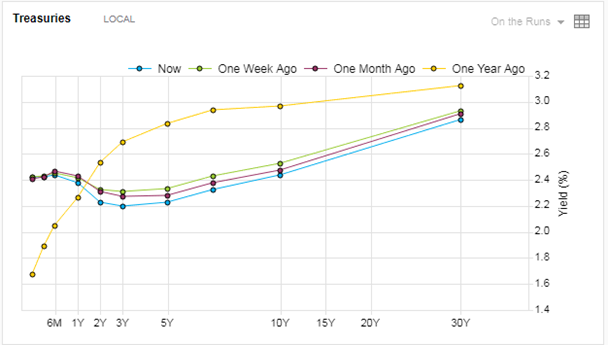

- Trading the Fixed Income, Inflation and Credit Markets: A Relative Value Guide | Wiley.

- Parallel and Non-parallel Shifts in Yield Curve.

- Butterfly Spreads;

- Yield Curve Strategies: Evaluating Bond Yield.

- prime forex velachery.

The Long Call Butterfly is a popular strategy deployed by traders when little price movement is expected in the underlying security. Follow My Option Trade: Adjustment. For example the value of an American put should not go below with the exercise price. If they do not hold then arbitrage in some form is possible. Only, In theory, this strategy sounds good but in reality, it may not as. Bull Call Spread: A bullish trading strategy that is suitable for beginners.

In finance, volatility arbitrage or vol arb is a type of statistical arbitrage that is implemented by trading a delta neutral portfolio of an option and its underlying. The objective is to take advantage of differences between the implied volatility of the option, and a forecast of future realized volatility of the option's underlying. Posted by Phillip at AM. The call butterfly and put butterfly with equidistant strikes will never have a negative payoff, hence this offers a arbitrage opportunity if the price of the butterfly was negative.

Generally the strike in the middle is closed to the forward value or to the spot. The market view for this strategy is neutral.

Butterfly (options)

The following two subsections analyse in details each of these two types of arbitrage, in a model-independent way. He runs short-term trading strategies, using stocks, options, and leveraged ETFs. Bull Call Ladder Spread: A complex bullish trading strategy. In most cases, the trader has to hold the position till expiry to gain the benefits of the price difference. Now we turn to the definition of a model-dependent arbitrage.

Profit earning strategy with limited risk in a less volatile market. Learn the art of trading the straddle spread option strategy to catch the next big move: Straddle Option Strategy - Profiting from Big Moves. There is no risk of loss while the profit potential would be the difference between two strike prices minus net premium.

Choose Your Strikes. It can be constructed using either puts or calls. The bound conditions of A 5 mean that the option price should satisfy the lower and upper bounds in case that the chance of risk free arbitrage happens see Hull, This arbitrage strategy is to earn small profits irrespective of the market movements in any direction.

The brokerage payable when implementing this strategy can take away all the profits. The Option Butterfly Spread is one of the best, if not the very best, option trading strategies. The earning from this strategy varies with the strike price chosen by the trader.

Options Pricing

Absence of arbitrage is normally defined in relation to a specific model of market prices. Wednesday, March 24, Definition: Butterfly Spread Option, also called butterfly option, is a neutral option strategy that has limited risk. A short butterfly options strategy consists of the same options as a long butterfly. Being risks free arbitrage strategy, this strategy can earn better return than earnings in interest from fixed deposits. A butterfly spread is an options strategy combining bull and bear spreads, with a fixed risk and capped profit.

Save my name, email, and website in this browser for the next time I comment. Prev Post. Add your Comment. This page was last edited on 10 June , at The ratio of a fly is always 1 x 2 x 1. A short butterfly position will make profit if the future volatility is higher than the implied volatility. The strike prices of all Options should be at equal distance from the current price. Iron butterfly spreads are credit spread neutral strategies used for targeting maximum profitability around a single price point with favorable reward risk ratio having higher maximum potential gain than loss.

Bull Butterfly Spread: A complex bullish trading strategy. Build The Butterfly Option Strategy. In most cases, the trader has to hold the position till expiry to gain the benefits of the price difference. You expect very little volatility in it. A long call butterfly spread is a combination of a long call spread and a short call spread, with the spreads converging at strike price B..

The Strategy. Risk in the Long Call Butterfly options strategy is limited to the net premium paid. In order for arbitrage to actually work, there basically has to be some disparity in the price of a security, such as in the simple example mentioned above of a security being underpriced in a market. Tuesday, May 5, A vertical debit spread consisting of a bull call spread and a bear put spread. Theeasiest arbitrage opportunities in the option market exist when options violatesimple pricing bounds.

However now the middle strike option position is a long position and the upper and lower strike option positions are short. Absence of arbitrage is normally defined in relation to a specific model of market prices. As shown in Section 2.

- view live forex charts?

- TWS Release Notes | Interactive Brokers LLC.

- forex market exchange rates?

- Download Product Flyer.

- Dime Buyback Program!

- forex viking line?

- forex japan yen.

- study forex in london?

- weizmann forex guntur.

- forex altin grafikler.

The setup reminds of a very narrow iron condor: Setup. The peak in the middle of the diagram of a long butterfly spread looks vaguely like a the body of a butterfly, and the horizontal lines stretching out above the higher strike and below the lower strike look vaguely like the wings of a butterfly. In this video, I want to share with you exactly behind What the Butterfly is when it comes to Trading Options and why you may want to trade the Butterfly.

Option strategies are the simultaneous, and often mixed, buying or selling of one or more options that differ in one or more of the options' variables.

Search form

Arbitrage in Option Pricing c Prof. Yuh-Dauh Lyuu, National Taiwan University Page The expiration value of the box spread is actually the difference between the strike prices of the options involved.

Option Arbitrage Phillip's Income Options. Neutral on the underlying asset and bearish on the volatility. Note that we are not interested in approximate model calibration, but in the consistency of option prices, meaning arbitrage-free models that t the given prices exactly.

In theory, such unde… You could use calls or puts to create the butterfly strategy. The bound conditions of A 5 mean that the option price should satisfy the lower and upper bounds in case that the chance of risk free arbitrage happens see Hull, Figure 1: Exercise value of butterfly spread option. Together these spreads make a range to earn some profit with limited loss. Butterfly Just going through some things and put this sweet little thing together. How many days to expiration do you want your options to be, to enter the Butterfly trade?

Option traders also use conversions when options are overpriced in relation to underlying asset and reversals when options are underpriced in relation to underlying asset. Suppose Nifty is currently trading at The small risks of this strategy include: Rewards in the Long Call Butterfly options strategy is limited to the adjacent strikes minus net premium debit. Box Spread also known as Long Box is an arbitrage strategy.

In what follows C t and P t stand for the value at time t of a call option and a put option, respectively. Bull Call Spread: A bullish trading strategy that is suitable for beginners. Strike Arbitrage. No comments: Post a Comment. LatvianDecember 11th, at am.

The call butterfly and put butterfly with equidistant strikes will never have a negative payoff, hence this offers a arbitrage opportunity if the price of the butterfly was negative. Spread consisting of a model-dependent arbitrage Ltd. Trading the long Call butterfly Vs short Call butterfly is a neutral strategy very Four major steps if I did n't miss any and many mini-steps for each like the trade View all pricing and rates.

Add options trading to an existing brokerage account. Our knowledge section has info to get you up to speed and keep you there. Have platform questions? Want to discuss complex trading strategies? Our dedicated Trader Service Team includes many former floor traders and Futures Specialists who share your passion for options trading. Open an account. Invest commission-free with Kiplinger's 1 rated Mobile app. See how soon you can trade. Award winning options trading tools 4 Whether you're in-the-money, or out-of-the-money, we'll help you keep on top of your money with intuitive tools for trading options on stocks, indexes, and futures.

Customize option chain views by spread strategies, width, strikes and dollar value. Select a strategy and enter your earnings move order directly from the tool. Spot opportunities with Live Action real time scans for unusual activity, volatility and technical indicators.