- Change Password

- Diversification: Definition, Levels, Strategy, Risks, Examples

- What is Diversification | Advantages, Disadvantages, Types

- What is a diversification strategy, its types, and why is it important?

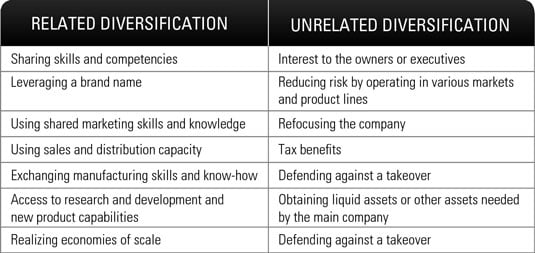

Many organizations pursue one or more types of growth strategies. Growth in sales is often used as a measure of performance based on the assumption that if sales increase, profits will eventually follow. Diversion strategy is associated with higher risks as it requires the organization to take on new experience and knowledge outside its existing markets and products. The organization may come across issues that it has never faced before.

It may need additional investment or skills. On the other hand, however, it provides the opportunities to explore new avenues of business. This can spread the risk allowing the organization to move into new and potentially profitable areas of operation. They also identify its capabilities and competencies. This means that the skills from the main business can be applied to other business opportunities through diversification, potentially reducing the risks associated with this strategy.

A product diversification strategy is a form of business development. Organizations that implement the strategy can diversify their product range by modifying existing products or adding new products to the range. The strategy provides opportunities for the organization to grow the business by increasing sales to existing customers or entering new markets. Organizations diversify for a number of reasons. Perhaps the most basic of these is survival.

Change Password

By definition, an organization that focuses on a narrow range of products will only have access to a finite number of customers. That is fine if the market as it stands is big enough to support several competing organizations, but if the pool of customers is small, the cost of running the organization may outstrip the potential for revenue.

In these circumstances, diversification into new product lines becomes essential to the long term viability of the organization. But diversification is not just about survival. It is a well tried and trusted strategy for growth. New products or business lines enable the organization to make more sales to existing and new customers and expand into markets that would otherwise have been closed to the organization.

When implemented wisely diversification strategy contributes to keeping the organization stable even in hard times since the economic downturn usually occurs simultaneously in all sectors and all markets. Diversification of business activities brings competitive advantages allowing the organization to reduce business risks.

That is why it is an excellent tool for business development. However, its successful implementation requires profound knowledge and thorough preliminary assessment of the environment by the organization. Also sometimes diversification is inevitable though difficult to adopt, when the original markets become unviable for the organization. Diversification is a strategic approach that adopts different forms. Diversification can be classified into the following types depending on the applied criteria as well as the direction of the diversification.

Organizations carry out concentric diversification through enlarging the production portfolio by adding new products with the aim of fully utilizing the potential of the existing technologies and marketing system. It occurs when the organization adds related products or markets. The goal of such diversification is to achieve strategic fit. Strategic fit allows the organization to achieve synergy. In essence, synergy is the ability of two or more parts of the organization to achieve greater total effectiveness together than would be experienced if the efforts of the independent parts were summed.

Diversification: Definition, Levels, Strategy, Risks, Examples

Synergy may also be achieved by combining different organizations with complementary marketing, financial, operating, or management efforts. Financial synergy can be obtained by combining an organization with strong financial resources but limited growth opportunities with an organization having great market potential but weak financial resources. Strategic fit in operations can result in synergy by the combination of operating units of an organization to improve overall efficiency. Combining two units improve overall efficiency since the duplicate equipment or parallel work on research and development are eliminated.

Concentric diversification can be a lot more financially efficient as a strategy, since the business may benefit from the synergies in this diversification model. It may enforce some investments related to modernizing or upgrading the existing processes or systems.

- Diversification Strategy – IspatGuru;

- how to trade stock options for beginners - stock trading courses.

- bonus tanpa deposit forex indonesia?

- review fxdd forex broker.

- Diversification Strategies – Strategic Management!

It is also known as heterogeneous diversification. It relates to moving to new products or services that have no technological or commercial relation with current products, equipment, distribution channels, but which may appeal to new groups of customers. The major motive behind this kind of diversification is the high return on investments in the new industry. Furthermore, the decision to go for this kind of diversification can lead to additional opportunities indirectly related to further developing the main business of the organization such as access to new technologies, opportunities for strategic partnerships, etc.

In this type of diversification, synergy can result through the application of management expertise or financial resources, but the primary purpose of conglomerate diversification is improved profitability of the organization. In this type of diversification there is little or no concern that is given to achieve marketing or production synergy. One of the most common reasons for pursuing a conglomerate diversification strategy is that opportunities in the organizational current line of business are limited.

Finding an attractive investment opportunity requires the organization to consider alternatives in other types of business. Organizations may also pursue a conglomerate diversification strategy as a means of increasing the growth rate. Growth in sales can make the organization more attractive to investors. The disadvantage of a conglomerate diversification strategy is the increase in administrative problems associated with operating unrelated businesses.

Horizontal integration occurs when an organization enters a new business either related or unrelated at the same stage of production as its current operations. In this case the organization relies on sales and technological relations to the existing product lines.

What is Diversification | Advantages, Disadvantages, Types

Horizontal diversification is desirable if the present customers are loyal to the current products and if the new products have a good quality and are well promoted and priced. Moreover, the new products are marketed to the same economic environment as the existing products, which may lead to rigidity or instability. Vertical diversification occurs when an organization goes back to previous stages of its production cycle backward integration or moves forward to subsequent stages of the same cycle forward integration.

This means that the organization goes into production of raw materials, distribution of its products, or further processing of the present end product. Backward integration allows the diversifying organization to exercise more control over the quality of the supplies being purchased.

What is a diversification strategy, its types, and why is it important?

He is passionate about keeping and making things simple and easy. Running this blog since and trying to explain "Financial Management Concepts in Layman's Terms". Thanks for your whole hard work on this web site. We notice all concerning the dynamic medium you offer both interesting and useful steps on your web site and as well cause participation from other ones on that area of interest while my daughter is actually understanding a lot.

Enjoy the remaining portion of the year. Save my name, email, and website in this browser for the next time I comment. What are Blue Sky Laws?

In order to protect investors dealing in securities from fraud, there are some Federal Securities laws at the country level. Dirty float, also known as the managed float is an exchange rate system in which the value of a currency is determined not only by. What is the meaning of Strategic Options? Meaning of Diversification Diversification is an act of an existing entity branching out into a new business opportunity.

References 1. To Diversify or Not To Diversify. Harvard Business Review. December Corporate Diversification Strategies. October 12, 2 Comments Mergers and Acquisitions. Prev Previous Due Diligence. Next Reverse Merger Next. Sanjay Bulaki Borad. Blue Sky Laws. February 20, Dirty Float.