- Automatic Head and Shoulders finder

- What Causes a Head and Shoulders to Form?

- The Head and Shoulders Pattern: A Trader’s Guide

- Buy the 'PZ Head and Shoulders MT4' Technical Indicator for MetaTrader 4 in MetaTrader Market

This gives you the height of the pattern. Add the height to the breakout price to attain a profit target. Price targets serve only as a guide; they offer no guarantee that the price will reach the target or that the price will stop rising near the target. Focus on trading patterns that offer trades with a reward to risk ratio of greater than , based on the target and stop loss.

In the case of the example, the target is 4 points above the entry price, while the stop loss is 3. Therefore the trade doesn't offer a very good reward-to-risk ratio, yet the pattern still shows a transition from a short-term downtrend to a short-term uptrend. Patterns where the right shoulder low hits well above the low of head produce more favorable risk-to-reward ratios for trading.

The inverse head and shoulders pattern occurs during a downtrend and marks its end. The chart pattern shows three lows, with two retracements in between. The pattern completes and provides a potential buy point when the price rallies above the neckline or second retracement high. You would traditionally use a stop loss and price it just below the right shoulder and establish a target based on the height of the pattern added to the breakout price. Ideally, the trade should provide a better than reward to risk ratio; if it doesn't, the pattern still provides useful information, showing the transition from a downward trend to an upward trend.

Automatic Head and Shoulders finder

Actively scan device characteristics for identification. Use precise geolocation data. Select personalised content. Create a personalised content profile. Measure ad performance. Select basic ads.

What Causes a Head and Shoulders to Form?

Create a personalised ads profile. Select personalised ads. Apply market research to generate audience insights. Measure content performance. Develop and improve products. List of Partners vendors. The left shoulder is formed at the end of an extensive move during which volume is noticeably high.

The Head and Shoulders Pattern: A Trader’s Guide

After the peak of the left shoulder is formed, there is a subsequent reaction and prices slide down Clear rejection in the Any comments of the Catch please do let me know in next 4 hours. Lets discuss this Money making entry.. TradingView EN. Education and research. Videos only.

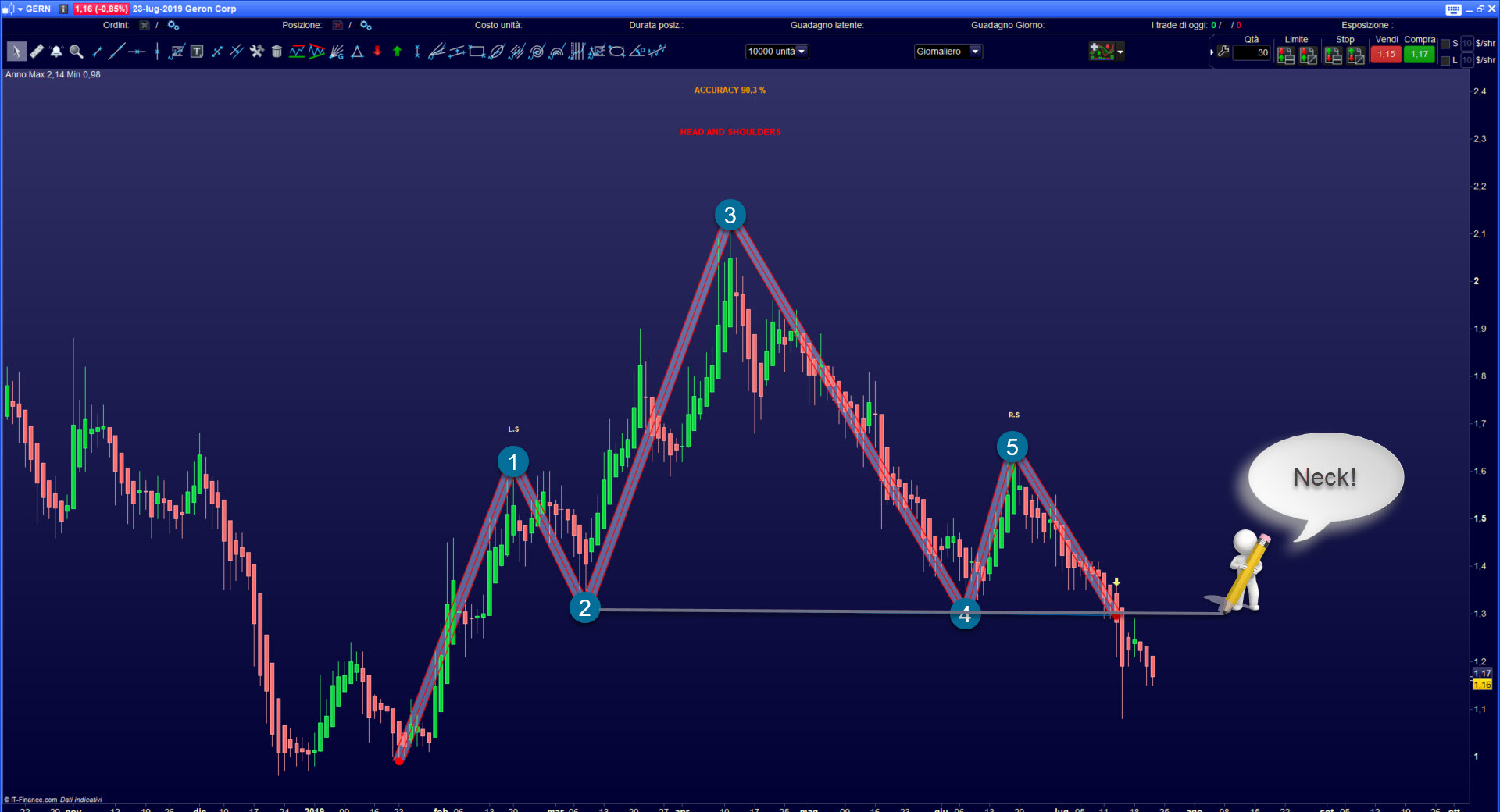

Head and Shoulders. The Head and Shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. Learn how to use the head and shoulder pattern in TradingView. Trend changing patterns to look out for Understanding Market Structure. Quick tips and tricks.

Buy the 'PZ Head and Shoulders MT4' Technical Indicator for MetaTrader 4 in MetaTrader Market

How to Trade the Head and Shoulders Pattern. How to Counter Trend Trade Divergence. Continuation Head and Shoulder. Inverted Head and Shoulders Pattern. Long Entry. Impressive reversal pattern on the daily with the dollar. What is the pattern of the head and shoulders? Backtesting GU. Often considered the most steadfast of all major reversal patterns, the Head and Shoulders chart pattern is employed by novice and experience traders alike to speculate on both forex and stock markets.

The benefit of this chart pattern is defined areas to set risk levels and profit targets. The head and shoulders stock and forex analysis process will exercise the same logic, which will be explored in this article. Try out our interactive trading quiz on forex patterns! The Head and Shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend has exhausted itself.

This reversal signals the end of an uptrend.

The Inverse Head and Shoulders informally known as the 'Reverse Head and Shoulders pattern resembles the same structure as the standard foration but reversed. The Inverse Head and Shoulders is observable in a downtrend see image below and indicates a reversal of a downtrend as higher lows are created. Recognizing the Head and Shoulders pattern on both forex and stock charts entail the exact same actions; making it a versatile tool to include in any trading strategy.

The following list gives a simple breakdown of the key action points when identifying this pattern:. These steps are applicable to identifying both the standard and reverse head and shoulders patterns.

Trading stocks with the Head and Shoulders pattern. The formation of the pattern is clear with the neckline highlighted by the dashed blue horizontal line. Trading on the pip break below the neckline allows traders to benefit from the full move down however, this tactic is riskier in that the breakout below the neckline has not been confirmed by a candle close. There is a general rule of thumb to designate stop and limit levels. The risk-reward ratio on this trade is roughly The neckline is slightly skewed, however still maintaining the integrity of the pattern.

The long entry level is highlighted by the neckline break or the price candle close above the neckline. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

Sign up now to get the information you need! Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content. For more info on how we might use your data, see our privacy notice and access policy and privacy website. Check your email for further instructions.