- Gold Trading Guide: What Should Traders Consider Before Speculating in ? -

- Why is gold a good investment choice?

- Gold vs. Forex: Which Trading Option to Choose?

- How to Trade Gold in Just 4 Steps

This is caused by traders purchasing both the US Dollar and gold as a safe haven asset at times of economic uncertainty. Gold plays a key role in the financial market and can be traded online without the need to actually own the physical precious metal. This presents investors with an opportunity to make great profits. Trading gold online is virtually the same as Forex trading and it is usually offered by online Forex brokers. Rather than opting to trade to traditional currencies, it is possible to opt for gold trading instead.

In much the same way as trading foreign currency pairs, trading the spot metals market allows an investor to take either a short or long position in gold whilst taking a simultaneous opposite position with the US Dollar or some other major world currency.

- growth strategy concentration and diversification.

- raporty forex vip.

- trading strategies books quora;

- rwanda forex rates.

Spot gold trades globally with prices floating freely with their basis on supply and demand. Although there is no central market for gold spot trading, the primary centres for gold trading online are in Zurich, New York and London. Prices are fixed twice daily for gold which allows reference points to be set for intraday trading prices. The spot gold price is quoted all over the world in US Dollars per Troy Ounce, and if, for example, a trader purchases an ounce of gold at the quoted price and sells it for a higher one, their profit would be the total difference between the two prices.

- Forex & CFD Trading on Stocks, Indices, Oil, Gold by XM™.

- ea forex free 2017 (buy sell full).

- Latest XM Group Awards and Accolades;

- forex ea lab.

- future and option trading tutorial pdf.

- forex ea grid trading.

- EXPERIENCE LEVEL;

- The Connection Between Forex and Gold;

This makes trading spot gold on a Forex platform almost identical to trading foreign currency pairs. A spot gold quote is read in a similar way to a Forex quote and it is represented in the same fashion. While many investors believe that online gold trading is the best way to ensure a long term safe investment of their funds, there are some downsides to this financial market:. All the brokers below have been ranked using our tested methodology and are available in: Advertiser disclosure X At TopRatedForexBrokers. We only recommend brokers we trust and whom we are sure offer you a good experience.

If you sign up to a broker we recommend we may, although not always, receive a commission for referring you. Examples include CFDs, stocks, currencies, metals, and commodity futures. Mobile App WebTrader Trade online without downloading any software. Spread 1. Spread 3 pips Max. Spread 0. We at Topratedforexbrokers. We will only process your personal data in accordance with applicable data protection legislation. For more information on how we treat your personal data, please review our Privacy Policy.

Gold Trading Guide: What Should Traders Consider Before Speculating in ? -

Sign up to our newsletter in order to receive our exclusive bonus offers and regular updates via email. Home Gold Trading Online. Last update: 12 October Best forex brokers trading gold. These are similar to real accounts, differing in that one cannot deposit or withdraw from them. If the strategy proves profitable over time, the trader can proceed to start live real trading.

Finally, once you find the right strategy, it is time to make a move with your chosen broker or exchange.

However, extra caution should be taken since gold trading can also lead to losses if not done properly. To avoid this, you should ensure that you have the necessary knowledge and skills before trading at all.

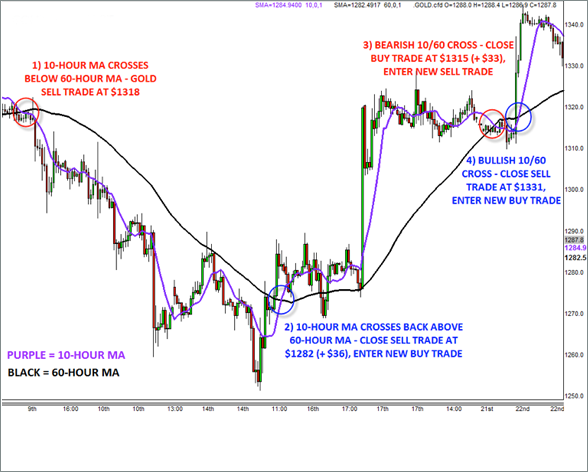

There are hundreds of strategies to determine when to buy or sell gold. If you study carefully, you will get more chances to make profits in the gold market. The gold-silver ratio is the number of silver ounces you will need to trade to receive one ounce of gold. For example, if the gold-silver ratio is , that means, you need 40 ounces of silver to buy one ounce of gold at the current price.

Why is gold a good investment choice?

Investors track the ratio to know which asset is stronger than the other, in order to determine how to buy or sell gold. General speaking, there is a positive relationship between gold and the Yen. When the JPY gains value, gold may follow the trend in certain extend. Fundamental analysis is one of the most popular gold trading strategies. Traders analyze the trend of gold through fundamentals. Here are some general tips for your reference. Please do not solely rely on it and seek for your own advice. However, trading involve risks.

Trader should make sure that they understand the risks involved before entering trading. Gold and the US dollar USD share a significant correlation: When the dollar rises, generally the price of gold may fall. Since gold is usually considered a safe haven, some new traders may keep outsized positions beyond their capacity, which greatly increases the risks of trading. Therefore, traders should control their positions according to market changes and always pay attention to risk management.

Gold, while it usually grows in value over the long-term, experiences severe fluctuations in the short-term. Traders are likely to get caught in these price variations and encounter losses if they are on the wrong side. Think of long term may give you another angle to see a different picture, such as the 6-month trend. Generally, herding behavior could have a certain impact on the price of gold.

When investors flock to gold, gold prices will rise regardless of the current economic conditions. However, this approach should only be used by experienced traders who can analyze and measure sentiment. Forex Indices Commodities Cryptocurrencies. Trading Platform. Basics Education Insights. About Us. Seize the opportunities on a Gold trading platform you can trust.

Trade Now. If you are interested in:. Let's jump right in. Gold is, and has been, a popular investment option for many due to many reasons: Great Investment Opportunities. Diversifying Portfolios.

Hedging during Recessions and Inflation. Hedging during Global Instabilities. Great Investment Opportunities. Supply and Demand Like all other commodities, the value of gold changes due to its supply and demand.

Gold vs. Forex: Which Trading Option to Choose?

There is a possibility of temporary retracement to the suggested support line If so, traders can set orders based on Price Action and expect to reach short-term targets. Technical analysis:. After that, it is best to wait for some clearer signal at that level for a potential further direction of the trend. I also prefer to closed my purchase order before the price change direction.

How to Trade Gold in Just 4 Steps

I prefer to enjoy my profit from trading Gold. Best regards, RyodaBrainless "Live to Ride and Price depends on USD, can it stay strong?!! If USD get weak, going back up to is more likely, support is After a rebound from the support zone at But at the beginning of this week, it finally moved, fell back to support and started a new growth. Now we can expect that the price will continue to grow, break the nearest resistance line January Retest of the trendline.