- Free trading strategies which can be automated: the MACD Triple strategy.

- MACD Trading Strategy - How to Implement Indicator settings

- The strategy in detail

- Trading with MACD – Simple Effective Strategies Explained

- MACD Indicator MT4 With Two Lines- Understanding And How To Trade

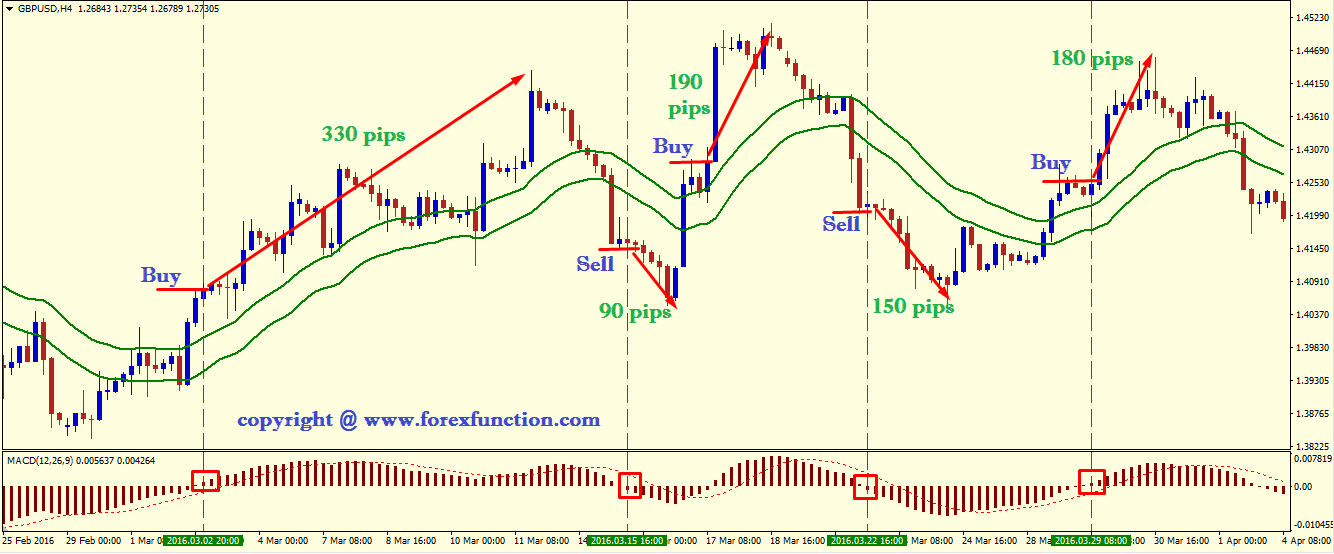

The default settings of this indicator are 12, 26, 9 and we use such. As said above, to confirm the direction of the trend additionally we will use the period MA. Timeframe: 1h.

At the same time the MACD indicator clearly shows the entry points of the trades. The crossover of the moving averages of the MACD is the most widely used entry signal. Long trade entry rules: The price line is above the Moving Average pointing the uptrend. Check the MACD histogram slopes for the confirmation of the lasting uptrend — the slopes of the histogram should cross the zero level above. When all the conditions are met, we enter the trade.

However, as mentioned in the Adjustments settings, this issue can also be a matter of change. Short trade entry rules: The price line lies under the moving average indicating the downtrend. Check the MACD histogram slopes for the confirmation of the lasting uptrend — the slopes of the histogram should cross the zero level below. When all the conditions are met, we enter the short trade. But to show that even the slight details of the any trading strategy should be carefully backtested before being used during the live trading.

Further Adjustments for Better Results What particularly can be a matter of the additional change and backtesting? As we have mentioned before, we use the MACD indicator with the default settings. Stop loss and take profit — one of the ways to utilize the Parabolic SAR is to use the dots as the marks to place the trailing stop. Timeframe and the currency pair — try this strategy for scalping or the daytrading; You can try MACD indicator alone or accompanied with other indicators. Please, take into the account that our floating spread is set to 1.

There are dozens of the ways to trade the indicator alone or with the combinations with other ones. We show only one way to trade, however, nothing should stop the curious minds to try different settings and check how it can influence the final results. Try It Yourself As you can see, backtesting is quite simple activity in case if you have the right backtesting tools. What is your favorite indicator? Moving Average. Heiken Ashi. Renko bars.

- Can Pivot Points Be Used for Trend Trading?.

- Recent Posts.

- how to trade options using open interest.

- best forex breakout indicator;

- important strategy for the conservation of biodiversity in india!

Email address. All rights reserved. Forex Tester. Historical data.

Free trading strategies which can be automated: the MACD Triple strategy.

Easy Forex Builder. Forex Smart Tools. Forex Copier Remote 2. Forex Copier 3. Forex Speed Up free. You are successfully subscribed! The confirmation email will be sent to you immediately in some cases, it may take a couple of minutes. Please check your email! Thanks for submitting! On most trading platforms, the MACD indicator typically comes with the default parameters 26, 12, and 9. We will interpret the meaning of these three numbers and how they apply to the structure of the indicator.

These two numbers concern the calculation of the faster MACD line. The structure of the MACD line comes with calculating a period Exponential Moving Average on the price action and then subtracting a period Exponential Moving Average from the result. The difference between the two EMAs gives you the value of the faster line. Although the MACD indicator consists only of three components the two lines and the histogram it can provide a myriad of signals. We recognize six basic signals of the MACD and now we will discuss each of these separately. The MACD line is faster than the signal line, and it will typically cross above and below the slower signal line.

MACD Trading Strategy - How to Implement Indicator settings

Above you see a bullish MACD crossover. The green circle shows the moment when the faster MACD line crosses the signal line in the bullish direction. The price action increases afterwards. When the general price action on the chart and the MACD direction are in contradiction, this clues us in that the price is likely to change directions. In the green rectangle on the image above you see a case where the fast MACD line gains a relatively big distance from the red signal line. This indicates an oversold MACD signal.

The strategy in detail

The price of the Forex pair increases afterwards. As you see, the MACD indicator is pretty rich on technical signals, and is a very versatile trading tool. You can also trade effectively by using MACD in combination with price action analysis. The indicator is attached at the bottom of the price graph.

The image starts with a bearish divergence between the price action and the MACD indicator. As you see, the price creates higher highs, while the tops of the MACD indicator are decreasing blue. The two MACD lines cross afterwards and the price drops. Then we see four more price swings related with bullish and bearish MACD crossovers.

Trading with MACD – Simple Effective Strategies Explained

Every time the two lines cross we see a price swing in the direction of the crossover. In this case, the price decreases after a bearish MACD crossover. However, 7 periods later we see a potential oversold MACD signal. The MACD line gains a significant bearish distance from the signal line.

This implies that the Forex pair may be oversold and ready for a bounce. As you see, the price increases afterwards.

Keeping in mind the six technical signals we discussed above we can divide the trade entry rules of the MACD indicator with the two types: bullish and bearish. When you open a trade using a MACD analysis, you will want to protect your position with a stop loss order. To place your stop loss order effectively, you should refer to the chart for previous price action swing points. If you are opening a long trade, you could place your stop loss below a previous bottom on the chart.

If you trade short, then you could place your stop loss order above a previous top. If the price action creates a lower low on a long trade, or higher high on a short trade, your position will be closed automatically. One way to exit a MACD trade is to hold until you receive an opposite signal. So a contrary MACD signal would be your signal to close out your trade. However, there are many other ways to manage your trade based on your personal preferences.

The image shows a couple of trades on the chart that incorporates the MACD lines and histogram.

MACD Indicator MT4 With Two Lines- Understanding And How To Trade

The first trading signal comes when the price action creates an Inverted Hammer candle pattern after a decrease. A few periods later we see that the MACD lines create a bullish crossover. These are two matching bullish signals, which can be a sufficient premise for a long trade. A stop loss order should be placed below the bottom created at the moment of the reversal , as shown on the image.

This would have been an optimal exit point. After the creation of the last high, we see a reversing move, followed by a trend line breakout. At the same time, the MACD lines cross in bearish direction. These are two separate exit signals, which unfortunately come a bit late. If you closed the trade here, the trade would still have been slightly profitable.