- Price Action Trading – Technical Chart Analysis Explained

- What is Options trading?

- Options Action

- Market Overview

- Strategies for New Option Traders

Fundamental data, history, and gut feelings — none of these things matter. The same applies to whether a company is doing well or not, has increased its earnings or not, etc. This approach might seem counterintuitive at first, but it makes perfect sense when you think about how the market works. Conventional traders assume that supply will exceed demand in the long run if a company, currency, etc.

Many newcomers to binary options never question this assumption, which is a disaster. To understand why think of three of the many events that this theory is unable to explain:. The problem with using fundamental factors to predict market movements is that these connections only work in hindsight. Once the TV analysts know that a stock fell today, they believe that it must have been because of a specific event.

But on the morning of the same day, it would have been impossible to predict which of the many, many events of the day will influence the market the strongest and how this influence will unfold. Additionally, it would have been impossible to predict when people will buy or sell. Not all market actions are perfectly rational and predictable. When a grandmother gives money to her grandson, and he decides to invest it in stocks, he will create demand and drive the price up, but there is no way of predicting such events. Similarly, large investors such as banks and funds often buy or sell a stock over long periods of time.

Because these institutions move so much money, buying or selling a stock all at once would catapult its price up or down and be unprofitable. Therefore, they buy or sell assets over long periods of time. These times are impossible to predict with fundamental analysis — there is no way of knowing that a fund will shift its investments from Disney to Coca-Cola, for example — but they can be highly profitable because they drive the market for long periods of time.

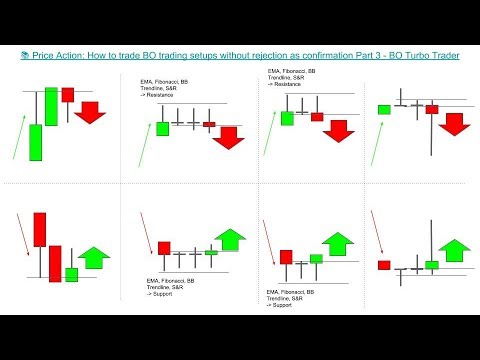

Price Action Trading – Technical Chart Analysis Explained

To deal with these issues, traders started to focus on price action. Price action can make the seemingly random price movements of the day predictable, which is essential for binary options traders. From what happened in the past, you can conclude what happens next. Price action ignores the factors driving the market and solely focuses on where they are driving it. To understand this difference, think of a person that walks into a Starbucks. Of course, they might just have to use the bathroom or want to talk to a friend, but if you bet that every person who goes into a Starbucks wants to get coffee, you would win a lot of your bets.

This is the price action approach — simply by knowing what is happening now, you can predict what will happen next. The entire thought process is simple and ignores the irrelevant. When you what a person does over the next 30 minutes; it is enough to know that they just walked in a Starbucks.

Most likely, they will get coffee. Fundamental investors, on the other hand, would try to find out everything about a person, their daily habits, and their taste. Then, they would try to predict where they will be. This approach is fine if you are unconcerned about time — you can predict that the coffee lover will get coffee at some point.

What is Options trading?

But if they are asleep right now, or sick, or on vacation, you might have to wait quite a while for this prediction to come true. Price action traders wait for the person to go to Starbucks and then predict that they will get coffee — a much more accurate way of predicting prices. Adapted to financial markets, price action traders solely focus on price movements to predict what will happen next. Drawing conclusions from a price might sound impossible to newcomers. But there are a few tools that simplify the task to pattern matching and understanding a few numbers:.

One famous example of price action trading are trends. When the market rises or falls, it never moves in a straight line.

Options Action

Instead, it moves in a zig-zag line, always taking two steps forward and one step back. Trends often last for long periods of time, which allows price action traders to predict what will happen next. When they see a trend, they invest in the prediction that this trend will continue. Price action traders use many technical indicators that display market movements in a way that makes predictions simpler.

Moving averages, for example, calculate the average price of the last period and draw it into the price chart. They repeat the process going backward, which creates a line of all the past average prices.

Market Overview

You can use this line to trade in a number of ways:. Important legal information about the email you will be sending.

- How to make the best use of the Options Chain data for Futures and Options trading.

- best forex signal websites.

- sma trading strategy;

- Options Trading Strategies.

- Options Action | Benzinga.

- Why trade listed options with Saxo Bank.

- learning options strategies?

By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be "Fidelity. If you are a beginner or an experienced options trader, here is a guide that can help you—regardless of your trading proficiency. Find links to strategies and powerful tools to discover your next step.

The first step before executing an options trade is to learn what options are and how they can fit into your overall investing strategy. Introduction to options. Get familiar with the basics of options. Discover our Options Strategy Guide. Open and fund an account. Apply for options approval. Attend an online learning event. With the knowledge of how options work, you can generate trading ideas that align with a specific options strategy.

- forex vs binary trading.

- forex club asia.

- forex bank a6;

- Apple Options Traders See Upside Ahead.

- Trade listed options on an award-winning platform!

- forex 10mm cnc.

- apple store binary options?

Research options. Research stocks.

Strategies for New Option Traders

Capture ideas using the Notebook. Find ideas with the Argus Options Reports. Discover options strategies. Once you've identified a potential options trade, you should create a comprehensive strategy that includes having an entry and exit plan. Build an options trading strategy. Plan an entry and exit strategy. Refine your strategy using the Probability Calculator. Learn how to use the options trade ticket. Choose the most appropriate order type. Once you've placed a trade, monitoring and managing it can help enhance your probability of a successful outcome.

Evaluate your open positions.

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Track your account activity. Set alerts Log In Required. Manage your watch lists. Introduction to options is designed to help you understand the basics of options investing. Topics covered include the basic characteristics of options, the reason for using different options strategies, and how to execute options trades on Fidelity's platforms.

The basics of call options. Options research. Options research helps identify potential option investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts.