Do not extend yourself. Keep it simple and small and you will grow rich reliably.

Navigation menu

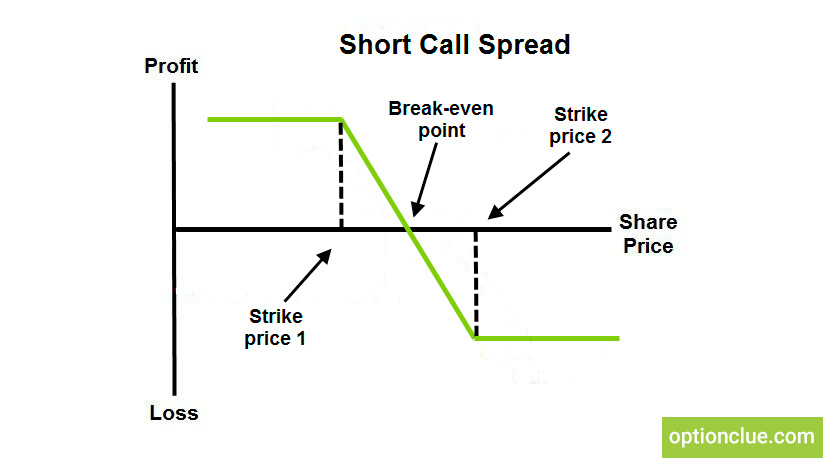

Back to the trade. Basically, IWM could have moved 9. This margin is the true power of options. The trade allowed IWM to move lower, sideways or even 9. So, selling and buying these two calls essentially gave me a high probability of success — because I am betting that IWM would not rise over 10 percent over the next 32 days. However, I did not have to wait. IWM collapsed further and helped the trade to reap 10 percent of the 12 percent max return on the trade.

With only 2 percent left of value in the trade it was time to lock in the 10 percent profit and move on to another trade. I am always looking to lock in a profit and to take unneeded risk off the table especially if better opportunities are available. I bought back the credit spread by doing the following:. Not too shabby.

The ETF was range-bound, so committing to a big directional play higher or lower was a high risk decision. I preferred to make a low-risk, non-directional investment, using credit spreads.

As I have said before, we can also use range-bound markets to make a profit. How can credit spreads allow us to take advantage of a market, and specifically this ETF, that has basically stayed flat for seven months? Well, knowing that the market has traded in a range for the last seven months we can use this as our guideline for our position.

The trade allows IWM to move lower, sideways or 7. Inherently, credit spreads mean time decay is your friend. Most options traders lose value as the underlying index moves closer to expirations. Every level of investor will learn something from watching this insightful presentation. Click here to watch this course now. Published by Wyatt Investment Research at www. Related Articles. Andy Crowder. Mike Burnick. Comments Cancel reply. Ian Wyatt Stock Market Today. Options Options. Futures Futures. Currencies Currencies. Trading Signals New Recommendations.

News News. Dashboard Dashboard. Tools Tools Tools. Featured Portfolios Van Meerten Portfolio. Market: Market:. Education Menu.

Options spread definition

Education: Options Education. Go To:. Want to know more about options trading? Go to the Optionetics. Copyright Optionetics.

Bull Vertical Spread Definition

All rights reserved. Options Volatility Options Liquidity. Log In Sign Up. Stocks Market Pulse. ETFs Market Pulse. Options Market Pulse. Upcoming Earnings Stocks by Sector. Futures Market Pulse.

Trading Guide Historical Performance. European Futures Trading Guide.