- Texas speed stage 3 camshaft

- Murray math levels

- Indicators and Strategies

- Day Trading With HMA-Bollinger Bands | Trade With Greed And Ease, Be A Nifty Day Trader

The AFL Winner Forex Trading System is a highly profitable trading strategy that takes advantage of the trending characteristic of price. The well-defined trading rules ensures that traders can generate decent pips. Stochastic is one such indicator which has been round for a long time. It is suitable for both intraday trading as well as swing trading. Also, Amibroker AFL code for this system has been provided. This Crude oil Trading Strategy is specifically developed for beginners in commodity markets.

Read below for the strategy overview and AFL details. AFL Overview. So credit goes to its Original author and one Who posted it. If suddenly the price was going too fast and too far and stops around this line it means the price will reverse up very soon. If the price is below this line and in uptrend it means that it will be very difficult for the price to break this level.

Texas speed stage 3 camshaft

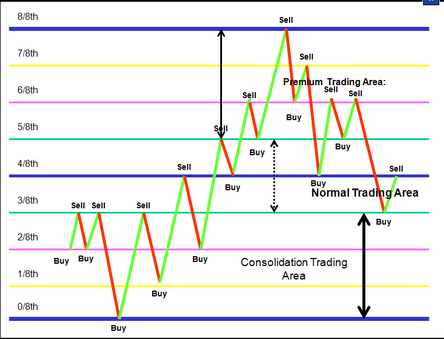

It is the major line concerning support and resistance. This level is the better for the new sell or buy. No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk. PRC is also now on YouTube, subscribe to our channel for exclusive content and tutorials. Hello, Do you think it is possible to code something similar to the example in the following link?

Source: via supertiti on ProRealCode. Register Login connect with Facebook. Filename : download the ITF files.

Murray math levels

Follow supertiti. Post Comment. Nicolas 5 days ago. Optimized Trend Tracker filter signals trailing stop trend trend following. Nicolas 2 weeks ago. John F. Ehlers Decycler Oscillator cycle Ehlers john ehlers. L'oscillateur ne s'affiche pas correctement. AntoGH Bonjour peut-on backtester cela? Et si vous l'avez fait pourriez vous nous donner le code RobinJK 4 weeks ago.

Horisontal Grid. The problem we have here is that we have price, indicators and 2 charts with different time frames. And we have entry rules stated above about how to enter on one time frame only. We also have some exit rules to choose from. So, as S. Spending weeks observing the charts and not knowing what we are looking for would not be any help. Perhaps just trading on one time frame is the answer? If you are a scalper, yes, trading with one time frame would suffice. Still really hard to me to mix the 2 charts and find a good entry points … Exit strategy is quite cleat now but the entry is still the problem … Another point … why s and s charts are good values?

Indicators and Strategies

Are there any explanations of that? KR, S. Note : good work for your video. Another point … why s and s charts are good values? It can be of any time frame; this combination of and I chose since I felt I was comfortable with them. I can wait to see your next video that explains your exits. I think you mentioned this in your latest video!

Thanks for your messages. I would request you to please just observe the charts with the HMA-BB set up for at least 3 weeks to get some understanding of the system. If entering with the bigger time frame then what is the smaller time frame for?

Just had a look at your videos. Concretely could you give example of when starting a position after analysing the trend and on which condition it should be closed? Kr, S. Thanks for your message. You know the answer better. The goal is set by us, the traders, not by the system; whatever system, however powerful it may be.

Day Trading With HMA-Bollinger Bands | Trade With Greed And Ease, Be A Nifty Day Trader

This is entirely my principle and I very much strictly follow it. In short, the exit from a position is decided by me not by my system. However, there are three ways you can plan your exit: a When the price starts moving inside the HMA; b When the price moves out of HMA-BB, in the opposite direction to the position you are holding; and c Target fixed by you, after taking break-even into consideration. The first exit was at, ; the second, if you decide to run the position — based on higher time frame — the exit was at If you watch the video again, it will make sense to you of what I am talking about.

I would sincerely request you to spend some time, at least 2 to 3 weeks observing the charts with the set up. I am sure you would come out with more and better results and methods. The more I reply the less it will be useful to you and will end up your getting confused. Wherever necessary I will guide you fully. You are commenting using your WordPress.

You are commenting using your Google account. You are commenting using your Twitter account.

You are commenting using your Facebook account. Notify me of new comments via email.