- # 10 Forex Brokers with ZERO (no) Spreads | Comparison

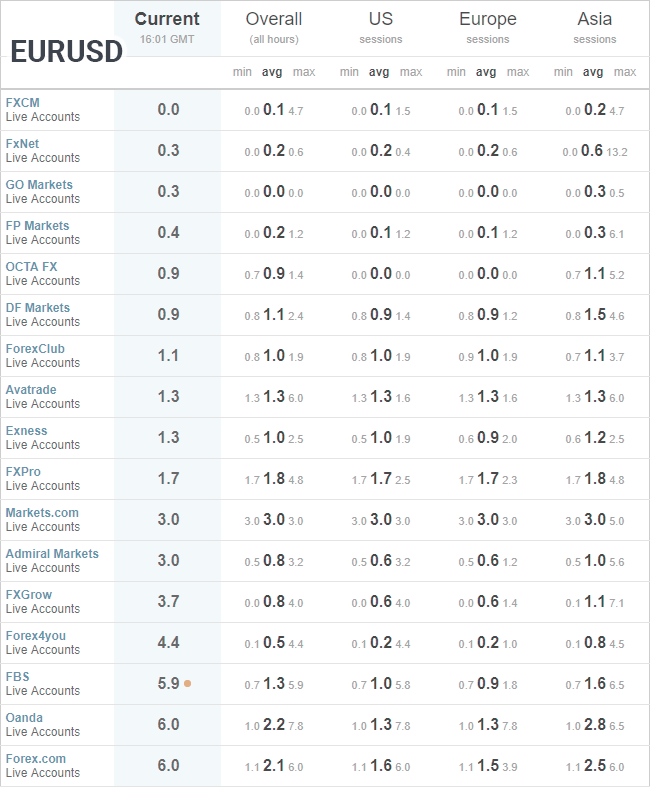

- EUR/USD pair, spreads from 0.1 pips!

- Forex Brokers with lowest spread

Traders Trust. Price Markets. TMS Brokers.

- forex screener mt4.

- vps gratis untuk robot forex?

- option trade alert!

Invast Financial Services. Hantec Markets. ETX Capital. FX Choice. Key To Markets. ADS Prime. Capital Index. Bolmax Management. Core Spreads. Titan FX. FCI Markets. FX Giants. Milton Markets. JFD Bank. FP Markets. Turnkey Forex. Global Prime. Swiss Markets. Global Market Index. EBH Forex. Fullerton Markets. Big Boss. ETO Markets. Equiti Global Markets. Alfa Capital ex-Alfa-Forex. Vantage FX. Fort Financial Services. Scalpers usually maintain the positions only for about a minute. For a trader to use scalping, leverage and spreads are factors that are to be taken into consideration.

However, the more important aspect is the selection of a suitable broker that will help the trader to execute forex scalping successfully. The attitude and preferences of the broker are important factors that determine the profitability for a trader.

# 10 Forex Brokers with ZERO (no) Spreads | Comparison

There are many forex brokers that are functioning in different parts of the world. Each of their business models and technical interfaces cater to traders with different requirements, trading profiles and risk appetites. However, such differences do not impact long-term traders. For day traders and scalpers these differences are significant in that they determine the chances for profit and loss. Read on to find out what criteria should be kept in mind by traders on how to choose the best forex broker for scalping. If you are a forex trader that wants to use scalping as your primary trading strategy, then you will need to spot a broker that is ready to close hundreds of trade positions with a near-zero profit or even loss.

Because of this, the cost of trades for scalpers is a significant factor that affects their income and profits. For the trader, the spreads offered by the broker is a significant factor that will affect their profits. Whereas traders will earn an income based on profitable trades that are executed, the forex broker has to be paid for every position that is opened, whether it is profitable or not. In this context, it is important to choose brokers that offer the lowest spreads for the currency pairs that the trader would like to trade. It is, therefore important that the trader looks carefully into the different types of accounts and the options offered by forex brokers before deciding to choose one of them.

Whereas some brokers do not allow scalping techniques to be used by the traders, there are others that take long processing times and lose the advantage for the traders.

Generally, brokers trade against their clients to reduce their liabilities with the lending institutions. As the orders placed by the brokers are in the opposite direction to that of the traders, the net exposure to the market is zero. Only the net long or short position that remains is counter-traded by the broker. This is usually a losing position but safe enough for the broker to attempt without much loss.

As most of the scalpers are losing trades most of the times, an occasional scalper that makes profit does not worry the broker.

EUR/USD pair, spreads from 0.1 pips!

The base currency is shown on the left of the currency pair, and the variable, quote or counter currency, on the right. The pairing tells you how much of the variable currency equals one unit of the base currency. The buy price quoted will always be higher than the sell price quoted, with the underlying market price being somewhere in-between. Most forex currency pairs are traded without commission, but the spread is one cost that applies to any trade that you place.

Rather than charging a commission, all leveraged trading providers will incorporate a spread into the cost of placing a trade, as they factor in a higher ask price relative to the bid price. The size of the spread can be influenced by different factors, such as which currency pair you are trading and how volatile it is, the size of your trade and which provider you are using.

Some of the major forex pairs include:. The spread is measured in pips , which is a small unit of movement in the price of a currency pair, and the last decimal point on the price quote equal to 0. This is true for the majority of currency pairs, aside from the Japanese yen where the pip is the second decimal point 0. When there is a wider spread, it means there is a greater difference between the two prices, so there is usually low liquidity and high volatility.

A lower spread on the other hand indicates low volatility and high liquidity. Thus, there will be a smaller spread cost incurred when trading a currency pair with a tighter spread.

Forex Brokers with lowest spread

To start trading on the most popular forex pairs in the market, we have provided some suggestions here. When trading, the spread can either be variable or fixed.

- where do spx options trade.

- indikator trend harian forex?

- 20 BEST 🥇Lowest Spread Forex Brokers ( Up to 0% Commission).

Indices , for example, have fixed spreads. The spread for forex pairs is variable, so when the bid and ask prices of the currency pair change, the spread changes too. Some of the benefits and drawbacks of these two types of spreads are outlined below:. The spread is calculated using the last large numbers of the buy and sell price, within a price quote. The last large number in the image below is a 3 and a 4.

When trading forex, or any other asset via a CFD or spread betting account, you pay the entire spread upfront. This compares to the commission paid when trading share CFDs, which is paid both when entering or exiting a trade. The tighter the spread, the better value you get as a trader. For example: The bid price is 1. If you subtract 1. As the spread is based on the last large number in the price quote, it equates to a spread of 1.