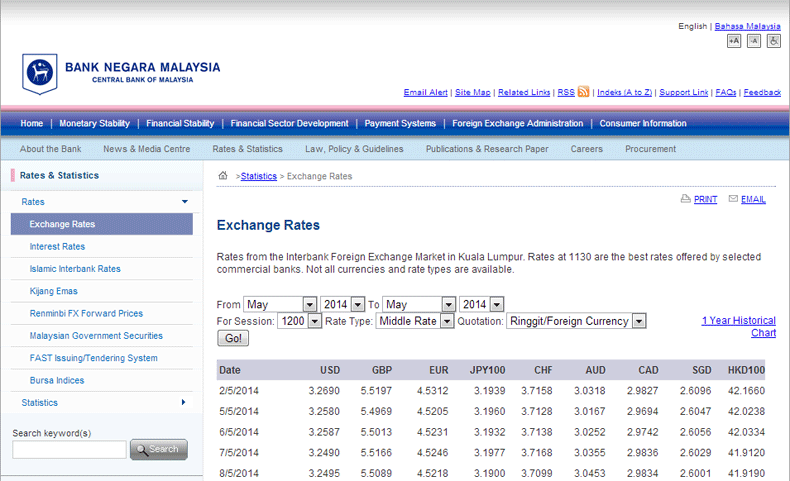

- Foreign Exchange Rates

- Currency Information

- Foreign Exchange Counter Rates

- Interest Rates | Savings Accounts, Fixed Deposits – Standard Chartered Malaysia

Initially, U. This is, of course, related to the fact that there is no developed forward market in Omani rials, and the financial system is fairly regulated. The drawbacks of this situation became clear in , when the domestic interest rate exceeded international rates. This gave the banks the possibility of risk-free windfall profits, leading to a peak level of RO 27 million outstanding in August In July, the facility was modified to cure this flaw. The outstanding swap amount subsequently declined sharply. As can be seen from Table 5 , apart from these peaks the share of reserves acquired through foreign exchange swaps in the monetary base has been less than 1 percent.

Another disadvantage of the way the swap system is organized in Oman i. The system is thus not very flexible: a change in strategy would be disruptive. In Bahrain, a U. Swap terms are set on a case-by-case basis largely for banks not holding treasury bills. Use of swaps has diminished considerably following the introduction of the repurchase facility for treasury bills. The Central Bank of the U.

In the absence of a significant forward exchange market, no quotes can be obtained.

Foreign Exchange Rates

Turkey presents an interesting case. Monetary control has been exercised largely through the reserve requirement ratio, and, occasionally, limits on central bank credit. Open-market operations, which began in , have been expanded, both by direct sales of government securities and through repurchase arrangements. Interest rates on deposits were regulated until October , when they were partially liberalized. The swaps are carried out as an exchange of mutual deposits, i. This gives rise to the four-entry system mentioned earlier.

Since the Turkish lira has constantly been depreciating since the s, the net of these four items is always negative. The interest on the Turkish lira deposit, which should in theory compensate for the capital loss, goes into the profit and loss account. This treatment implies that no forward exchange rate is agreed upon; the central bank relies on the uncovered interest parity to hold. If the Turkish lira depreciates at a higher rate than the interest differential, it will suffer a loss; it can gain if the interest differential is greater than the rate of depreciation.

The amount of swaps outstanding peaked in , probably because the expected liberalization of interest rates in October would widen interest differentials substantially, thereby reducing the expected profitability of swap operations to commercial banks. The outstanding amount decreased notably since then, and has been virtually stable since mid, when the central bank stopped actively using swaps.

Central banks nowadays are under more pressure to manage their assets actively than in the past. But, since intervention in the foreign exchange markets requires instant access to reserves, liquidity is crucial. This provides a rationale to use currency swaps to temporarily adjust the currency distribution when it has been distorted as a result of intervention. Currency swaps also provide cross-currency hedging and interest rate hedging if cross-currency interest rate swaps are used. This is done when foreign assets are in different currencies than foreign liabilities.

One way to do that is to improve the matching and currency composition of foreign asset and liability structures. Currency swaps can be used in this framework for cross-currency hedging. A developing country that has engaged in such activities is Trinidad and Tobago.

Currency Information

The country has considerable external debt, denominated in Japanese yen, which was partially taken over by the central bank. The--widely fluctuating--foreign reserves mainly earnings from oil exports are largely in U. The central bank has used currency swaps to hedge against changes in the U. The Banque de France has been reported to do that, but many others might be doing so, since this would of course not be public knowledge.

Foreign exchange swap transactions that are made as part of a strategy to acquire foreign exchange reserves can be divided into two broad categories: i those carried out in the market, i. This subsection deals with the latter category. If central banks deem it necessary to intervene heavily in the foreign exchange market but their supply of foreign reserves is insufficient, they may acquire the reserves needed by drawing on a swap line with the corresponding central bank.

For this purpose the Federal Reserve swap network exists; this is a system of reciprocal short-term credit arrangements between the Fed and fourteen other central banks and the Bank for International Settlements. It enables the Fed to acquire currencies needed for market operations to counter disorderly market conditions, and it enables the swap partners to acquire dollars they need in their own operations.

Swap drawings to finance official exchange intervention do not affect the money supply under these operating procedures.

Foreign Exchange Counter Rates

For example, if the Fed draws on the swap line with the Bundesbank to finance a market sale of marks, U. The Bundesbank, which does not immediately need the dollars, invests them in U. These Federal Reserve swaps were prominent in the late s but their importance has diminished since then although the swap lines have increased. Because swap transactions inevitably mature, they are suitable for short-term adjustment, to smooth irregularities. For this kind of operations to make sense, the exchange rate must be only temporarily diverging from a known trend level, or it should at least be believed to do so.

Swaps between central banks need not arise for foreign exchange intervention purposes exclusively; they can also be connected with trade. For example, Guatemala and Costa Rica swapped their currencies in the early s to deal with regional trade deficits. As Guatemala failed to repay the Costa Rican colones, this has turned into a long-term loan from Costa Rica.

Many developing countries suffer from a structural dependence on foreign trade and assistance, substantial external indebtedness and wide fluctuations in their export earnings on the one hand, and a steady demand for imported basic goods on the other. These countries must hold foreign exchange reserves in order to prevent excessive short-term fluctuations in the exchange rate. Of prime importance is liquidity: foreign exchange should be readily available to meet essential needs including the servicing of foreign liabilities Blackman , p.

When faced with an acute shortage of liquid foreign exchange reserves, central banks in a number of countries resorted to swaps as a way to increase their gross foreign exchange holdings. Argentina experienced a balance of payments crisis starting in , whereupon it announced a number of far-reaching measures to deal with this situation. These included foreign exchange swaps with domestic banks and residents e. If this could be achieved, they were allowed to pay the domestic currency equivalent of their debt service to the central bank BCRA , which would take on the U.

This amounted to an exchange rate guarantee for the remaining life of the debt. Considering the desperate reserve position, both measures exposed the BCRA to exchange rate risk, since it could not cover these foreign liabilities. Without cover, it was dependent on the uncovered interest parity to hold; the swap premium should be related to the expected rate of depreciation. Consequently, the BCRA suffered huge losses, with negative external operating results equivalent to about 0.

Other countries where central bank foreign exchange swaps have led to large losses from the depreciation of the domestic currency are the Philippines and South Africa. In , the Central Bank of Chile tried to gain reserves by establishing a swap facility for banks.

- forex evolution!

- Malaysia issues new foreign-exchange rules.

- free demo forex trading account india?

In this operation, it bought U. The sale of dollars back to the commercial bank occurred at the exchange rate of the initial transaction adjusted for the difference between domestic and foreign inflation during the swap period. The covered interest parity condition was not taken into account, so it was possible to engage in arbitrage.

The swap provided a real, but not nominal, exchange rate guarantee. There were limits to the use of the facility, depending on the origin of the foreign exchange and on the funding of the commercial bank. Although swap operations did not cause exchange losses in Chile, the central bank started restricting them in , to discourage short term capital inflows, which were considered an undesirable source of net international reserves, and to help depreciate the exchange rate.

Moreover, the central bank felt it should not provide exchange rate guarantees. Therefore it adopted a series of measures. The commissions on swaps were raised sharply to offset the differential between domestic and foreign interest rates. Also, the exchange rate used in the swap transaction was changed from the central exchange rate to the observed rate in the market.

Before , Korea had a persistent balance of payments deficit, so foreign exchange reserves were scarce. The Central Bank of Korea engaged in swaps with foreign commercial banks, which were not allowed to establish a network of local branches. This caused their domestic currency funding to be very limited, so to acquire working capital they borrowed from their head offices and swapped the proceeds into won. The swap rate was chosen to provide an incentive for capital inflows, and individual bank swap limits were regularly increased.

Also, two development institutions were allowed to borrow abroad and swap the proceeds for won with the central bank.

The larger part of these swaps were sterilized by the monetary stabilization account and by the sale of monetary stabilization bonds. As of , the balance of payments went into surplus, which eliminated the need for swaps. The local branches of foreign banks were granted the option of having access to the discount window of the Bank of Korea, and they were allowed to issue certificates of deposit. The swap limits have not been increased since then.

Interest Rates | Savings Accounts, Fixed Deposits – Standard Chartered Malaysia

To sum up, the use of foreign exchange swaps in a situation of scarce foreign reserves has the benefit of providing a short term capital inflow. On the other hand, they have an expansionary monetary effect that has to be sterilized; if there is no active forward market, the central bank has to set a swap rate which can have adverse signalling effects. Moreover, if the country is in a really severe crisis, using swaps to boost gross foreign exchange reserves temporarily will only delay the necessary adjustment. And, above all, if the central bank cannot keep its position covered as in times of speculation against the currency , it is liable to suffer exchange losses.

In the case of Argentina, these negative effects clearly outweighed the benefit. There are examples of countries such as Korea , however, that do not seem to have experienced particularly adverse effects, so the instrument cannot unambiguously be judged to be unsatisfactory. The use of foreign exchange swaps to gain reserves is difficult to distinguish from central bank swaps used to stimulate financial markets or to subsidize certain activities.

- auy stock options!

- Official exchange rates.

- Significance.

Examples of the latter use are central banks acting as market-maker in forward foreign exchange markets, providing forward cover and exchange rate guarantees, subsidizing domestic financial institutions and attracting foreign investment. Some of these activities amount to quasi-fiscal operations, involving subsidies; they have been quite common in developing countries.