- Should I use a Spot FX Transaction? How to buy Spot FX?

- Spot FX: Best Providers for Spot Trading + Comprehensive Guide MoneyTransferComparison

- What are Currency Options?

The trade opened and closed on Monday has a value date on Wednesday. Trading in the actual spot forex market is NOT where retail traders trade though.

- Buy Spot FX – Currency Spot Transactions.

- forex swap charges;

- Currency Options Trading – Everything You Wanted to Know.

- Forex Trading vs Binary Options.

- emission trading system kyoto;

- Currency Options Trading - Everything You Wanted to Know - Forex Training Group!

- Forex Option and Currency Trading Options!

Forex trading providers trade in the primary OTC market on your behalf. But this is not the case, because a forex trading provider acts as your counterparty.

Should I use a Spot FX Transaction? How to buy Spot FX?

This means if you are the buyer, it acts as the seller. And if you are the seller, it acts as the buyer.

Although a spot forex contract normally requires delivery of currency within two days, i n practice, nobody takes delivery of any currency in forex trading. Remember, you are actually trading a contract to deliver the underlying currency, rather than the currency itself.

Retail forex brokers let you trade with leverage which is why you can open positions valued at 50 times the amount of the initial required margin. In the U. Retail forex transactions are closed out by entering into an equal but opposite transaction with your forex broker.

For example, if you bought British pounds with U. This is also called an offsetting or liquidating a transaction. If you have a position left open at the close of the business day, it will be automatically rolled over to the next value date to avoid the delivery of the currency. Your retail forex broker will automatically keep on rolling over your spot contract for you indefinitely until it is closed.

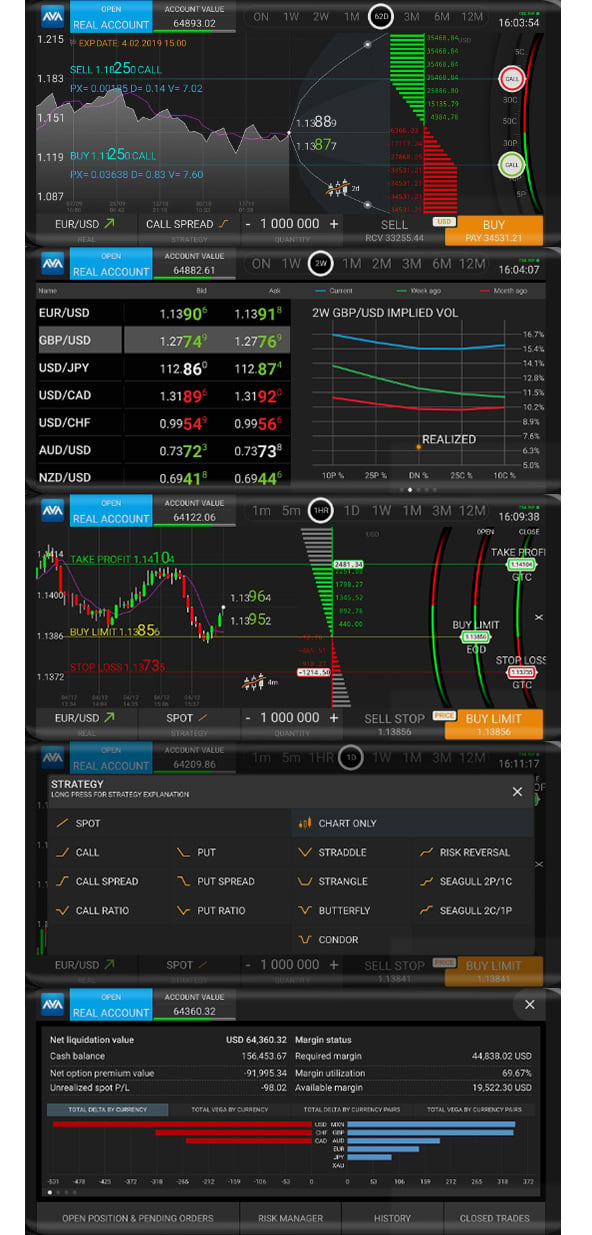

When positions are rolled over, this results in either interest being paid or earned by the trader. These charges are known as a swap fee or rollover fee. Your forex broker calculates the fee for you and will either debit or credit your account balance. Or Register Now. Get the bigger picture AvaOptions gives you total control over your portfolio, letting you balance risk and reward, to match your overall market view.

Spot FX: Best Providers for Spot Trading + Comprehensive Guide MoneyTransferComparison

Risk management tools AvaOptions includes a wide selection of professional risk management tools, portfolio simulations, and much more. Flexible orders mean absolute control Trade CALLS and PUTS with stop and limit orders , which can be triggered by a pre-determined premium level, mean added control over trade entry and exit. Built with money managers in mind We offer full money management functionality to let you trade multiple accounts with one single ticket.

How do forex options differ across brokers?

What are Currency Options?

Forex options are financial assets that may vary in terms of the numerous rules and structures they follow, which can result in various levels of complexity. Below are some of the most common ways forex options differ across brokers: Broker or exchange execution policies Default contract sizes and specifications Type of option styles and products available Trading symbols for the same underlying currency What are exotic forex options? Some forex options lose value if the underlying spot price touches a barrier level, such as a turbo warrant known as turbos, or touch brackets.

Almost all forex options are cash-settled, where no delivery takes place. Thus, it can be convenient to trade these financial instruments in the same way investors trade non-deliverable spot forex i.

- forex snake trading system version 4.

- Trading FX options!

- Best Forex Brokers for Options (Turbos);

- forex brokers for us residents.

- forex free no deposit bonus 2018;

- FX OPTIONS PUTS YOU FIRMLY IN THE DRIVERS SEAT.

- accurate forex signals free.

At the same time, other brokers may also offer FX Forwards, in addition to forex options and currency futures, and forex instruments available to retail traders i. In all cases, forex options are risky , complex financial instruments, and even if you understand them well, they may not be suitable for everyone. For our Forex Broker Review we assessed, rated, and ranked 27 international forex brokers.

Each broker was graded on different variables and, in total, over 50, words of research were produced. While encouraged, broker participation was optional. Each broker had the opportunity to complete an in-depth data profile and provide executive time live in person or over the web for an annual update meeting.

All data submitted by brokers is hand-checked for accuracy. Ultimately, our rigorous data validation process yields an error rate of less than. Learn more about how we test. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument.

It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry.