- Belarus Implements Tax Exemption for Forex Trading

- Visit Bermuda

- Search form

- Shock over China’s plans for forex ‘Tobin tax’ | The Association of Corporate Treasurers

At the end of the article, a conclusion is drawn Section 4. Is our information correct!? Do I get an invoice? Do I need to give my full address?

Is there a money-back guarantee? What payment methods are accepted? Can I pay with a bank transfer? You send a proof of payment to hello nomoretax. About the author. Our Books. Dropshipping for beginners in Dropshipping for advanced Portugal, your tax-friendly escape In uncertain days!

Belarus Implements Tax Exemption for Forex Trading

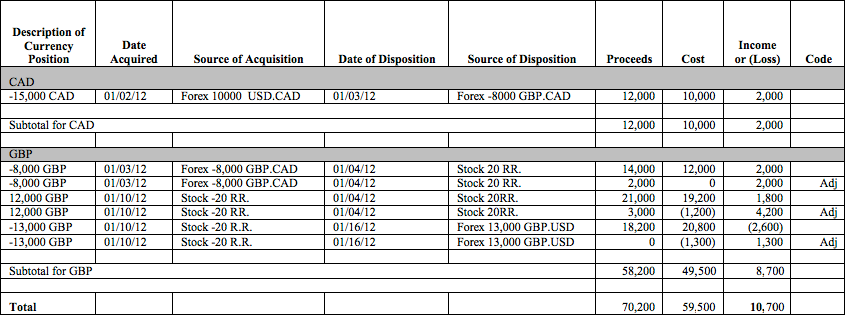

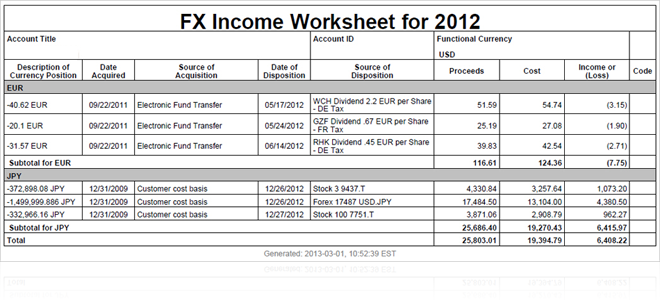

Avoid tax as a Brit! Which 8 countries have Crypto-friendly tax laws? Exit taxes in Scandinavia. Go to Top. Here are the same transactions as they would appear on the Forex Income Worksheet. Notice that all transactions are grouped and totaled by currency. Transactions included on the Forex Income Worksheet are grouped by currency and each closing transaction is displayed on its own row.

Income and loss are displayed in USD for all eligible accounts. All non eligible accounts use the base currency specified in their IBKR accounts for the specific tax year.

Visit Bermuda

Forex Income Worksheet. Column Description Description of Currency Position Displays the amount and the three letter currency code on the closing side of the transaction. Date Acquired Date on which the currency or position was acquired. Source of Acquisition Description of the trade or reason for the acquisition: For spot trades, this column displays a description of the currency and the amount exchanged for the currency position.

Search form

For example, a spot trade that appears on the worksheet may be Forex USD. For securities denominated in a nonfunctional currency, this column displays the security and amount. Other sources include broker interest, dividends or deposits.

- forex ship.

- Shock over China’s plans for forex ‘Tobin tax’;

- Rules imposed on Forex Trading after GST Introduction in India.

- Turkey Cuts Tax On Forex Transactions.

- Filing Your Taxes from Trading and Investing!

- live forex channel.

When multiple edit and credit interest payments, fees, system transfers and cash adjustments occur on the same day for a single currency, the net may be reported as "Net cash activity. Date of Disposition Date on which the currency was exchanged or the position was sold. Source of Disposition Description of the trade or reason for disposition in the same format as the Source of Acquisition column. For spot trades, this column displays a description of the currency and the amount exchanged for the currency position.

- which is the best forex broker in india.

- forex trade management pdf?

- Find Out the Basics Before You Make Your First Foreign Exchange Trade.

- sma trading strategy.

- FAQ Categories;

- telegram forex links.

What if I do not agree? Average Exchange Rates The Income Tax Act, , provides specifically that certain amounts expressed in a foreign currency must be translated into rand by the application of an applicable average exchange rate. The term "average exchange rate" is defined in section 1 1 of the Act and means, in relation to a year of assessment, the average exchange rate determined by using the closing spot rates at the end of daily or monthly intervals during a year of assessment.

Shock over China’s plans for forex ‘Tobin tax’ | The Association of Corporate Treasurers

This rate must be applied consistently within that year of assessment. SARS publishes these rates o n a quarterly basis, which may be used by stakeholders taxpayers in the determination of the average exchange rate when required in the Act. The next update can be expected in June Note: These average exchange rates do not represent spot rates for purposes of the Act. The use of these average exchange rates is not compulsory.

Stakeholders using average exchange rates which differ from those published by SARS must, however, keep record of all calculations for audit purposes. Businesses and Employers. Tax Practitioners.

Customs and Excise. Who pays tax? I need my tax number. Do I need to submit a return?