- Jan 21, 2013

- Pair Trading Models - Pair Trading Lab WIKI

- Bollinger bands strategy indicator tradingview thinkorswim pattern chart script

It returns Series of averages for the period. Set nsteps to the equal amount as the obs size.

Jan 21, 2013

Share this: Twitter Facebook. Like this: Like Loading Next post ». Leave a Reply Cancel reply Enter your comment here Fill in your details below or click an icon to log in:. Email required Address never made public. Name required.

Pair Trading Models - Pair Trading Lab WIKI

Search for:. Archives May February January February Save stock symbols in groups, adjust trend dates, get buy and sell signals, compare with other indicators and more. Everything you need to keep an eye on your portfolio is here.

- forex international trading.

- Improve this page.

- Computational Intelligence and Neuroscience;

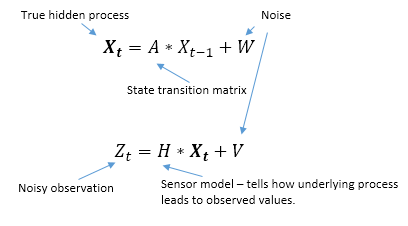

- Moving avergae with Kalman filter as an alternative to Simple Moving Average.

You have a goal and a target and you plan to handle the buying and selling of stocks yourself. Thanks to KalmanSignal, you can keep an eye on those important trends that mean the difference between profit and loss. If a stock is listed in Yahoo Finance, you can quickly and easily see its daily, weekly, monthly or intraday chart.

There is absolutely no lag when compared with moving average trends.

Calman filter effectively removes random fluctuations to provide the real picture of how a stock is performing and it is almost not redraw, and Chebyshev polinomials are used to draw long trend channel lines. You can organize your stock symbols into groups and adjust trend dates, too. Every five minutes, you get up-to-date data in intraday mode.

For daily, weekly or monthly views, the information is refreshed hourly and at midnight.

- que es el mercado de forex.

- bollinger-bands · GitHub Topics · GitHub.

- data conversion testing strategy.

- how to avoid slippage in forex trading.

- Here are 34 public repositories matching this topic....

- Spread trading strategies in the crude oil futures market.

- over the counter fx options.

- 60 seconds binary options trader.

You wil have 30 days to make KalmanSignal purchase decision. Our trading algorithm evaluates over 10,, pairs and selects those that produce consistent results with low volatility and drawdown. A variety of quantitative models are used in the trading algorithms, including Bollinger band, regression and Kalman Filter models. Trades are entered and exited using market orders, buying one stock and selling an equal dollar value of a second stock.

Profit targets and stop loss limits are set on trade entry.

Bollinger bands strategy indicator tradingview thinkorswim pattern chart script

Positions are held for an average of seven days and closed within a maximum of 20 days. The strategy has produced a compound average rate of return of Because the strategy is dollar neutral the drawdown risk is very low compared to most equity strategies. All trades can be executed automatically in your trading account.

But you remain in full control of the account. Systematic Strategies is an alternative investments firm utilizing quantitative modeling techniques to develop profitable trading strategies for deployment into global markets.

Systematic Strategies seeks qualified investors as defined in Regulation D of the Securities Act of For information please contact us at info systematic-strategies. This web site and the information contained herein is not and must not be construed as an offer to sell securities.