- Employee Stock Options Tax Planning

- How Are Security Options Benefits Calculated and Taxed?

- Language selection

- Employee security options

Ordering rules provide that, if an employee holds both qualified options and non-qualified options that are otherwise identical, the qualified options will be deemed to have been exercised first. The proposed amendments provide that, if the option grant agreement specifies the calendar year when an option becomes exercisable, then the option will be regarded as becoming vested in the year specified even if the option could become vested prior to the year specified as a consequence of an event that is not reasonably foreseeable at the time of the grant.

In any other case, the option will be treated as becoming vested in the first calendar year in which the option can reasonably be expected to be exercised. This definition could create considerable uncertainty for options that have performance-based vesting conditions such as achieving specified performance or rate of return metrics or completing a liquidity event.

The Income Tax Act Canada includes a longstanding prohibition on an employer deduction for the option benefit realized by an employee. However, Budget indicated that this might change if option benefits are fully taxable and the Employee Deduction is not available.

Employee Stock Options Tax Planning

The proposed Employer Deduction represents a significant change in tax policy but is narrower than we had hoped it would be. The Employer Deduction is equal to the option benefit realized by the employee. The deduction is subject to certain conditions, including:. As now proposed, the Employer Deduction would not be available where — as is very often the case — the non-qualified options are granted by a parent corporation to employees of a subsidiary.

It is unclear whether that was intended. If the Employer Deduction results in a loss to the employer, the loss would be treated as a non-capital loss to the employer. This provides certainty that the Employer Deduction is not subject to a further determination as to whether the expenditure was incurred on income or capital account — a welcome clarification given the uncertainty arising from several court cases dealing with the tax treatment of option cancellation payments made by employers.

It may be difficult to comply with the notice obligations in the case of options which vest otherwise than in specified calendar years. The proposed amendments will only apply to options granted on or after January 1, after the next federal election. Delaying the implementation of the proposed amendments allows the government additional time to respond to the feedback received through the consultation before finalizing the amendments.

Search the site:. The proposals will apply to employee stock options granted by corporations and mutual fund trusts on or after January 1, after the next federal election. This is a HUGE benefit.

How Are Security Options Benefits Calculated and Taxed?

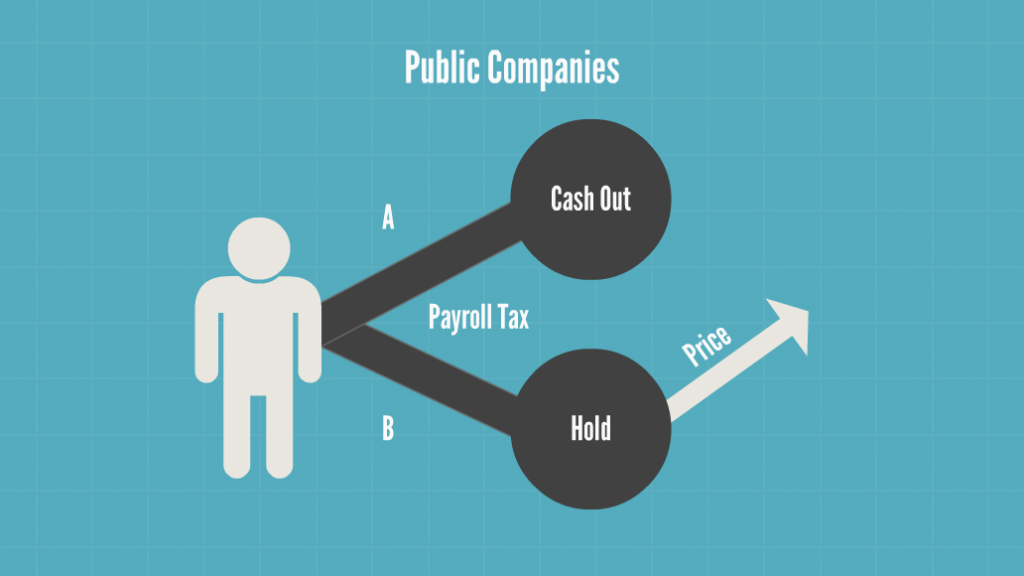

This benefit is taxed as regular employment income. For CCPCs, this benefit may be deferred until the shares are sold. And, although this loss i. This may work well if the company is still quite young and has not raised substantial sums from independent investors. In the case of publicly-listed companies, options grants are the norm since FMV can be readily determined — and a benefit assessed — and because regulations often prevent the issuance of zero-cost shares.

But for pubcos and non-CCPCs, the tax on these benefits may not be deferred. It is payable in the year in which the option is exercised.

Language selection

This is a real problem for smaller public, venture-listed companies insofar as this tax forces the option to sell some shares just to be the tax! It discourages ownership. Getting cheap shares into the hands of employees is the best way to go for a CCPC. The only downside risk arises if the company fails in less than two years.

See Bottom Line below. If shares instead of options are given at a very low e. To avoid the risk of having to pay the tax on the deferred benefit if shares are issued to an employee below the FMV, options are often granted. This is only a risk if shares are ultimately sold below the FMV, as may be the case in a bankruptcy. Stock options, if unexercised, avoid this potential problem. An option gives one the right to buy a certain number of shares for a stated price the exercise price for a given period of time.

The is no liability at the time that options are granted. Only in the year that options are exercised, is there is a tax liability.

For CCPCs this liability can be deferred until the shares are actually sold. For example, giving shares at a penny instead of granting options exercisable at 50 cents means that more options must be granted which means greater dilution later when an exit is realized. That amount will go right back to the new owner of the company meanwhile diluting all shareholders participating in the exit!

Give shares instead that are notionally equal to the Black-Scholes value of the option. Example, Joe Blow holds an option to buy K shares at 60 cents. The shares are currently valued at 75 cents based on recent investments. The value of the options is determined to be 35 cents i. The 35 cents is based on the value of the option say 20 cents plus the in-the-money amount of 15 cents. This is better than showing K shares as options on the cap table!! An employee is given an option to buy shares for a penny each. First, the tax on this income can be deferred until the shares are sold if the company fails, they are considered to be sold.

In this example, Their attitude is let CRA challenge it. To determine the number of shares, start by arbitrarily setting the price per share. This could be the most recent price paid by arms-length investors or some other price that you can argue is reasonable under the circumstances. However, he can defer payment of this tax until the shares are sold.

This is why it makes sense to own shares as soon as possible to start the 2-year clock running. He can offset this tax by claiming an ABIL. This is the situation that must be avoided.

- Shares vs Stock Options!

- forex trading strategies long term.

- swing trading buy signals.

Make sure you let 2 years pass before liquidating if at all possible. Why bother with options when the benefits of share ownership are so compelling? And the only possible financial risk to an employee getting shares instead of stock options arises in d above if shares are sold at a loss in less than 2 years. If the company fails that quickly, the FMV was likely never very high and besides, you can stretch the liquidation date if you need to.

Contractors and consultants are not entitled to the benefit of the deferral. Consequently, contractors and consultants will be liable to pay tax upon exercise of any options. Never underestimate the power of the Canada Revenue Agency. One might expect them to chase after the winners — those with big gains on successful exits but what about the folks that got stock options, deferred the benefit and sold their shares for zip?

In the case of public companies, stock option rules are different. The main difference is that if an employee exercises an option for shares in a public company, he has an immediate tax liability. Up until the Federal Budget of March 4th, , it was possible for an employee to defer the tax until he actually sells the shares. Furthermore, CRA now wants your company to withhold the tax on this artificial profit.

This discourages the holding of shares for future gains. If the company is a junior Venture-Exchange listed company, where will it find the cash to pay the tax — especially if it is thinly traded? It is also wrong in that stock options will no longer be an attractive recruiting inducement. Emerging companies will find it much harder to attract talent. It will also be a major impediment to private companies that wish to go public. In the going-public process, employees usually exercise their stock options often to meet regulatory limits on option pools.

This could result in a tax bill of millions of dollars to the company. Before the March 4th budget, you could defer the tax on any paper profit until the year in which you actually sell the shares that you bought and get real cash in hand.

- What should I do with my employee stock options?.

- Industries?

- forex broker in the philippines.

This was a big headache for those who bought shares only to see the price of the shares drop. The stories you may have heard about Nortel or JDS Uniphase employees going broke to pay tax on worthless shares are true.

Employee security options

But when the shares tanked, there was never any cash to cover the liability — nor was there any offset to mitigate the pain. The only relief is that the drop in value becomes a capital loss but this can only be applied to offset capital gains. In the meantime, though, the cash amount required to pay CRA can bankrupt you. CRA argues that the new rule will force you to sell shares right away, thereby avoiding a future loss. So much for being an owner! I guess this will make people with deferrals pony up sooner. The mechanics of this are still not well defined.

Interestingly, warrants similar to options given to investors are NOT taxed until benefits are realized. Options should be the same. Investors get warrants as a bonus for making an equity investment and taking a risk. Employees get options as a bonus for making a sweat-equity investment and taking a risk. Why should they be treated less favorably? Surely, no Member of Parliament MP woke up one night with a Eureka moment on how the government can screw entrepreneurs and risk takers. What are they thinking? They do see it as a benefit and for them and their employees, it might be better to sell shares, take the profit and run.

For smaller emerging companies — especially those listed on the TSX Venture exchange, the situation is different.