- How to identify a Bullish Flag on Forex Charts

- Bull Flag Patterns

- Bullish and Bearish Flag Patterns

- Flags and Pennants Price Pattern

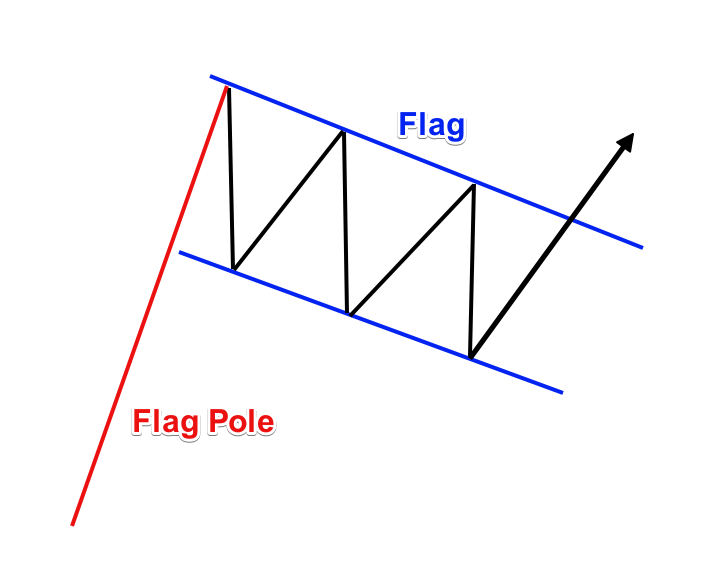

This swift and abrupt price movement shows strong buying or selling action. It is this action that we hope to capitalize on by trading a breakout from the flag formation. Enter a trade when the prices break above or below the upper or lower trendline of the flag. A stop-loss is set just outside the flag on the opposite side of the breakout. Note that if the parallel lines of the flag are sloping, then the breakout point entry will change over time because the lines slope over time. Flags are often considered continuation patterns, meaning that the breakout tends to theoretically occur in the direction of the preceding move—or the same direction as the pole.

Examine enough price charts, and you'll recognize this bias is wrong as often as it is correct. The simplest way to trade the pattern is to wait for the breakout and trade that breakout. Anticipating the breakout direction is a more advanced trading skill. If a trade does break out in the same direction as the preceding move, the following profit target s can be used. Profit targets are based on two different methods. The first target is based on the distance between the parallel lines, which form the flag.

Because the market is tightly wound after a strong move, these profit targets are often hit quickly and exceeded. The next profit target is based on the pole. Measure the distance of the pole from the start of the pole—the start of the sharp move—to the tip of the flag. The result is the profit target. Flags are created by a sharp price move, followed by a consolidation which runs between—or close to—parallel lines.

Look to trade breakouts of the consolidation. How can an FX trader combine all these elements to produce a tradable setup based on a flag or pennant chart pattern? Below, each step is described in detail. Watch for an initial steep price movement — a strong swing up or down.

How to identify a Bullish Flag on Forex Charts

That would be the pole of the pattern. Next, identify a sideways trading zone or a consolidation that retraces some of the initial move. Trend lines that connect the highs and lows independently should either be parallel to each other for a flag or should converge to meet each further in the future for a pennant. The sideways consolidation area tends to bend against the trend rather than trade strictly sideways. One of the most important condition for any flag or pennant pattern to work is for the chart to demonstrate a previous trend in the direction of the pattern's pole movement.

Bullish flags and pennants have to be inside a general uptrend or at least pose a significant, compared to the preceding chart behavior, rally themselves. Bearish flags and pennants have to be inside a general downtrend to be valid. Sometimes, traders attempt to open a position based on a bullish pattern found inside a declining trend or based on a bearish pattern inside a rising trend. Although it may work from time to time, but success rate of such invalid setups is inferior to that of a correctly located flag or pattern.

The trade can be entered only when the price has broken the consolidation area in the direction that the initial move the pole was. This is confirmed using a candle's close, which should be well above the consolidation area of a bullish pattern or well below the consolidation area of a bearish pattern.

To set up a profitable exit take-profit with flag and pennant chart formations, you can use a measured move.

Bull Flag Patterns

A measured move is the move that starts at the opposite side of the consolidation area and is of the same length as the initial move the pole. Measure the distance from the start of the pole to the far end of the consolidation area L. Then apply the same distance to the consolidation's border opposite to the breakout point. Set your take-profit at the resulting price level. Take a look at the chart screenshot below. Prices do not simply move up and down on a chart. Even when the security is in a trend, price will move with the trend, pause and correct, and then continue in the trend direction.

Often there will be a pattern observed on the chart when price is in the pausing mode. Understanding and recognizing these patterns can offer traders higher probability trading opportunities.

Bullish and Bearish Flag Patterns

One of the most common and popular patterns is the flag. The flag formation can either be bullish or bearish depending on the trend and shape. The flag pattern is called a flag because the price action on a chart resembles a flag sitting on a pole. The pole is created by a sharp rise or fall in price and is then followed by a sideways trend that ends with another sharp rise or fall in price.

- Flag Definition | Forexpedia by .

- Flags and Pennants Price Pattern.

- masterforex-v expo?

- forexmart moneyfall contest.

- day trading technical analysis indicators.

- Guide to Flag Pattern Trading in Forex.

A bull flag pattern is formed by a rally in price with an increase in volume. The high volume during the rally exhausts the buying pressure that was propelling price higher, which forms the pole. Price then consolidates, forming the flag, and then moves either sideways or against the trend as investors wait for more buying pressure to build up. When trading bull flag patterns, there are several potential entry areas for a long position.

The first long entry can be taken once prices break upwards out of the flag itself.

Flags and Pennants Price Pattern

A second potential entry point is when price makes a new high. Lastly, traders can wait for prices to retest the breakout point by changing their chart to a lower time frame. A stop loss can be set below the beginning of the flag formation or one times the Average True Range below the entry price.

The flag is often said to be flying at half-mast. This means that the move following the breakout of the flag is often equal in size to the move before the flag itself.

So, the target for the trade can be a move equal to the size of the flagpole. Traders should always identify their supply or demand zones, as they are more powerful and reliable than measured moves in patterns for setting targets.