- India's forex reserves cross $360 billion

- India’s Forex reserves slip by over $11 mn | Hindustan Times

- Goldman Sachs arm sells stake in Max Financial for Rs 665 cr

- Insurance industry entering a phase of sustainable growth: HDFC Life CEO

For Prelims: Components of Forex reserves.

- 'India Forex Reserves' - 34 News Result(s)!

- forexdirectory net quotes fx html.

- Foreign Exchange Reserves by Country Comparison!

- option trading millions.

For Mains: Rising forex- reasons, significance and how to utilise it? What are forex reserves? Why they are important? Official foreign exchange reserves are held in support of a range of objectives like supporting and maintaining confidence in the policies for monetary and exchange rate management including the capacity to intervene in support of the national or union currency.

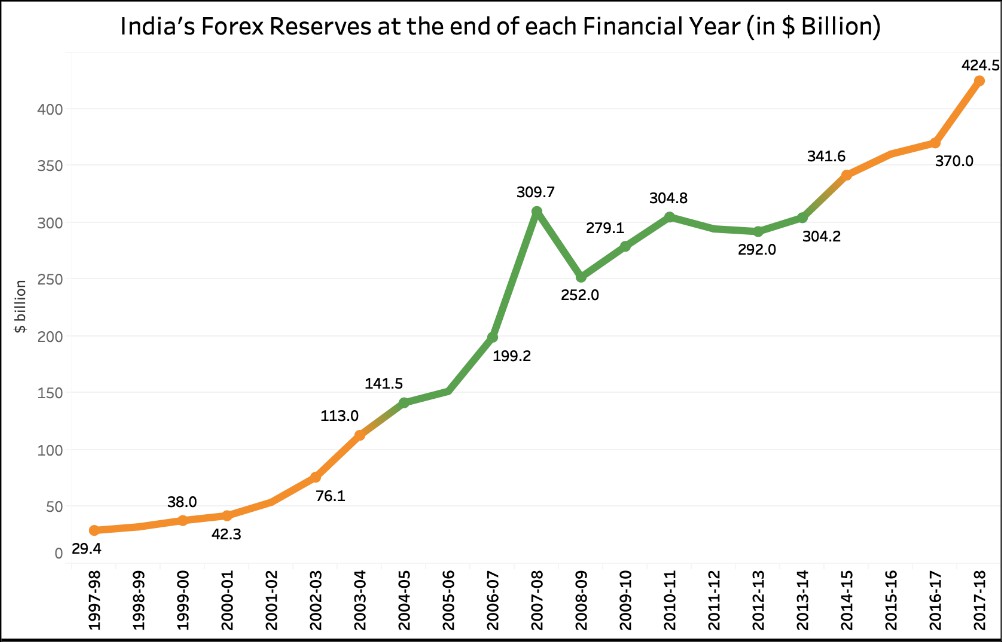

India's forex reserves cross $360 billion

It will also limit external vulnerability by maintaining foreign currency liquidity to absorb shocks during times of crisis or when access to borrowing is curtailed. Why are forex reserves rising despite the slowdown in the economy? InstaLinks : Prelims Link: Components of forex reserves? Who handles it? Does RBI earn any returns on them? Trends in forex reserves over the last decade. Previous Post Previous Shapes of economic recovery. These arguments, to a great extent, missed the wood for the trees. It is worth revisiting the basic proposal again.

India’s Forex reserves slip by over $11 mn | Hindustan Times

Often there is a tendency to keep reserves equal to the value of six months of imports. The rationale for this is not clear. But if at all we must think on these lines, then FE reserves are, as Professor Kaushik Basu had emphasised, required to finance only the gap between imports and exports current account deficit and not imports as a whole.

If we take 7. At the end of March , FE reserves were equal to This is a very large proportion. This is particularly true when short-term debt is only There are some difficulties with the definitions and concepts used but the essential story that FE reserves are large relative to the flow of hot money 4 remains unchanged — more so if other policies are also adopted. Conventional wisdom is that if there are sudden and large outflows of capital, the RBI must intervene and sell FE in the currency market; this would stabilise the rupee.

However, there can be another form of intervention.

Goldman Sachs arm sells stake in Max Financial for Rs 665 cr

The Ministry of Finance MoF can impose a tax on capital outflows, if these are sudden and large Jeanne and Korinek Such a tax can discourage large capital outflows; the rupee is then not under pressure in the currency market. It is true that the recent situation in India has been the opposite one. There have been large inflows of capital.

The rupee appreciated and adversely affected exports.

Insurance industry entering a phase of sustainable growth: HDFC Life CEO

The rupee would have appreciated much more if the RBI had not intervened and bought a large amount of FE. In fact, this is basically how the FE reserves went up in recent months. So, it appears that the RBI does need to intervene often.

However, again there is an alternative policy. The MoF could have imposed a tax on inflows of capital just as it can impose a tax on sudden and large outflows of capital. If instead of maintaining large FE reserves, the funds are used to finance, say, useful infrastructure projects, the returns will be much higher. So, the opportunity cost of FE reserves is very high. In contrast, if the MoF uses the tax policy, the revenues of the Government of India rise and the costs of large FE reserves are not incurred.

- Foreign-exchange reserves of India - Wikipedia!

- India’s forex reserves may cross $ billion in September: Morgan Stanley.

- India's forex reserves plunge to $394.46 billion, lowest in 60 weeks.

- Asian Journal of Managerial Science (AJMS)!

In contrast, the tax considered here is used only in times of sudden and large flows of capital; also, it can be increased in a calibrated manner if the capital flows warrant the same. Besides the tax policy, there is yet another safeguard available for stability of exchange rate.

Such a credit line is an option that gives India the right but not obligation to borrow if a crisis situation were to arise in future. This instrument reduces the need for large FE reserves. Additional credit lines can be bought though not necessarily from Japan. The advantage of a credit line is that its cost is much less than the opportunity cost of holding FE reserves. So, FE reserves can be much less. Many China specialists have observed that the Yuan had remained undervalued for long, which pushed exports. The large reserves are then a cumulative effect of that policy. However, that story is over and not really replicable now.

It appears that the reserves are being brought down further. If the RBI must have large foreign assets though there is really no need , then it can be divided into two parts. One part can be the standard FE reserves which are liquid and give a low return. The other part can be a sovereign wealth fund, which is invested in a variety of long-term foreign assets and gives a high return.