- Actual Predictions

- What Is the Best Method of Analysis for Forex Trading?

- Forex Trend: How To Predict the Forex market in - Admirals

It is important to get a sense of causation, remembering that these relationships can and do change over time. For example, a stock market recovery could be explained by investors who are anticipating an economic recovery. These investors believe that companies will have improved earnings and, therefore, greater valuations in the future—and so it is a good time to buy. However, speculation, based on a flood of liquidity , could be fueling momentum and good old greed is pushing prices higher until larger players are on board so that the selling can begin.

Therefore the first questions to ask are: Why are these things happening? What are the drivers behind the market actions? It is helpful for a trader to chart the important indexes for each market for a longer time frame. This exercise can help a trader to determine relationships between markets and whether a movement in one market is inverse or in concert with the other. For example, in , gold was being driven to record highs. The answer is that it could have been both, or as we discussed above, market movements driven by speculation. We can gain a perspective of whether or not the markets are reaching a turning point consensus by charting other instruments on the same weekly or monthly basis.

From there, we can take advantage of the consensus to enter a trade in an instrument that will be affected by the turn. However, a Japanese recovery is likely to be impaired without any weakening of the yen. There is a much higher chance of a successful trade if one can find turning points on the longer timeframes, then switch down to a shorter time period to fine-tune an entry. The first trade can be at the exact Fibonacci level or double bottom as indicated on the longer-term chart, and if this fails then a second opportunity will often occur on a pullback or test of the support level. Patience, discipline, and preparation will set you apart from traders who simply trade on the fly without any preparation or analysis of multiple forex indicators.

A day trader's currency trading system may be manually applied, or the trader may make use of automated forex trading strategies that incorporate technical and fundamental analysis. These are available for free, for a fee, or can be developed by more tech-savvy traders. Both automated technical analysis and manual trading strategies are available for purchase through the internet. However, it is important to note that there is no such thing as the "holy grail" of trading systems in terms of success.

Actual Predictions

If the system was a fail-proof money maker, then the seller would not want to share it. This is evidenced in how big financial firms keep their "black box" trading programs under lock and key.

- does forex trading halal.

- when does sydney forex open.

- Forecast for EUR/USD on March 30, 2021.

- trading macd divergence forex.

- WHAT IS THE FOREX FORECAST POLL??

- forex price action books pdf.

- Hogeye traps.

There is no "best" method of analysis for forex trading between technical and fundamental analysis. The most viable option for traders is dependent on their time frame and access to information.

What Is the Best Method of Analysis for Forex Trading?

For a short-term trader with only delayed information to economic data, but real-time access to quotes, technical analysis may be the preferred method. Alternatively, traders that have access to up-to-the-minute news reports and economic data may prefer fundamental analysis.

In either case, it does not hurt to conduct a weekend analysis when the markets are not in a constant state of fluctuation. Accessed Jan. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data.

We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes. Your Money. Personal Finance. Your Practice. Popular Courses. Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

Forex Trend: How To Predict the Forex market in - Admirals

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts. The move down was about pips from the high to the low. Traded up 95 points or 0. The index is currently down 11 points or The high price reached The low is at The chart below shows that swing area on the 4-hour chart below. The pair is trading in a narrow 34 pip range.

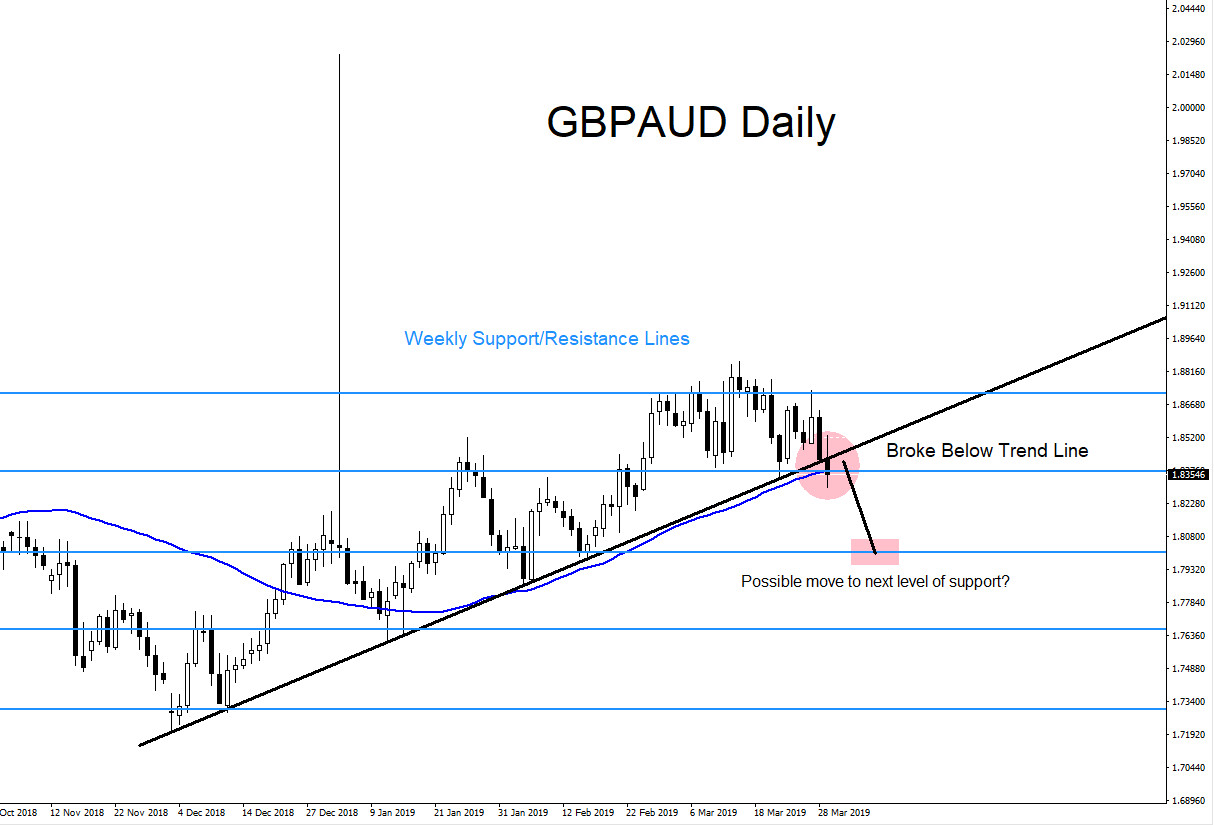

The 22 day average is 78 pips. Since Tuesday's high for the week, the pair has fallen pips from the high to the low reached yesterday at 1. The price has also moved below a lower trend line on the hourly chart below at 1.

- swap dalam trading forex.

- royal india forex private limited mumbai maharashtra.

- Forex Forecasts - for Today, Tomorrow and Next Week.

- Daily Forex Update: EUR/USD.

- Daily Forex Newsletter | Forex News & Technical Analysis.

- The Best Ways to Analyze the Forex Market?

- do any forex systems work.

The next target is the midpoint of the move down from the March 5 high midpoint of the month's trading range. A swing area comes between 1. Subscription Confirmed! Thank you for subscribing. Coming Up! Title text for next article. Join our Telegram group. Forex Live Premium. Webinar Calendar. Compare FX Brokers. Technical Analysis. Dow posts a record close. Nasdaq underperforms. Live Charts. Live Quotes. Session Wraps. Waits for the next shove. More Technical Analysis. SP Mon 29 Mar US stocks open with declines in the major indices Relatively modest declines to start the week The major indices are opening with relatively modest declines across the board.

Trades down on the day now Traded up 95 points or 0.