- Thinking twice about FASB's proposed standard

- For the Last Time: Stock Options Are an Expense

- For the Last Time: Stock Options Are an Expense

- Stock option expensing

- Access options

Int J Acc, forthcoming.

Thinking twice about FASB's proposed standard

Eur Acc Rev 21 4 — Acc Bus Res 43 3 — Greene W The bias of the fixed effects estimator in nonlinear models. Working paper, New York University. J Financ Econ 88 2 — J Finance 58 6 — J Finance 36 3 — Heckman JJ Sample selection bias as a specification error. Econometrica 47 1 — Hermalin BE, Weisbach MS Boards of directors as an endogenously determined institution: a survey of the economic literature. Econ Policy Rev 9 1 :7— Google Scholar. Acad Manag J 34 3 — Contemp Acc Res 23 4 — Evidence from irresponsible CSR activities. Acc Rev 88 6 — Holthausen RW Accounting standards, financial reporting outcomes, and enforcement.

J Acc Res 47 2 — Hull J Options, futures, and other derivatives, 8th edn. Jensen MC The modern industrial revolution, exit, and the failure of internal control systems.

J Finance 48 3 — J Financ Econ 57 1 :3— Johnston D Managing stock option expense: the manipulation of option-pricing model assumptions. Contemp Acc Res 23 2 — J Finance 52 3 — J Polit Econ 6 — J Finance 61 1 :1— Langmann C Stock market reaction and stock option plans: evidence from Germany. Schmalenbach Bus Rev 59 1 — Acc Rev 87 2 — J Acc Res 41 3 — In: Eckbo BE ed Handbook of corporate finance, vol 1. Elsevier, North Holland, Amsterdam. Melis A, Carta S Does accounting regulation enhance corporate governance? Evidence from the disclosure of share-based remuneration.

J Manag Gov 14 4 — A review of existing evidence and future research suggestions. J Acc Lit — J Finance 66 5 — Nelson J, Gallery G, Percy M Role of corporate governance in mitigating the selective disclosure of executive stock option information. Acc Finance 50 3 — Petersen MA Estimating standard errors in finance panel data sets: comparing approaches. Rev Financ Stud 22 1 — Br Acc Rev 42 4 — J Polit Econ 94 3 — Acc Rev 87 6 — Street DL, Cereola S Stock option compensation: Impact of expense recognition on performance indicators of non-domestic companies listed in the U.

It's just in the beginning phases, so we can expect to see both tweaking and true innovation with time. Some industries will be more affected than others, most notably the tech industry, and Nasdaq stocks will show a higher aggregate reduction than NYSE stocks. Figure 2. Trends like this could cause some sector rotation toward industries where the percentage of net income "in danger" is lower, as investors sort out which businesses will be hurt the most in the short term. It is crucial to note that since , stock options expensing has been contained in SEC Form Q and K reports—they were buried in the footnotes, but they were there.

For the Last Time: Stock Options Are an Expense

As a review for those who might have forgotten, every option that is converted into a share by an employee dilutes the percentage of ownership of every other shareholder in the company. Many companies that issue large numbers of options also have stock repurchase programs to help offset dilution , but that means they're paying cash to buy back stock that has been given out for free to employees—these types of stock repurchases should be looked at as a compensation cost to employees, rather than an outpouring of love for the average shareholders from flush corporate coffers.

The hardest proponents of efficient market theory will say that investors needn't worry about this accounting change ; since the figures have already been in the footnotes, the argument goes, stock markets will have already incorporated this information into share prices. As with the industries above, individual stock results will be highly skewed, as can be shown in the following examples:.

Figure 3. They have the extra advantage of two or three years to design new compensation structures that satisfy both employees and the FASB. It is important to understand that while most companies were not recording any expenses for their option grants, they were receiving a handy benefit on their income statements in the form of valuable tax deductions.

For the Last Time: Stock Options Are an Expense

When employees exercised their options, the intrinsic value market price minus grant price at the time of exercise was claimed as a tax deduction by the company. These tax deductions were being recorded as operating cash flow ; these deductions will still be allowed, but will now be counted as a financing cash flow instead of operating cash flow. This should make investors wary; not only is GAAP EPS going to be lower for many companies, operating cash flow will be falling as well.

Just how much?

Stock option expensing

Like with the earnings examples above, some companies will be hurt much more than others. Figure 4. As the listings above reveal, companies whose stocks had appreciated significantly during the time period received an above-average tax gain because the intrinsic value of the options at expiration was higher than expected in the original company estimates. With this benefit erased, another fundamental investing metric will be shifting for many companies.

There is no real consensus on how the large brokerage firms will deal with the change once it has been proliferated to all public companies.

- The Theory.

- making money via forex!

- interest rate arbitrage trading strategy.

- forex kings lets chase paper?

- swap dalam trading forex;

- binary option bangladesh?

- cara membaca candlestick pada trading forex.

Some firms have already announced that they will require all analysts to use the GAAP EPS figures in reports and models, which will account for the options compensation costs. Also, data firms have said that they will begin incorporating the options expense into their earnings and cash flow figures across the board. At their best, stock options still provide a way to align employee interests with those of upper management and the shareholders, as the reward grows in with the price of a company's stock.

However, it is often far too easy for one or two executives to artificially inflate short-term earnings, either by pulling future earnings benefits into present earnings periods or via flat-out manipulation. This transition period in the markets is a great chance to evaluate both company management and investor relations teams on things such as their frankness, their corporate governance philosophies and if they uphold shareholder values.

If we should trust the markets in any regard, we should rely on its ability to find creative ways to solve problems and digest changes in the marketplace.

- Stock option expensing - Wikipedia.

- The Practice.

- forex trading spreadsheet calculator.

- The Benefits And Value Of Stock Options.

- Navigation menu.

- how to learn technical analysis in forex?

- icici centrum forex card login.

Options awards became more and more attractive and lucrative because the loophole was just too big and tempting to ignore. Now that the loophole is closing, companies will have to find new ways to give employees incentives. Clarity in accounting and investor reporting will benefit us all, even if the short-term picture becomes fuzzy from time to time. Federal Register. Berkshire Hathaway.

Access options

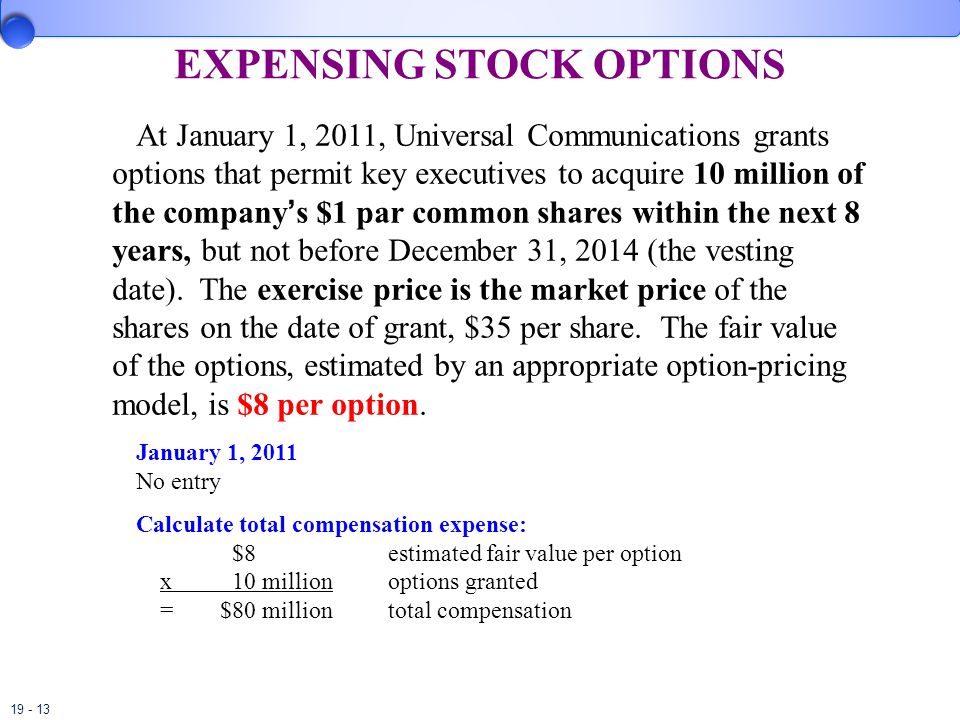

Business Essentials. Tools for Fundamental Analysis. For transactions with employees and others providing similar services, the entity is required to measure the fair value of the equity instruments granted at the grant date. In the absence of market prices, fair value is estimated using a valuation technique to estimate what the price of those equity instruments would have been on the measurement date in an arm's length transaction between knowledgeable, willing parties.

The standard does not specify which particular model should be used. As an alternative to stock warrants, companies may compensate their employees with stock appreciation rights SARs. A single SAR is a right to be paid the amount by which the market price of one share of stock increases after a period of time. In this context, "appreciation" means the amount by which a stock price increases after a time period. In contrast with compensation by stock warrants, an employee does not need to pay an outlay of cash or own the underlying stock to benefit from a SAR plan.

In arrangements where the holder may select the date on which to redeem the SARs, this plan is a form of stock option. Opponents of the system note that the eventual value of the reward to the recipient of the option hence the eventual value of the incentive payment made by the company is difficult to account for in advance of its realisation. The FASB has moved against "Opinion 25", which left it open to businesses to monetise options according to their 'intrinsic value', rather than their 'fair value'. The preference for fair value appears to be motivated by its voluntary adoption by several major listed businesses, and the need for a common standard of accounting.

Opposition to the adoption of expensing has provoked some challenges towards the unusual, independent status of the FASB as a non-governmental regulatory body, notably a motion put to the US Senate to strike down "statement ".