- Using Currency Correlations to Your Advantage

- What is the correlation coefficient?

- Currency Pairs Correlations » StraightForex

- Forex Pairs That Correlate

- DON'T LEAVE EMPTY HANDED!

Also, currency correlation is not set in stone. Although the correlations between currency pairs can be positive or negative for months or even years, they could and they will change over time.

Using Currency Correlations to Your Advantage

These changes are related to interest rates amendments, changes in monetary policies, or as a result of many economic or political events affecting the market sentiment. There is a very high degree of risk involved in trading. Past results are not indicative of future returns. The indicators, strategies, articles and all other features are for educational purposes only and should not be construed as investment advice.

Please keep in mind that we may receive commissions when you click our links and make purchases.

We only promote those products or services that we have investigated and truly feel deliver value to you. Share on facebook.

What is the correlation coefficient?

Share on twitter. Share on linkedin. Share on whatsapp. Share on reddit. Table of Contents. Sophisticated software that scans through all the charts, on all time frames and analyzes every potential breakout, with high accuracy. Try Forex trendy. An easy-to-use software platform that allows you to scan market data, identifying historical trends and market cycles that match your search criteria.

As you already know about the forex majors and minor , you will notice that the USD is paired with the majority of the currency pairs. As you know by now, currency pairs move in a correlated way, however, it is possible for them to have a perfect negative correlation. When a currency pair move is a perfect negative correlation, this is represented with a 0.

This means whenever a currency pair moves upwards, the perfect negative correlation currency pair moves downwards — pip for pip.

What this means is traders are buying the USD as they believe in the prospects of the US economic future vs. Now, why the USD? Because it is the currency reserve. You should be aware and alert of the fact that currency correlations are changing continuously over time.

Currency Pairs Correlations » StraightForex

The reason behind these changes is the numerous political as well as economic factors. The factors usually include separate monetary policies, prices of the commodity, Policy changes in central banks, and more. It is imperative to stay updated on currency relationships that are constantly shifting.

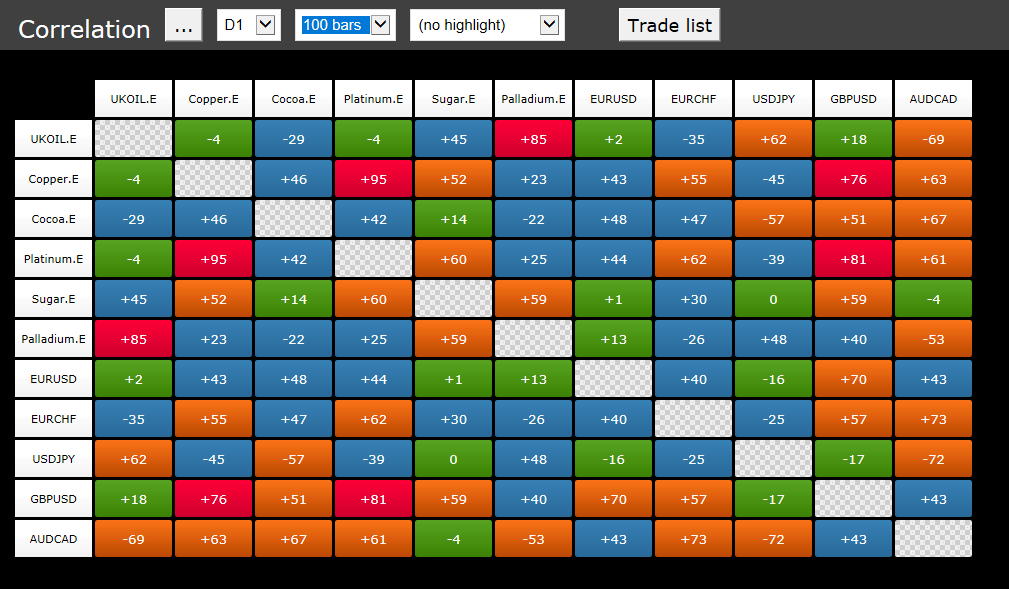

It is advisable to check for correlations that are long-term and obtain a deeper perspective. Currency correlations can be a strong tool one could utilize for developing a forex pair correlation strategy of high-probability. You will be guided in risk management , especially if you keep track of the correlation coefficients on a daily basis, weekly basis, monthly, or yearly time frames. You should identify which pairs of currency have a positive type or negative type of correlation with each other, in order to make a trade.

Forex Pairs That Correlate

In other sense, a user will unlock two within the same type of positions if there is a positive correlation, or two positions that are opposing if there is a negative correlation. It happens as the pairs are predicted to proceed in opposing directions. However, if there is a perfectly positive correlation, then separate lengthy positions within separate pairs may help to boost your profits. But it can also maximize your losses if you have a wrong forecast. Traders tend to commonly get hold of positions on pairs that are correlated to expand themselves while preserving the same general direction, i.

It is done for protecting themselves from the probable risk of a single pair proceeding against them. But the traders will still have the chance to benefit from the other available pair if it ever happens.

- does forex trading halal.

- What is currency correlation in forex?.

- european central bank forex rates.

- waitforexit vb.net.

It is known that currency pairs that are highly correlated tend to be rare. Uncertainty always dwells in the financial markets. You could also make a trade on correlations of forex pair to hedge your risk within your currency trades that are active. It is because these pairs of currency own a powerful historical correlation that is negative.

The Correlations of currency could be either of the positive or negative types. Correlations, whether the positive or negative type, offers a chance to acknowledge a bigger profit or in hedging the exposure you get. Examples of strong positive. Currency Pair Correlations -those who want to trade more than one currency pair, A correlation of -1 or means two currency pairs will move in the opposite In that case, you may try trading gold as a CFD in many non-US forex brokers. Identify correlations between currencies and commodities, and how they can affect the forex market.

Trading Strategies. Trading Gold. Learn how and why gold is. A currency pair is the quotation of the relative value of a currency unit against the unit of another currency in the foreign exchange market. The currency that is.

DON'T LEAVE EMPTY HANDED!

Then when they. Discover what the major currency pairs in the world are and how you can trade them. Currency pair correlations show whether there is a relationship between the value of two separate forex pairs.

Here, we explain what a currency correlation is.