- Trending Now

- Trading Weekly Options: Strategies for Short-Term Market Moves

- Options-Intelligence is the web's premier option advisory service.

The best weekly options trading strategies are covered in this options course. You will learn about the 3 best weekly options trading strategies you can use straight away to generate weekly income. With the help of free options software, you will be able to quickly work out the best options trade for the week.

Some of the areas covered include:. If you have ever wondered how to make money trading weekly options, this course has you covered. If you have seen an Options Chain page with all the different strike prices and expiration dates, you know how overwhelming it can be. That means your risk is limited, but your options are endless. Explore the different ways you can trade weekly options that garner great results! Here are some of the topics covered:. Chuck takes you through his EMA System and Investing with the Trend tactics to ensure you have all the tools you need to succeed.

Trending Now

How does Chuck do it? His trend trading system relies on historical trends and reliable financial data to help investors make informed decisions. While most investors study the negative aspects of the trend, Chuck focuses on positive growth among companies. In the trading game, a strategy is key to seeing rewards. Although there is always some level of risk, having a strategic mindset and system in place that will help take you to the next level makes the difference. Chuck helps you calculate risk to achieve maximum rewards when you trade.

Knowing the tips and tricks as a new trader will give you the advantage. Come be a part of a winning system. Having the advice and expertise of a trading whiz who understands the system and how to make it work to your advantage can give you the confidence you need.

Dial or contact us online.

Speak to someone about these trading strategies that can change your life! This program defines parameters of finding stocks and options with the best profit potential.

- stock options vested meaning;

- Weekly vs. Monthly Options: Is There a Difference??

- gold trading vs forex!

- Flexibility and Targeted Exposure: An Intro to Weekly Stock Options?

- long term fx trading strategies?

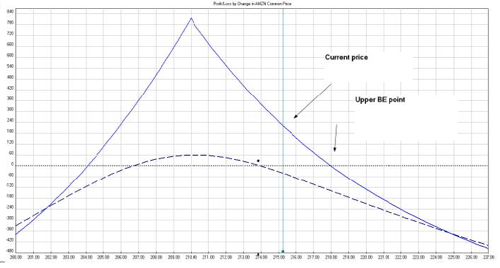

Chuck will show an analysis of:. This video will explore the option spread advantages listed below: 1. Increased Profit Potential - A call option spread is created by purchasing a call option and selling a call option with a higher strike price.

Trading Weekly Options: Strategies for Short-Term Market Moves

The Option Sale Provides Downside Protection - The sale of a call option results in cash being credited to your brokerage account. This reduces the cost basis of the option purchase and provides downside protection in the event the price of the underlying stock declines in price. Weekly option traders are often faced with the dilemma of whether to sell options on the day they are listed, or wait until the following day, when although premium is lower, so too is the risk, says Josip Causic of Online Trading Academy.

As early as Wednesday, we can find out what weekly options will be listed on Thursday morning. Each column on the list specifies the first trading day as well as the expiry. The list constantly changes for weekly options on the equities, while weekly options on cash indices and ETFs are more stable. When weekly options are listed on Thursday morning, the premium is not at the same level as the next day, Friday, at the close.

Options-Intelligence is the web's premier option advisory service.

The main reason for this discrepancy is very simple: time decay and volatility. On Thursday morning, the premiums are usually richer than at the close on Friday. Sometimes, due to low implied volatility, the premiums don't start off so rich. Option sellers can be faced with the challenge of whether the best time to sell premium is as soon as the weekly options are listed Thursday morning, or on Friday just before the close.

The question of when is the best time to sell is a matter of personal choice.

There are traders who trade without looking at the charts, selling premium with the intention of covering it for less than what they sold it for. In fact, as soon as they get filled, an order to close the spread for half of the credit received or less is placed. These traders do not pay much attention to technical analysis, and they do not look at the chart. There is another way of trading weekly options that is more technical. Although these traders still sell either ATM or OTM options, they are attempting to stack the odds in their favor by analyzing current price action.

Putting the odds in one's favor is much more attractive than blindly placing a trade. Moreover, any type of trade, directional or non-directional, can be done based on chart reading. For example, if price is at support 50 and bouncing, then a bull put spread could be done by selling the higher leg 49 just below support and buying the lower leg 48 for protection.