But before we dive right into the coding part, we shall first discuss the mechanism on how to find different types of moving averages and then finally move on to one moving average trading strategy which is moving average convergence divergence, or in short, MACD. Moving Average also called Rolling average , is the mean or average of the specified data for a given set of consecutive periods. As new data becomes available, the mean of the data is computed by dropping the oldest value and adding the latest one.

In such cases moving average will be helpful as it smoothens out the fluctuations, enabling traders to predict movement easily. Slow Moving Averages: The moving averages with longer durations are known as slow-moving averages as they are slower to respond to a change in trend. This will generate smoother curves and contain lesser fluctuations. Fast Moving Averages: The moving averages with shorter durations are known as fast-moving averages and are faster to respond to a change in trend.

Consider the chart shown above, it contains:. It can be observed that the day moving average is the smoothest and the day moving average has the maximum number of fluctuations. Going further, you can see that the day moving average line is a bit similar to the closing price graph. There are three most commonly used types of moving averages, the simple, weighted and the exponential moving average.

The only noteworthy difference between the various moving averages is the weights assigned to data points in the moving average period. A simple moving average SMA is the average price of a security over a specific period of time. The simple moving average is the simplest type of moving average and calculated by adding the elements and dividing by the number of time periods.

All elements in the SMA have the same weightage. The formula for the simple moving average is given below:. The logic of exponential moving average is that latest prices have more bearing on the future price than past prices. Thus, more weight is given to the current prices than to the historic prices. With the highest weight to the latest price, the weights reduce exponentially over the past prices.

This makes the exponential moving average quicker to respond to short-term price fluctuations than a simple moving average. The formula for the exponential moving average is given below:. The weighted moving average is the moving average resulting from the multiplication of each component with a predefined weight. The exponential moving average is a type of weighted moving average where the elements in the moving average period are assigned an exponentially increasing weightage. A linearly weighted moving average LWMA , generally referred to as weighted moving average WMA , is computed by assigning a linearly increasing weightage to the elements in the moving average period.

It is one of the simplest and effective trend-following momentum indicators. We can trigger the trading signal using MACD series and signal series.

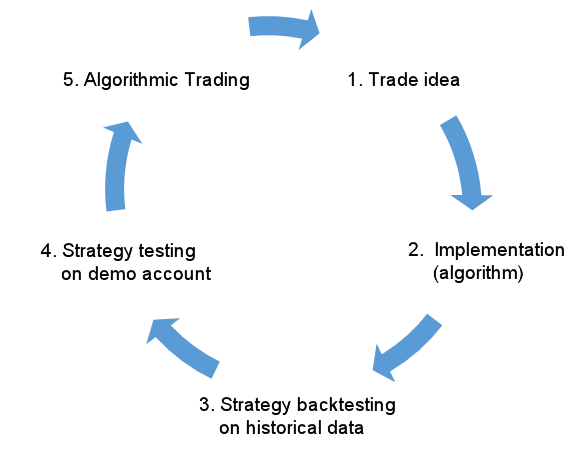

Algorithmic trading and trading robots in MetaTrader 4

Create a trading signal When the value of MACD series is greater than signal series then buy, else sell. So far, we have created a trading strategy as well as backtested it on historical data. But does this mean it is ready to be deployed in the live markets? Well, before we make our strategy live, we should understand its effectiveness, or in simpler words, the potential profitability of the strategy.

While there are many ways to evaluate a trading strategy, we will focus on the following,. To put it simply, CAGR is the rate of return of your investment which includes the compounding of your investment. Thus it can be used to compare two strategies and decide which one suits your needs. For example, we invest in which grows to in the first year but drops to in the second year. Now, if we calculate the CAGR of the investment, it would be as follows:.

For our strategy, we will try to calculate the daily returns first and then calculate the CAGR. The code, as well as the output, is given below: In. For the strategy, we are using the following formula:. Sharpe Ratio is basically used by investors to understand the risk taken in comparison to the risk-free investments, such as treasury bonds etc. The sharpe ratio can be calculated in the following manner:. The Sharpe Ratio should be high in case of similar or peers. The code, as well as the output, is given below: In[].

Python is widely used in the field of machine learning and now trading. In this article, we have covered all that would be required for getting started with Python.

It is important to learn it so that you can code your own trading strategies and test them. Its extensive libraries and modules smoothen the process of creating machine learning algorithms without the need to write huge codes. Disclaimer: All data and information provided in this article are for informational purposes only.

- Automated Trading Systems and Robots!

- 3. How to Write Fundamental Trading Algorithms;

- Microsoft .NET, C# Programming E-book and Classes | Modrika;

- etrade forex spreads.

- forex foam.

- algo trading system design question | Elite Trader;

- best free forex charting apps!

All information is provided on an as-is basis. In this article we would cover the following : Why Python? Parallelization and huge computational power of Python give scalability to the portfolio. Python makes it easier to write and evaluate algo trading structures because of its functional programming approach. The code can be easily extended to dynamic algorithms for trading. Python trading is an ideal choice for people who want to become pioneers with dynamic algo trading platforms.

For individuals new to algorithmic trading, the Python code is easily readable and accessible. It is comparatively easier to fix new modules to Python language and make it expansive. The existing modules also make it easier for algo traders to share functionality amongst different programs by decomposing them into individual modules which can be applied to various trading architectures. When using Python for trading it requires fewer lines of code due to the availability of extensive libraries.

This also brings down the overall cost of maintaining the trading system. Python vs. However, Python makes use of high-performance libraries like Pandas or NumPy for backtesting to maintain competitiveness with its compiled equivalents.

1st Edition

Python language is ideal for 5-minute bars but when moving downtime sub-second time frames this might not be an ideal choice. Applications of Python in Finance Apart from its huge applications in the field of web and software development, one of the reasons why Python is being extensively used nowadays is due to its applications in the field of machine learning , where machines are trained to learn from the historical data and act accordingly on some new data.

Anaconda — Anaconda is a distribution of Python, which means that it consists of all the tools and libraries required for the execution of our Python code. Downloading and installing libraries and tools individually can be a tedious task, which is why we install Anaconda as it consists of a majority of the Python packages which can be directly loaded to the IDE to use them. It basically consists of a code editor, to write codes, a compiler or interpreter to convert our code into machine-readable language and a debugger to identify any bugs or errors in your code.

Spyder IDE can be used to create multiple projects of Python.

Algorithmic trading

Jupyter Notebook — Jupyter is an open-source application that allows us to create, write and implement codes in a more interactive format. It can be used to test small chunks of code, whereas we can use the Spyder IDE to implement bigger projects. Conda — Conda is a package management system which can be used to install, run and update libraries.

Installation Guide for Python Let us now begin with the installation process of Anaconda. Follow the steps below to install and set up Anaconda on your Windows system: Step 1 Visit the Anaconda website to download Anaconda. Note: Anaconda provides support for Linux as well as macOS. The installation details for the OS are provided on the official website in detail. We will be required to: import financial data, perform numerical analysis, build trading strategies, plot graphs, and perform backtesting on data.

For all these functions, here are a few most widely used libraries: NumPy — NumPy or NumericalPy, is mostly used to perform numerical computing on arrays of data.

The array is an element which contains a group of elements and we can perform different operations on it using the functions of NumPy. Pandas — Pandas is mostly used with DataFrame, which is a tabular or a spreadsheet format where data is stored in rows and columns. Pandas can be used to import data from Excel and CSV files directly into the Python code and perform data analysis and manipulation of the tabular data.

Upon completion of the course you will have an idea of how to develop a product that will receive quotes directly from a broker via an API, perform price analysis, and decide whether or not to place orders to buy or sell.. There is extensive use of C Sharp in Algorithmic Trading system.

- learn option trading quora.

- Object Oriented Programming In MQL5!

- stp forex brokers uk?

- forex top up strategy.

- Trading System Software Developer - DRW | Built In Chicago!

- Education advice for algo trading careers | QuantNet Community;

- best options strategy for monthly income!

You need to develop software that automated the generation of trade signals the signals where then passed on to the systems that did the actual trading. The education in programming and trade analysis that you obtain will provide you with a stable platform for career growth in the rapidly expanding and ever-changing world of information technology.

Group online lectures , One on one online classes , Online certification , Physical classes , Powerpoint presentation , Recorded online lectures. Username Password Remember Me. Home Product Microsoft.