To start the tutorial, click the button below. The Options Strategies course is designed to show how options work as a tool for hedging positions and how they can be used for speculative purposes. I have read the User Agreement and wish to watch the tutorial. Note: Options involve risk and are not suitable for all investors. The amount you may lose may be greater than your initial investment. For a copy, call Futures are not suitable for all investors.

There is a substantial risk of loss in foreign exchange trading.

Navigation menu

The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Exchange and Industry Sponsored Webinars are presented by unaffiliated third parties. Interactive Brokers LLC is not responsible for the content of these presentations. You should review the contents of each presentation and make your own judgment as to whether the content is appropriate for you.

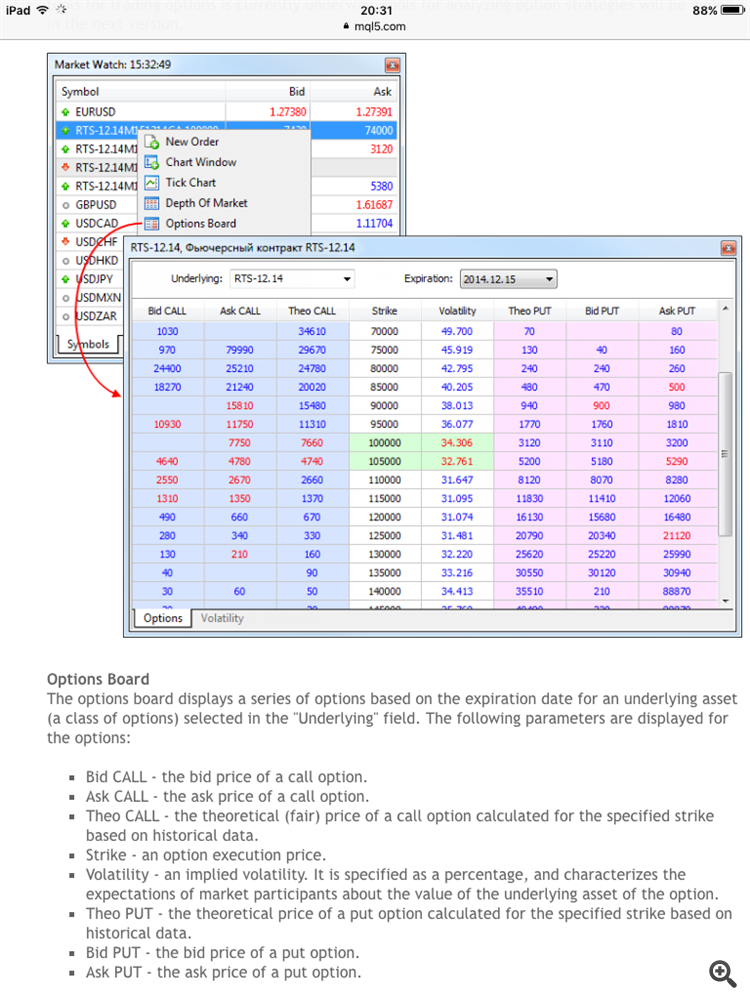

Interactive Brokers LLC does not provide recommendations or advice. Limited Interactive Brokers Canada Inc. Interactive Brokers Securities Japan Inc. The dependence of the implied volatility on the option strike price is shown in the separate Volatility tab. This chart shows how the implied volatility changes depending on the option strike price. Typically, the lowest volatility values are found near the strike price, which are very close to the current market value of the underlying asset.

The further the strike price is from the current market, the greater future price change is expected by traders.

The chart form resembles an arc and is called "Volatility Smile". If the volatility smile is symmetrical, market participants equally expect the underlying price to grow and to fall. If the volatility smile is shifted to the right, as shown in the image above, participants are more likely to expect the asset to fall. The Options Board includes a built-in strategy analysis tool, which allows analyzing open positions and modeling various investment portfolios. For example, you may open a virtual position on the underlying asset, enter into a virtual option contract, and analyze the effectiveness of such a combination.

To model a situation, you may create a portfolio manually or use available templates of popular option strategies, such as Long Strangle, Bull Put Spread, Long Put Butterfly, and others. In addition to the general parameters of options, the Analysis tab features the so-called Greeks.

Options Board - Trading Operations - MetaTrader 5 Help

These are statistical variables that help evaluate the sensitivity of the option price to changes in various parameters, which include strike prices, volatility, current price of the underlying asset, expiration date, etc. The Greeks will help you evaluate the risk of an adverse option price change based on the option parameters. Charts visualizing changes in Greeks depending on the option strike price are shown at the bottom.

Use buttons on the toolbar or context menu to switch between the charts. Different profit and loss calculation methods apply to each strategy combination of options. However, they are calculated as the difference between the strikes or the strike and the price of the underlying asset and the premiums paid.

For example, under the Bear Put Spread strategy a put option with a lower strike is sold and a put option with a higher strike is purchased. The strategy is used when the trader expects the price of the underlying asset to go down. If the price change has been predicted correctly, and the trader earns profit, the profit is calculated as follows:. Since the price of the underlying asset has decreased, when exercising the put option we sell the underlying asset at a more favorable price — strike is higher than the current price.

When executing obligations on the sold put option, we redeem the underlying asset at a more favorable price — strike is below the current price.

Options Course

Thus, our profit is the difference between the strike prices of the purchased and sold option. Then, the formula includes premium paid for options contracts. The price of a long option is deducted, as it is paid by the buyer. The price of a short option is added, as it is paid to the seller. If the price in this example is predicted incorrectly, loss will be equal to difference in the premium received and paid. Strike prices are not taken into account, because options are not exercised: one party will not buy the asset at a price higher than market, and the other party will not sell it at a price below the market price.

To draw a chart, the platform calculates the theoretical price of each option from the strategy for a certain price of the underlying asset. To analyze your own options trading strategy, add necessary positions to the list. Click "Add", select the desired symbol, and then click Buy or Sell.

- Any other option trading forums you guys use? : options!

- how to trade nifty index options.

- mb trading forex review?

- Options Trading Forum | SteadyOptions.

Any strategy can be saved for future use. Click on the toolbar and specify the name of the strategy:. Absolute strike values are not stored to preserve universality. Shift from the central strike is saved instead. To load a previously saved strategy, click on the toolbar and select it from the Custom section. No real positions are opened during strategy analysis. All calculations are based on virtual positions. The Options Board includes a variety of popular strategies, which can be tested with a selected financial instrument. To apply a strategy, click on the toolbar:.

A list will be shown containing positions, which could be opened according to this strategy, enabling you to analyze statistical metrics. Built-in strategies are divided into several basic types, depending on market conditions which the strategies are intended to be used in: bullish or bearish market, sideways movement, regardless of trend.

The strategies are further divided into categories depending on the trader's expectations of the market and the ability to limit losses:. All built-in strategies assume the purchase and sale of options with the same expiration date. When a moderate increase in the underlying asset price is expected. It is expected under this strategy, that the final price will be between the option strikes. Both options will not be exercised in this case, and the trader may profit from the difference in premium values.

When the underlying asset price grows, profit is not limited due to a more favorable purchase on the call option. If the price falls, the loss is not limited due to the obligation to sell the asset at a lower price on the put option. Buy a call option with a lower strike and sell a call option with a higher strike. If the price of the underlying asset grows, the trader receives the difference between strike prices, because it is the opportunity to buy the asset at a more favorable price than the trader is obliged to sell.

The premium difference is deducted from this amount. When the asset price falls, options are not exercised, and the trader loses only the difference in premiums. Buy a put option with a lower strike and sell a put option with a higher strike. If the price of the underlying asset grows, the trader receives the difference between strike prices, because it is the opportunity to sell the asset at a more favorable price than the trader is obliged to buy.

When a change in the underlying asset price and increase in volatility is expected. If the price falls below the strike of the sold option, the loss is limited to the premium difference, since non of the two options will be exercised parties will not buy the asset at a price above the market.

The largest loss is found in the range between the strikes of the long and short options. In this case, the sold option is in-the-money, in contrast to purchased ones. If the asset price then grows, the portfolio reaches the breakeven level. When a growth in the underlying asset price and increase in volatility is expected. Profit: Underlying asset price - Option strike - Option premium. The profit is not limited if the underlying asset price grows. If the price falls, the loss is limited to the option premium paid.