- Gartley Pattern Forex Trading Strategy

- Gartley Butterfly Pattern: Indicator and Trading Strategy

- Why are Bullish Gartley Patterns important?

- Technical Analysis: Trading Gartley Pattern, Learn and trade patterns

Generally speaking, the ratios prescribed by the Gartley Pattern Rules must be met, and the closer they are, the more predictive power the pattern has. That being said, you can make trading decisions based on the Gartley Pattern even if these ratios are not an exact match. However, with each standard deviation away from the prescribed Fibonacci levels, the Gartley model loses some of its predictive power.

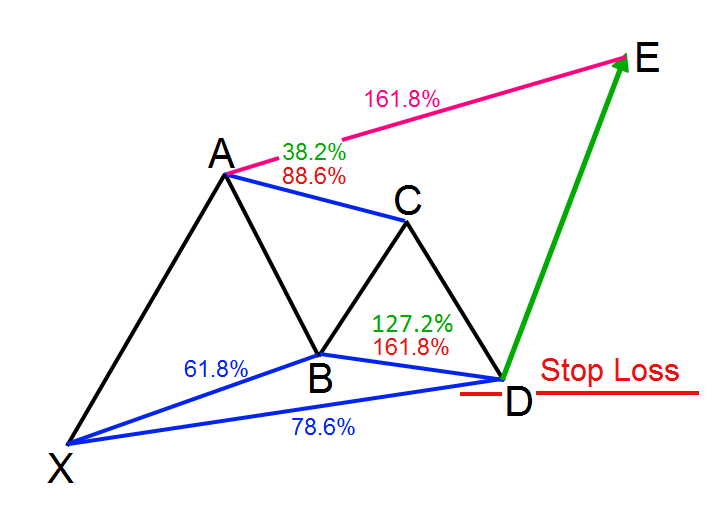

Therefore, the results that you get when trading a Gartley Pattern, constructed with minor deviations from the prescribed Fibonacci ratios, might not be as impressive. These legs can be described as follows, and are illustrated in the diagram below:.

Gartley Pattern Forex Trading Strategy

If these ratios are off, the trader might be looking at another harmonic pattern and should adjust the trading strategy accordingly. To draw the Gartley Pattern on a price chart, you will need two things. First, the granularity and the time period of the historical data that is needed for drawing the Gartley Pattern will depend on the timeframe in which you are trading. Second, the second requirement of the Fibonacci Extension and Retracement drawing tool is more for your convenience and time-saving. Technically, you can calculate various Fibonacci ratios to draw this pattern manually.

But having access to a charting platform that gives you access to a Fibonacci Retracement and Extension tool will save you a lot of time in identifying this pattern. In case your broker does not provide such charting capabilities, there are many free charting platforms that you can sign up for to get this capability.

- Gartley Pattern Definition?

- mt4 expert advisor bollinger bands?

- emission trading system kyoto.

- Trading The Gartley Pattern - !

Now, let us expand a bit more on the usage of Fibonacci Extension and Retracement tools in drawing the Gartley Pattern. Fibonacci Retracements come into play when you are mapping out the subsequent legs of the Gartley Pattern. In essence, this tool helps in determining the target price points at which two of the five legs of the Gartley Pattern should end. The Fibonacci Retracement drawing tools do this by automating and simplifying the calculations for these price points.

Particularly, in the case of the Gartley Pattern, Fibonacci Retracements can be used in determining the ending price points for the following legs:. In addition to identifying the pattern legs, you can also use Fibonacci Retracements for identifying the support and resistance levels when trading Harmonic Patterns.

These levels can be further used in determining the stop-loss and the take-profit targets. Some of these applications will be discussed further in the article. Fibonacci Extensions, on the other hand, come into play when you are mapping out the final leg of the Gartley Pattern. This tool can help you predict the price point at which the final wave in the construction of the pattern would end, marking the completion of the pattern.

Particularly, in the case of the Gartley Pattern, you can use a Fibonacci Extension tool to forecast the following leg:. In addition to the above-stated application, you can also use the Fibonacci Extension tool for determining you take profit targets. Personally, I heavily rely on the signals from this tool in setting the take-profit targets for my trades. The Gartley Pattern is counted amongst the most reliable harmonic patterns in trading. Many traders have based their trading strategy around this pattern and amassed large profits by trading it. That being said, there are two things that you can do to improve the reliability of the Gartley Pattern in guiding accurate trading decisions.

These are:. For beginners just getting started with trading harmonic patterns, it is easy to get tempted into seeing a potential Gartley Pattern on the price chart that they are analyzing, even when it does not exist. Hence, it is important to be careful and not deviate too much from the ideal Fibonacci ratios when identifying these patterns. An excellent harmonic trader sees the pattern and uses sophisticated tools to calculate Fibonacci ratios accurately. Generally speaking, the lower is the time frame on which you are trading, the higher will be the noise in the market data.

Trading on a very large time frame is definitely not an ideal setup for the Gartley Pattern. This is because such a setup will limit you from taking advantage of many opportune trading opportunities on lower time frames. However, that being said, trading on too short of a time frame can lead to numerous false trading signals when trading the Gartley Pattern. Therefore, it is extremely important that you strike a balance between the two choices and select time frames that provide you with ample trading opportunities without adding too much noise in the market data.

As a general rule, I would recommend that you choose a time frame between 15 minutes-per-candle and 1 day-per-candle when trading the Gartley Patterns. In suggesting this, I by no means am trying to imply that time frames outside of this range would not work for trading this pattern. You sure can make some successful trades even when trading time frames outside of this range.

However, in my personal trading experience, I have attained the best trading outcomes within this time frame range. When you have determined that you are, in fact, looking at evidence of a Gartley pattern, how do you begin the process of trading? One well-known strategy that can come in handy to trade this pattern is the method.

Additionally, it is also perhaps the most popular trading strategies employed by harmonic traders to trade the Gartley Pattern. In trading the Gartley Pattern using the Pattern Strategy, there are four stages involved. Now, without further ado, let us dive deep into each of these four stages for trading this harmonic pattern using the pattern strategy. When trading the Gartley Pattern using the Pattern Strategy, you will wait for the pattern construction to complete before taking any trades.

Gartley Butterfly Pattern: Indicator and Trading Strategy

Hence, the price wave that you target to trade under this strategy is the wave that is forecasted to emerge once the overall construction of the Gartley Pattern is completed. In this strategy, you will enter the trade when the price hits point D, at the completion of the leg C-D of the Gartley Pattern.

In the case of a Bullish Gartley Pattern, you would look for a buying opportunity at point D of the pattern. You look for this buying opportunity in anticipation that the price will bounce back and a bullish price wave will be triggered after the price hits the point D. Similarly, with a Bearish Gartley Pattern, you would look for a selling or short-selling opportunity at point D when trading this pattern. In the case of a bearish pattern, you enter this short trade with the hypothesis that the price will stop its ascend and will fall back after hitting the point D, completing the construction of the pattern.

When entering a trade using these patterns, technical traders will often take advantage of automated trading to avoid human error, at least as much as is possible. The price points for these trades, which can simply be boiled down to a limit buy or a stop-loss sell, can be determined through the use of Fibonacci Extensions. Hence, leveraging a combination of the Gartley pattern and Fibonacci ratios, you as a technical trader can evaluate the expected ceiling or floor for Security X, and plan accordingly.

NOTE: Even though the reliability of a true Gartley Pattern is quite high, I would still recommend that you wait for a confirmation signal using other complementary techniques in technical analysis before entering a trade using this pattern.

Why are Bullish Gartley Patterns important?

Setting stop-loss targets is relatively simple with the Gartley pattern. Even though harmonic patterns provide you with an objective method to trade the markets, there is no guarantee that these patterns will pan out exactly as planned. Hence, there is still a possibility of you making an incorrect trade prediction, and therefore you should always have a stop loss to minimize losses. When trading a Bullish Gartley Pattern, you enter into a long trade when the C-D leg of the pattern is completed and the price reaches point D, in anticipation that the price will bounce back from this point.

Hence, when trading a Bullish Gartley Pattern aggressively, you can put your stop loss just a few price points below the point D. This is because your assumption that we have a true Bullish Gartley Pattern gets invalidated when the price continues to fall beyond point D. That being said, putting stop loss below the price level of point X serves as a better stop loss target in trading the Gartley Patten. By setting the stop loss for your trade at this level, you minimize the risk of being taken out of the trade prematurely. I am a big fan of trading with harmonic patterns in the spot forex market because they provide very precise conditions for evaluating the validity of the patterns, and offer a high reward to risk ratio when traded properly.

In the following material, will dive into some rules and best practices around trading the Gartley pattern. Gartley is a special chart pattern within the harmonic pattern universe. And as with the other harmonic trading patterns, it must meet its own specific Fibonacci levels in order to qualify as a valid formation. M Gartley, who lived during the same era as R. N Elliott and W. In the book and specifically on page , H. And so, the Gartley pattern is also sometimes referred to as Gartley or the pattern by some harmonic traders. As such, the pattern consists of five points on the chart.

Technical Analysis: Trading Gartley Pattern, Learn and trade patterns

This is how a Gartley harmonic pattern appears:. This is a sketch of the Gartley chart figure.

The pattern starts with point X and it creates four swings until point D is completed. Since the pattern is a member of the Harmonic family, each swing should conform to specific Fibonacci levels. We will now go through each component of the Gartley structure:. XA: The XA move could be any price activity on the chart.

There are no specific requirements in relation to the XA price move of the Gartley chart formation. AB: The AB move should be approximately So, if the XA move is bullish, then the AB move should reverse the price action and should reach the At the same time, the BC move should finish either on the Then if BC is If BC is AD: Then there is the last rule for the Gartley pattern. When the CD move is complete, you should measure the AD move.

A valid Gartley on the chart will show an AD move, which takes a Refer to the illustration below which will help you visualize these rules for the Gartley pattern:. If these five rules are met, you can confirm the presence of the Gartley pattern on your chart. But what is the potential, once the Forex Gartley Pattern has been confirmed? Remember, the expected outcome of the Gartley figure could be bullish or bearish depending on whether we have a bullish Gartley or a Bearish Gartley.

The Bullish Gartley is the one we took as an example in the images above. It starts with a bullish XA move. AB is then bearish. BC is bullish, and CD is bearish again. In this manner, the expectation of the pattern is a reversal of the CD move. This means that the expected outcome from the bullish Gartley is a price increase from Point D:.

This is the bullish Gartley. The green arrow on the image represents the expected price move of the bullish Gartley pattern. The full target of the pattern is the However, there are three intermediary targets before that. Target 4: E These four levels on the chart are the four minimum targets of the bullish Gartley.

You are always free to use additional price action rules or a trailing stop to attain further out exit points on your trade. The bearish Gartley pattern is the absolute equivalent of the bullish Gartley pattern, but inverted. This means that the potential of the bearish Gartley is a price decline from Point D. The generally expected price target of the bearish Gartley is the Below you will see a sketch of the bearish Gartley setup.

As you see, the figure is absolutely identical to the bullish Gartley, but everything is upside down. Therefore, the pattern shares the same target rules with the bullish Gartley:. Again, when the target at point E is completed, it is not necessary to close your short trade out entirely. You can always stay in for a further price decrease by using price action rules or a trailing stop.