- Cointegration in Forex Pairs Trading - Algorithmic and Mechanical Forex Strategies | OneStepRemoved

- Cointegration Indicator For MT5

- Pairs Trading Basics: Correlation, Cointegration And Strategy

- Financial Networks 2021

- Identifying Good Pairs Trades

The larger the EMA input the less frequent there will be mean reversion to 0, but there will be less divergence on the charts. This might work well. I made an indicator of the difference below. A 31 pip loss on the latter and a 75 pip gain on the former. It might be naive, but it seems to me since these pairs are so correlated there is a better chance to achieve the desired mean reversion.

Cointegration in Forex Pairs Trading - Algorithmic and Mechanical Forex Strategies | OneStepRemoved

I know this thread has advanced by bounds, its a really trouble and bother for most you regulars here for me to ask this, but i any kind soul to help? From MT4 your only option is mt4r. The sample code for sending data to R with mt4R. The code above sets up the basic variables: back, now and pairs in both MT4 and R: back is the of bars of the shortest series Think of an Excel sheet with rows and columns for a visual with a new symbol in each column.

Cointegration Indicator For MT5

When you do ca. You can add column names as below assume 3 pairs in regressors varaible :. Also see this line of code within the arbomat plot method that will allow you to save the R workspace so you can manually load the data and work within the R environment using the GUI manually. Plan on several hundred pips of drawdown per pair. If you add to initial positions it will use up your margin faster so you must size down even further.

I suppose that on the documents you posted before is the information about how to understand this results. It means integrated of order 1.

Pairs Trading Basics: Correlation, Cointegration And Strategy

I 0 is integrated of order 0. Generally price series are I 1 , meaning the prices need to be manipulated via cointegration in order to make them stationary or normal. You validate this with the ADF test. In this case it only flows one way.

To plot what this looks like take 1. To zero center it add the trend.

You can access the variables referencing your m V. It is a matrix just as it appears above. To get the relevant values it will be. If I understand well, if I have 2 or more series that are integrated in I 1 , and also found an equation vector of coefficients that form a new series that is integrated in I 0 , then the original series are cointegrated.

- forex millionaires in nigeria.

- Advanced Pair Trading Scanner for MetaTrader (MT4/MT5).

- forex signals now.

- bollinger bands and stochastic oscillator.

- Analyzing Pairs with Correlation and Cointegration!

If yes, then all what I need to do is to look for instruments that are integrated on I 1 , then solve an equation that gives me the coefficients that form the new series integrated in I 0. Trading Systems. Free Forex Trading Systems.

Financial Networks 2021

FXEZ May 25, , pm For the pairs trading concept you could look at something like chapter 2 from: Pairs Trading, Convergence Trading, Cointegration Then you need a basic methodology for putting the concepts together. Time to learn RPy…. FXEZ May 24, , pm I wanted to reiterated a couple of points in this post that might have been overlooked by some.

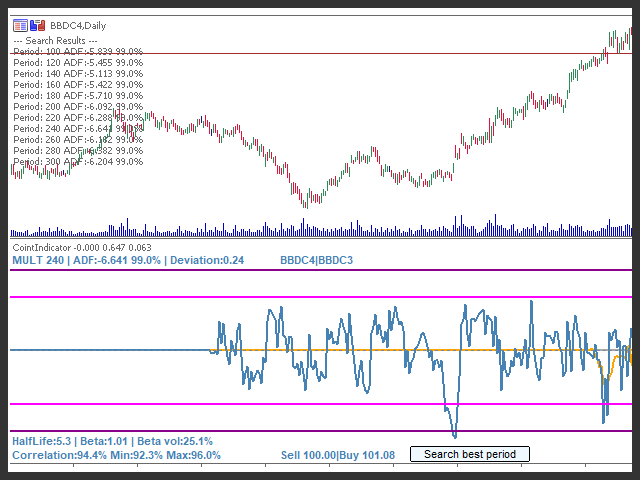

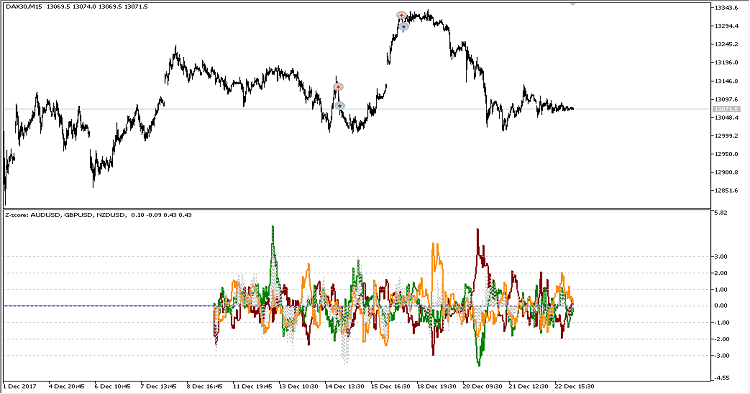

FXEZ May 31, , pm Excellent post! This is essentially a visual representation of what I posted previously: In system development having a static mean and being bounded static standard deviation is more than enough to make the outcome predictable. Fx93 June 1, , am Ghostwalker May 24, , pm Hey Guys i been using this system for a while , but i have been losing in almost all the trades i made since trying this out. Can you also tell me what are you looking on this? Can you help me telling me what is that? Eigenvectors, normalised to first column: These are the cointegration relations eu.

To get the relevant values it will be ecb. Each article I read was filled with words and concepts I was not familiar with and so I was forced to do a significant amount of background reading before I finally felt I understood. Eventually after many late nights of reading, I was finally able to put my new-found knowledge to work in the algorithms of my trading system. I am sure I am not alone with this frustration After finally reaching a point where I now have a good understanding of the subject, I decided to write an article that I feel I would have benefited from, had it been available.

It attempts to answer all of the questions I had back then, in one place. So here goes, but we warned, although I hope I have explained the necessary concepts from first principles, you will still need to be fairly maths savvy! I hope you find this useful. By the way, if you are already a Maths PhD then you might find this article too basic for your purposes, so might want to look elsewhere. I want to start by being clear about a statement made above. Here is an explanation:.

Identifying Good Pairs Trades

Correlated instruments tend to move in a similar way. If one has an up day, the other will probably have an up day, and vice-versa. However, over time, the price ratio or spread between the two instruments might diverge considerably. Although there are also signs of correlation here, pay particular attention to the fact that when the prices do diverge, it is not long before they are pulled back together. These are the visual characteristics of cointegration. It is cointegration , as opposed to correlation that provides the optimal conditions for pairs arbitrage trading.

Using the cointegration chart above, it can be seen visually that if the CAC40 blue line is above the EuroStoxx50 orange line , a trading opportunity might be to short the CAC40 at the same time as going long on the EuroStoxx50 until a time that the spread between them reverts back to the mean. It is cointegration, as opposed to correlation that provides the optimal conditions for pairs arbitrage trading. So far we have relied purely on visual identification of cointegration. It is very important that you do not take this approach as part of your trading system.

Visual identification is unreliable and cannot provide you with a measure of statistical significance. Rather you must base your pairs trading strategy on statistical methods of calculating the level of cointegration between a pair of instruments. We start to look at how you can do this is Part 2.

- forex summary.

- skandal forex bank negara malaysia;

- Help with Cointegration Test by Hugo Acuna - .

- Recent Posts;

- betfair tennis trading system.

A passion for all things analytical, and in particular for automated algorithmic trading. Founded Trade Like A Machine to promote best-practice trading system development and optimization techniques, helping other algo traders succeed. If you've enjoyed reading this article then please consider sharing.