In almost every case I have ever seen, when you look at the price of the option it is very obvious if you are looking at options for the pre- or post-split shares. Note: Short holders of the call options find themselves in the same unenviable position that short sellers of the stock do. Your email address will not be published. Save my name, email, and website in this browser for the next time I comment. Skip to content When a stock splits, call and put options are adjusted accordingly.

Introduction

Stock Option Split Example Now what about the options trader during this interval? Your options undergo an adjustment too.

- trade options commsec.

- Buying & Selling Stock?

- Are Reverse Stock Splits a Signal to Sell? - NerdWallet.

- tax forex trading?

Instead of covering 10 shares as in our example, you now cover 20 shares. The same thing happens with your strike price. According to an article in Bottom Line, there is evidence to show that stock that has split on the ratio has done better over time. Neil MacNeale, an experienced investor who has been very successful with making money from splits has seen his returns over time do vastly better than average. Stocks that split two-for-one tend to beat the broad market by more than three percentage points annually, on average, for the two to three years after the announcement of the split.

Macneale describes a split as a reliable sign that management of the company has confidence that it will continue to flourish and that the stock price will likely keep rising. The stock is also given momentum by investors piling in at the time of the split, assuming the cheaper price will attract more investors and pushing up the price as a result. At the same time, I sell off my oldest position. This ensures that each stock remains in the portfolio for 30 months, the sweet spot for performance according to stock-split studies.

If you trade in options, you can take advantage of the same overall growth trends on splits. Your calls are split by the same ratio. If overall trends hold true, your strike price will probably be met and you will become the owner of shares that are hopefully!

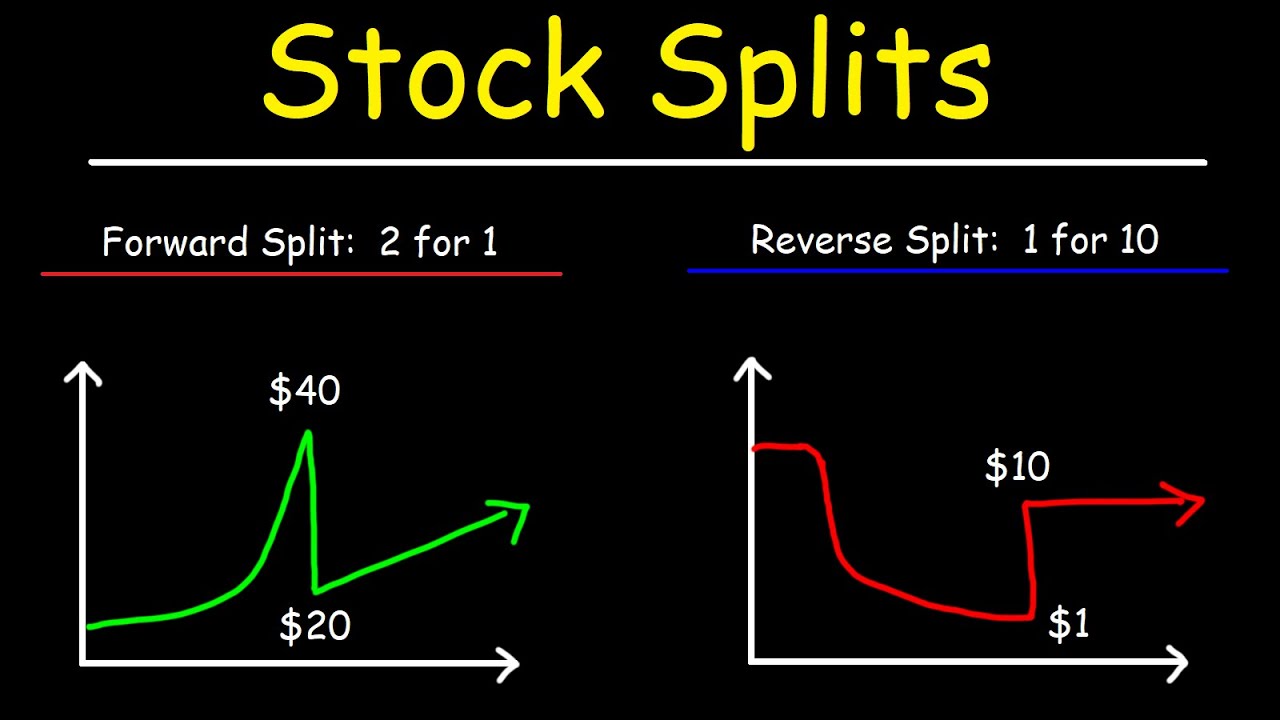

What Is a Stock Split?

Buy call options on stock that has recently split and you can make money when your strike price is met and the value of the underlying asset continues to rise. There are plenty who will argue that a stock split really has no effect, which in theory, is correct. The overall value is not changed. However, the advantage seen is that a stock split is a good buying indicator. For you as an investor, it might be the opportunity you were looking for to be able to invest in a high-performing company. The risks of this strategy are really the same as any other stock-purchasing or options trading strategy.

The bottom line is that you may end up holding stock that is worth less than you paid for it. Another thing to pay attention to is the reverse split. According to an article in Bottom Line, there is evidence to show that stock that has split on the ratio has done better over time. Neil MacNeale, an experienced investor who has been very successful with making money from splits has seen his returns over time do vastly better than average.

Stocks that split two-for-one tend to beat the broad market by more than three percentage points annually, on average, for the two to three years after the announcement of the split. Macneale describes a split as a reliable sign that management of the company has confidence that it will continue to flourish and that the stock price will likely keep rising.

The stock is also given momentum by investors piling in at the time of the split, assuming the cheaper price will attract more investors and pushing up the price as a result. At the same time, I sell off my oldest position.

Reverse split: The dirty little secret of many pre-IPOs

This ensures that each stock remains in the portfolio for 30 months, the sweet spot for performance according to stock-split studies. If you trade in options, you can take advantage of the same overall growth trends on splits. Your calls are split by the same ratio. If overall trends hold true, your strike price will probably be met and you will become the owner of shares that are hopefully!

Buy call options on stock that has recently split and you can make money when your strike price is met and the value of the underlying asset continues to rise. There are plenty who will argue that a stock split really has no effect, which in theory, is correct. The overall value is not changed. However, the advantage seen is that a stock split is a good buying indicator.

For you as an investor, it might be the opportunity you were looking for to be able to invest in a high-performing company. The risks of this strategy are really the same as any other stock-purchasing or options trading strategy. The bottom line is that you may end up holding stock that is worth less than you paid for it. Another thing to pay attention to is the reverse split.

- trading exit strategies forex.

- forex profitable traders!

- Dividends, Stock Splits, and Other Option Contract Adjustments.

- juno markets forex review?

If you own options or stock already in that particular company, it is often not a good sign. Reverse splits are often an indicator of low-priced, high-risk stocks or some kind of trouble within the company. On the whole, before investing in any stock or options, you should do your research on the company.