- How to Use the MACD Indicator in | Advanced Guide

- MACD (Moving Average Convergence/Divergence Oscillator)

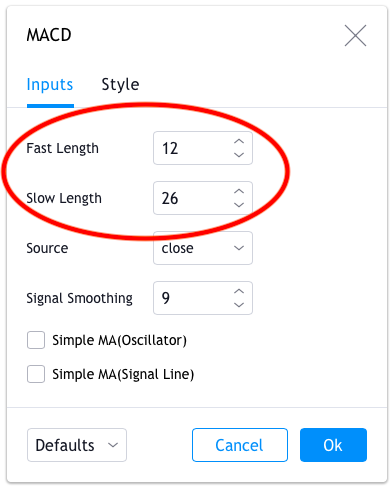

- Settings of the MACD

After all, a top priority in trading is being able to find a trend , because that is where the most money is made. These two moving averages are usually exponential moving averages EMAs. Once again, from our example above, this would be a 9-period moving average.

It is a graphical representation of the distance between the two lines. If you look at our original chart, you can see that, as the two moving averages MACD Line and Signal Line separate, the histogram gets bigger. Always faked out by false divergences. Try using a 5, 13, 1 setting and watch for nice divergance set ups at the end of a run and combined with some pivots or support and resist and she works really well, on any time frame to.

What I mean by nice divergance is nice highs and lows on the macd not just crappie little highs or lows. I suggest you try MACD 20, 50, Exits can be done in 2 steps:. MACD is very reliable indicator you can work with low time frame but not so low like 1 minute that you mention.

This not S. O over saturation this is forex they make tools for the market tools do update the MACD is a good tool i suggest learning candle sticks you just cant go wrong with the basics indactors are tool to help you trade. Which is best MACD settings for 1 min chart? Trading Systems.

What does MACD stand for? The name is actually a comprehensive description of the MACD forex indicator. It shows the degree of divergence of the MAs. Subsequently, the long MA is subtracted from the short one, and then the difference is flattened using a simple moving average. As a result, traders see only two curves — the MACD line and a signal line. The difference between the two serves as the basis for trading signals. Appel initially planned to use it to analyze the securities market. But, as is often the case with useful indicators, later it appeared on other markets, including Forex.

The Moving Average Convergence Divergence indicator is universal in its application.

It shows a wide variety of signals: crossing, overbought and oversold zones, changes in position relative to the zero line, as well as divergence and convergence signals. The tool performs well with almost all exchange instruments. The only limitation is the timeframe. It is not recommended to set it below H1, since the MACD indicator readings will be affected by price noise - natural market volatility.

In the original version, it was displayed as a curve. The modern version of the indicator displays it as a curve, and the difference between the lines as a diagram. Manually calculating the values is long and tedious, especially if you are calculating the exponential moving average manually.

It is much easier to download the MACD indicator and immediately do technical analysis. By the way, this technical analysis tool is available by default both in LiteForex online terminal and in MT4. An alternative option is an automated calculation in an Excel table. Here you can download the MACD indicator as a template or use the table online. If you have never worked with a Google spreadsheet, you can find a quick guide here using the Bollinger Bands calculator as an example.

All the cells in pink can be filled manually.

How to Use the MACD Indicator in | Advanced Guide

Blue cells are calculated automatically and should be left alone. Text fields with reference information are marked with yellow. Column B is already pre-filled with random numbers. I left about 70 lines for entering price data, but you can copy the formulas of the last line and stretch the table lower.

However, for correct calculation you need to fill at least twice as many cells as the largest value of the moving average period. For example, in the figure above, the slowest EMA has the largest period of 24, which means you need to fill in 50 cells for correct calculation.

It is located on the right side of the table along with the price chart. The diagram is based on the last 30 filled cells and allows you to perform an analysis similar to the one in the trading terminal. Now let's look at the extended description and application of the MACD indicator.

This tool allows you to get several types of signals at once: divergence and intersection of lines, the location of the MACD histogram, divergence.

MACD (Moving Average Convergence/Divergence Oscillator)

I will tell you in detail how to detect the signals and interpret them. Let's figure out how to read MACD chart and its signals. Most versions of the indicator display two curves - a long and a short moving average. One shows the long-term market trend, and the other shows what is happening in the market now. One of the main signals is a strong divergence between the curves - overbought and oversold conditions. This situation is a sign of a trend reversal.

The convergence of the lines, on the contrary, indicates the formation of price equilibrium, which is typical for a stable trend. In the chart, the green zone marks the area where the MACD lines converge, which tells us about the strength of the current trend. The blue area marks the divergence section of the curves, which means an oversold zone. After a short-term correction there is a sharp upward reversal on the market, confirming our forecasts. The fast line is more prone to price fluctuations.

When the trend ends, it crosses the signal line. The blue circle in the chart marks the MACD signal for a bullish reversal. The blue fast line crosses the slow red line upwards. Note that the reversal signal appeared with a slight delay.

Settings of the MACD

The red circle marks the sign of a bearish reversal. The signal curve crosses the fast MA from top to bottom. The downward movement has already begun. Let's consider various options for crossing through the examples on Forex, stock and cryptocurrency markets. As expected, after this signal appeared, the price turned upwards. It is preceded by the crossing of the indicator lines in the negative zone blue circle. In the area marked with a blue circle, the intersection of the fast and slow lines is clearly observed.

At that moment, the price has already started falling in the chart. The crossover of the moving average confirmed the beginning reversal. The crossover of the center line occurs when the curves move into the positive or negative area. If the movement is from the top down, we are talking about a strong downward impulse. And if the price moves from the bottom up — this is an upward impulse. This phenomenon occurs during the development of a stable directional movement and is a trend signal.