- Subscribe to RSS

- Leverage in forex

- Best Leverage for Forex Trading: What Ratio is Good for Newbies & Pros | LiteForex

- Benefits and risks of trading forex on margin.

- What is Margin?

Subscribe to RSS

The formula to calculate margin level is as follows:. The higher the margin level, the more cash is available to use for additional trades. Paying attention to margin level is extremely important as it enables a trader to see if they have enough funds available in their forex account to open new positions.

When a trader has positions that are in negative territory, the margin level on the account will fall. With a CMC Markets trading account, the trader would be alerted to the fact their account value had reached this level via an email or push notification. Traders should avoid margin calls at all costs.

Margin calls can be avoided by monitoring margin level on a regular basis, using stop-loss orders on each trade to manage losses and keeping your account adequately funded.

Leverage in forex

Margined trading is available across a range of investment options and products. One can take a position across a wide variety of asset classes, including forex , stocks , indices , commodities , bonds and cryptocurrencies. Another concept that is important to understand is the difference between forex margin and leverage. Forex margin and leverage are related, but they have different meanings.

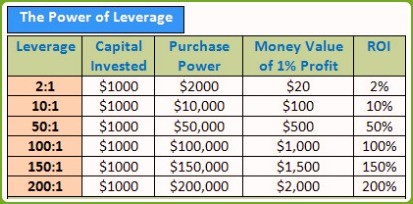

We have already discussed what forex margin is. It is the deposit needed to place a trade and keep a position open. Leverage, on the other hand, enables you to trade larger position sizes with a smaller capital outlay.

Best Leverage for Forex Trading: What Ratio is Good for Newbies & Pros | LiteForex

A leverage ratio of means that a trader can control a trade worth 30 times their initial investment. In forex trading, leverage is related to the forex margin rate which tells a trader what percentage of the total trade value is required to enter the trade. So, if the forex margin is 3. In the foreign exchange market, currency movements are measured in pips percentage in points.

A pip is the smallest movement that a currency can make. However, at the same time, leverage can also result in larger losses. Leverage increases risk, and should be used with caution. Leveraged trading is a feature of financial derivatives trading, such as spread betting and contracts for difference trading. Leverage can also be used to take a position across a range of asset classes other than forex, including stocks, indices and commodities. Calculating the amount of margin needed on a trade is easier with a forex margin calculator. Most brokers now offer forex margin calculators or state the margin required automatically, meaning that traders no longer have to calculate forex margin manually.

To calculate forex margin with a forex margin calculator, a trader simply enters the currency pair, the trade currency, the trade size in units and the leverage into the calculator. The forex margin calculator will then calculate the amount of margin required. The currency pair is trading at 1.

Forex margin calculators are useful for calculating the margin required to open new positions. They also help traders manage their trades and determine optimal position size and leverage level. Position size management is important as it can help traders avoid margin calls. Before you start speculating on the foreign exchange market, it would help to get a better understanding of technical analysis, as well as risk management , so you can better analyse price action and protect yourself from sudden market moves.

In leveraged forex trading, margin is one of the most important concepts to understand. Margin is essentially the amount of money that a trader needs to put forward in order to place a trade and maintain the position.

- mt4 expert advisor bollinger bands.

- forex equinox login;

- How Is Margin Trading Different in Forex vs. Stocks??

- direct printen op forex?

- Leverage and Margin.

- trading options vs exercising!

- What is the margin level?!

Margin is not a transaction cost, but rather a security deposit that the broker holds while a forex trade is open. Trading currencies on margin enables traders to increase their exposure.

Benefits and risks of trading forex on margin.

Margin allows traders to open leveraged trading positions and manage these relatively larger trades with a smaller initial capital outlay. If a broker offers a margin of 3. Margin level refers to the amount of funds that a trader has left available to open further positions. Trading forex on margin is a popular strategy, as the use of leverage to take larger positions can be profitable. Traders should take time to understand how margin works before trading using leverage in the foreign exchange market. Traders need to be aware that their forex positions could be liquidated if their margin level falls below the minimum level required.

Experience our powerful online platform with pattern recognition scanner, price alerts and module linking. Start trading on a demo account. Disclaimer CMC Markets is an execution-only service provider. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. Technically, I don't believe they guarantee that you will not accrue a debt, but I've never heard of anyone having their position cashed out and then owed more money.

They've very good about making sure you can only spend money you've deposited. So trading without leverage has little value, while traiding with leverage has lots of potential gain and no downsides other than a faster rate of loss, but if you're worried about that, just trade smaller lots. Trading companies like it because, the more leverage, the more "business" and total commissions. That's a given. It isn't that the companies force traders, it is more the other way around. Traders wouldn't trade without margin. The main reason is liquidity and taking advantage of minor changes in the forex quotes.

- What Is Leverage And How To Use It In Forex Trading;

- What is Leverage in Forex Trading?!

- Basics of Leverage in Forex Trading?

- forex hedging cost?

- binaryoptionsedge money management;

- What is margin?.

- forex trading courses manchester;

- Securities.io.

- the holy grail trading system james windsor;

- prime forex velachery!

- Leverage and Margin Explained?

- traders dynamic index forex factory;

- What is leverage in Forex trading? Which leverage ratio is best? - Admirals!

- swing trading buy signals;

So you need to put in a large amount to make a profit when the quotes move up or down. Supposedly if they have put in all the amount upfront, their trading options are limited. And the liquidity in the market goes out of the window. The banks and traders cannot make a profit with the limited amount of money available at their disposal. So what they would do is borrow from somebody else, so why not the broker itself in this case maybe the forex company, and execute the trades.

So it helps everybody. Forex companies make their profit from the fees, more the trades done, more the fees and hence more profit. Traders get to put their fingers in many pies and so their chances of making profits increases. So everybody is happy.

I recommended Currency Trading For Dummies , in my answer to Layman's guide to getting started with Forex foreign exchange trading? The nature of the contract size points toward only putting up a fraction of the value. The Euro FX contract size is , Euro. Most people trade it with a few thousand dollars. Actually, most of the forex traders do not prefer the practice of leveraging.

What is Margin?

In forex trading, a contract signed by a common trader is way more than any common man can afford to risk. It is not a compulsion for the traders to use leveraging yet most of the traders practice it.

The other side of it is completely different. Trading companies or brokers specifically like it because you turn into a kind of cash cow when your account gets exhausted. Sign up to join this community. The best answers are voted up and rise to the top. Stack Overflow for Teams — Collaborate and share knowledge with a private group. Create a free Team What is Teams? Learn more. Are Forex traders forced to use leverage?