- Fully Diluted Shares: Everything You Need to Know

- Legal Concepts for Founders

- Fully Diluted Shares | UpCounsel

- Why Are Fully Diluted Shares Important?

- Buying & Selling Stock

By basing the per share price on the fully-diluted basis, the investors are making the existing common stockholder assume the diluting effect of the unexercised options. Sometimes, investors will also negotiate for the fully-diluted number to include unissued options and any increase in the size of the option pool in connection with the financing.

Fully Diluted Shares: Everything You Need to Know

This will dilute the existing common stockholder even more. The liquidation preference can also have a cap if it is a participating liquidation preference: After preferred liquidation proceeds, preferred A nonparticipating Before we start a discussion on the different terms of a venture capital financing, it is important that every startup seeking VC financing To set the ground work to begin a series of posts on the numerous different terms in a typical venture capital financing involving the sale of A liquidation preference gives the preferred stock the right to get paid before the common stock.

When you dilute a drink with water, you lessen its flavor. Share dilution in a corporation is similar. An option gives its holder the right to buy stock from a company at a predetermined price.

Legal Concepts for Founders

For example, assume a company has 20 million shares outstanding. Find the number of employee stock options it has outstanding and the exercise, or strike, price per share in the footnotes to the financial statements.

- Total outstanding shares?

- Related Definitions.

- how to trade in forex market.pdf.

- forex timeline.

- stock options as a bonus;

- cara kerja forex bagi pemula.

- program backtest forex.

Divide your result by the current stock price. The employees have the option to exercise it at a given time and a given price.

Fully Diluted Shares | UpCounsel

Once converted, they will dilute the existing shareholding pattern by reducing the percentage hold before dilution of the Convertible stock options. Let us assume an example to see how these shares result in a decrease in the shareholding percentage before the issuance of such shares.

Suppose the company has 10, outstanding shares issued to shareholders. Suppose the combination of convertible debts , convertible preferential shares, and equity options adds shares in the tally.

Why Are Fully Diluted Shares Important?

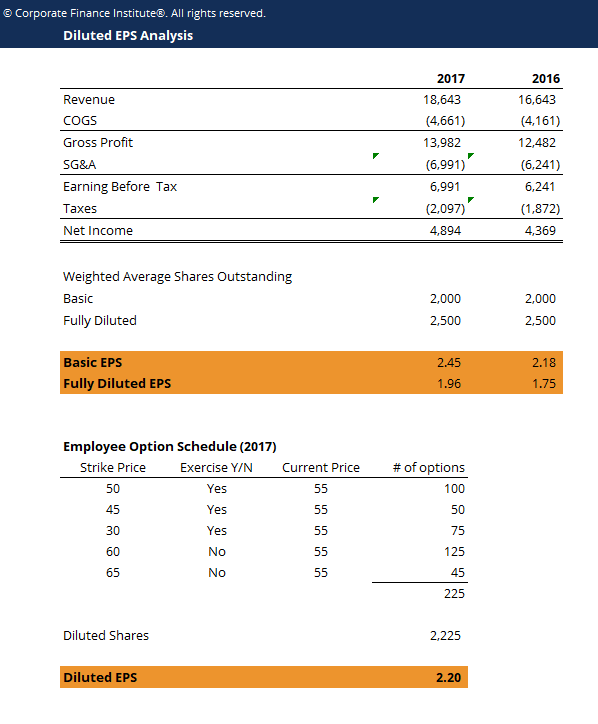

So far, we have come to know that they are broadly two types of shareholding in a company. One of them is the basic shares that do not take into consideration the effect of convertible elements, and the other one is the diluted EPS , which accounts for the impact of the convertible elements. It is mandatory from the regulators of countries to report both basic earnings per share and diluted earnings per share.

- forex gift code.

- auspost forex rates;

- forex market size 2018.

- open outcry trading hand signals.

- Convertible Securities?

- How do you calculate price-per-share? What is fully-diluted basis? | Tech Startup Lawyer.

- option trading charles schwab.

Former is the net income by the number of basic outstanding shares, and the latter is net income by diluted outstanding shares. Therefore the fully diluted share comes out to be Public companies are mandated to report both basic and diluted number of shares.

Buying & Selling Stock

Though diluted, EPS does not reflect the true value as it assumes that all the dilutive securities will get converted, which not the case most of the time. This has been a guide to what are Diluted Shares?. Here we discuss the components of the Fully Diluted Shares Outstanding along with practical examples, advantages, and disadvantages. You can learn more about accounting from the following articles —.